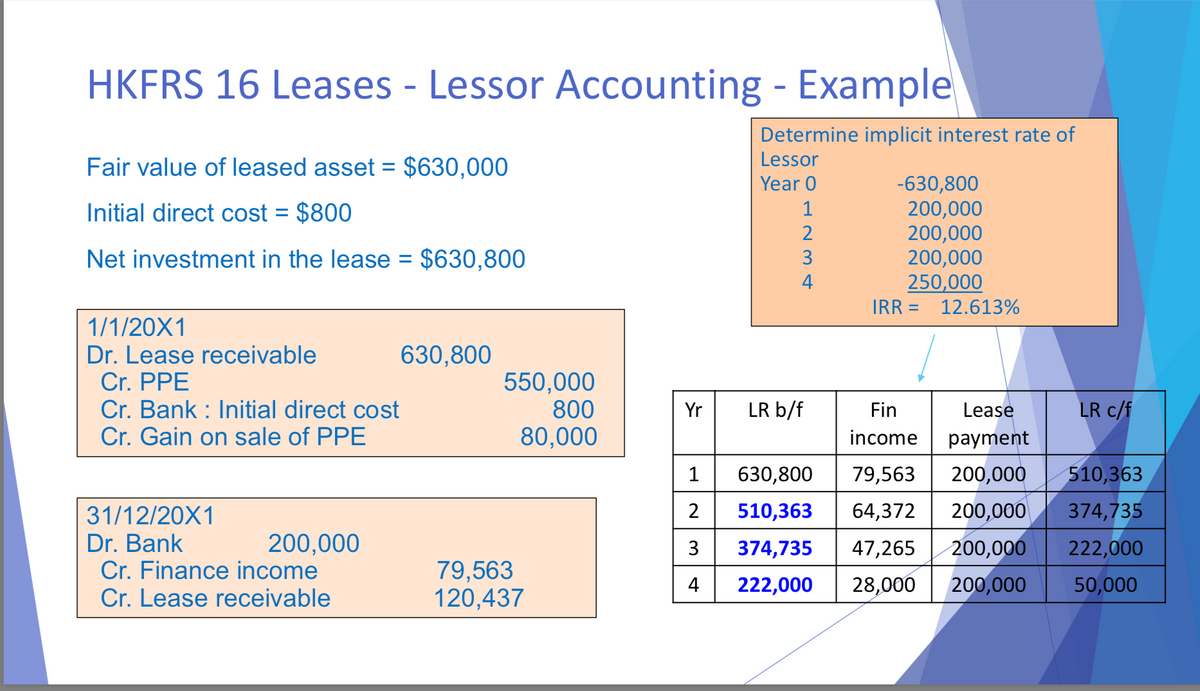

HKFRS 16 Leases - Lessor Accounting - Example Fair value of leased asset = $630,000 Initial direct cost = $800 Net investment in the lease = $630,800 1/1/20X1 Dr. Lease receivable Cr. PPE Cr. Bank Initial direct cost Cr. Gain on sale of PPE Determine implicit interest rate of Lessor Year 0 -630,800 1 200,000 2 200,000 3 200,000 4 250,000 IRR = 12.613% 630,800 550,000 800 Yr LR b/f 80,000 Fin income Lease payment LR c/f 1 630,800 79,563 200,000 510,363 31/12/20X1 2 510,363 64,372 200,000 374,735 Dr. Bank 200,000 3 374,735 47,265 200,000 222,000 Cr. Finance income 79,563 4 222,000 28,000 200,000 50,000 Cr. Lease receivable 120,437 HKFRS 16 Leases - Lessor Accounting - Finance Lease Example On 1 January 20X1, Y Ltd entered into a finance lease of motor vehicle as a lessor. The fair value of the motor vehicle was $630,000 and its carrying amount was $550,000. Y Ltd incurred additional costs of $800 for arranging the lease contract. Estimated useful life of the motor vehicle is 5 years. Lease term is 4 years, and annual lease payments are $200,000 due on 31 December each year. Y Ltd expected that the machine has a residual value of $50,000 at the end of the lease term and the lessee agreed to guarantee the first $30,000 of loss for a sale below the estimated residual value. B332F Lecture Notes 2020 Spring

HKFRS 16 Leases - Lessor Accounting - Example Fair value of leased asset = $630,000 Initial direct cost = $800 Net investment in the lease = $630,800 1/1/20X1 Dr. Lease receivable Cr. PPE Cr. Bank Initial direct cost Cr. Gain on sale of PPE Determine implicit interest rate of Lessor Year 0 -630,800 1 200,000 2 200,000 3 200,000 4 250,000 IRR = 12.613% 630,800 550,000 800 Yr LR b/f 80,000 Fin income Lease payment LR c/f 1 630,800 79,563 200,000 510,363 31/12/20X1 2 510,363 64,372 200,000 374,735 Dr. Bank 200,000 3 374,735 47,265 200,000 222,000 Cr. Finance income 79,563 4 222,000 28,000 200,000 50,000 Cr. Lease receivable 120,437 HKFRS 16 Leases - Lessor Accounting - Finance Lease Example On 1 January 20X1, Y Ltd entered into a finance lease of motor vehicle as a lessor. The fair value of the motor vehicle was $630,000 and its carrying amount was $550,000. Y Ltd incurred additional costs of $800 for arranging the lease contract. Estimated useful life of the motor vehicle is 5 years. Lease term is 4 years, and annual lease payments are $200,000 due on 31 December each year. Y Ltd expected that the machine has a residual value of $50,000 at the end of the lease term and the lessee agreed to guarantee the first $30,000 of loss for a sale below the estimated residual value. B332F Lecture Notes 2020 Spring

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.7E

Related questions

Question

How do they find the

Transcribed Image Text:HKFRS 16 Leases - Lessor Accounting - Example

Fair value of leased asset = $630,000

Initial direct cost = $800

Net investment in the lease = $630,800

1/1/20X1

Dr. Lease receivable

Cr. PPE

Cr. Bank Initial direct cost

Cr. Gain on sale of PPE

Determine implicit interest rate of

Lessor

Year 0

-630,800

1

200,000

2

200,000

3

200,000

4

250,000

IRR =

12.613%

630,800

550,000

800

Yr

LR b/f

80,000

Fin

income

Lease

payment

LR c/f

1

630,800

79,563

200,000 510,363

31/12/20X1

2

510,363

64,372

200,000 374,735

Dr. Bank

200,000

3

374,735

47,265

200,000 222,000

Cr. Finance income

79,563

4

222,000 28,000 200,000

50,000

Cr. Lease receivable

120,437

Transcribed Image Text:HKFRS 16 Leases - Lessor Accounting

- Finance Lease Example

On 1 January 20X1, Y Ltd entered into a finance lease of motor vehicle

as a lessor. The fair value of the motor vehicle was $630,000 and its

carrying amount was $550,000.

Y Ltd incurred additional costs of $800 for arranging the lease contract.

Estimated useful life of the motor vehicle is 5 years. Lease term is 4

years, and annual lease payments are $200,000 due on 31 December

each year. Y Ltd expected that the machine has a residual value of

$50,000 at the end of the lease term and the lessee agreed to

guarantee the first $30,000 of loss for a sale below the estimated

residual value.

B332F Lecture Notes 2020 Spring

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning