Holly and Luke formed a partnership, investing $240,000 and $80,000, respectively. Determine their participation in the year's net income of $200,000 under each of the following independent assumptions: a. No agreement concerning division of net income; b. Divided in the ratio of original capital investment; c. Interest at the rate of 1596 allowed on original investments and the remainder dividied in the ratio of 2:3 d. Salary allowances of $50,0000 and $70,000, respectively, and the balance divided equally; e. Allowance of interest at the rate of 1596 on original investments, salary allowances of $50,000 and $70,000, respectively, and the remainder divided equally. DO NOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY. Holly Luke Total a. b. 24 C. d.

Holly and Luke formed a partnership, investing $240,000 and $80,000, respectively. Determine their participation in the year's net income of $200,000 under each of the following independent assumptions: a. No agreement concerning division of net income; b. Divided in the ratio of original capital investment; c. Interest at the rate of 1596 allowed on original investments and the remainder dividied in the ratio of 2:3 d. Salary allowances of $50,0000 and $70,000, respectively, and the balance divided equally; e. Allowance of interest at the rate of 1596 on original investments, salary allowances of $50,000 and $70,000, respectively, and the remainder divided equally. DO NOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY. Holly Luke Total a. b. 24 C. d.

Chapter11: Investor Losses

Section: Chapter Questions

Problem 35P: LO.2 In the current year, Bill Parker (54 Oak Drive, St. Paul, MN 55164) is considering making an...

Related questions

Question

Transcribed Image Text:B 210 220 23L240

25

26 2

QUESTIONS

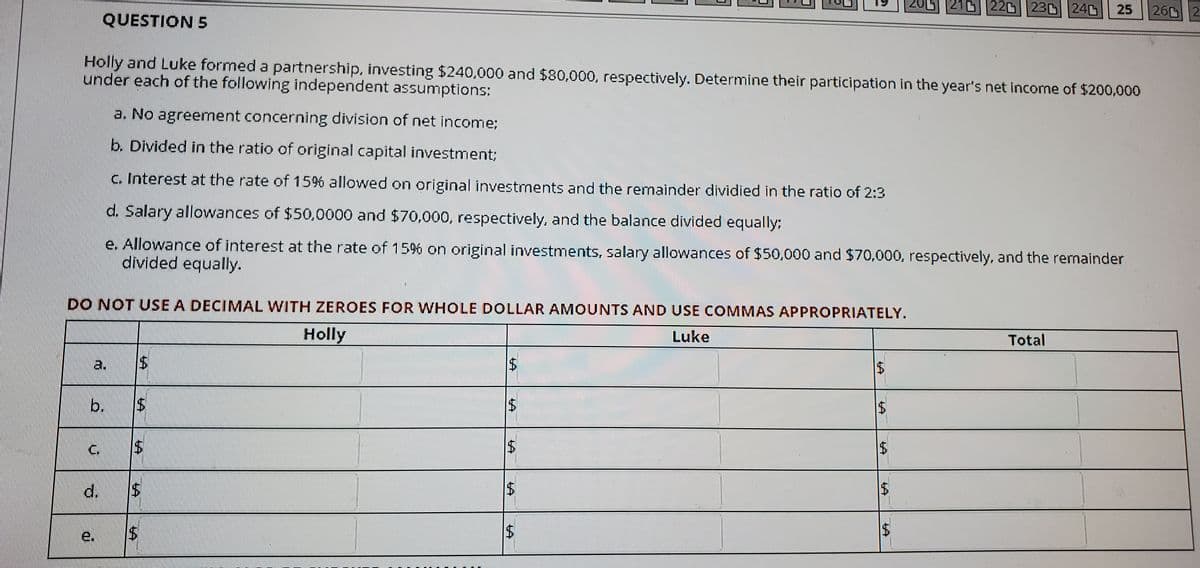

Holly and Luke formed a partnership, investing $240,000 and $80,000, respectively. Determine their participation in the year's net income of $200,000

under each of the following independent assumptions:

a. No agreement concerning division of net income;

b. Divided in the ratio of original capital investment;

C. Interest at the rate of 15% allowed on original investments and the remainder dividied in the ratio of 2:3

d. Salary allowances of $50,0000 and $70,000, respectively, and the balance divided equally:

e. Allowance of interest at the rate of 15% on original investments, salary allowances of $50,000 and $70,000, respectively, and the remainder

divided equally.

DO NOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY.

Holly

Luke

Total

a.

$4

b.

$1

C.

e.

%24

%24

ŁA

%24

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,