Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna GP (a general partnership in which both partners are active owners). Anna contributed land and a building valued at $640,00o (basis of $380,000) in exchange for the remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. Sales $560,000 Utilities, salaries, depreciation, and other operating expenses 360,000 Short-term capital gain 10,000 Tax-exempt interest income 4,000 Charitable contributions (cash) 8,000 Distribution to Suzy 10,000 Distribution to Anna 20,000 During the current tax year, Suz-Anna refinanced the land and building (i.e., the original $100,000 debt was repaid and replaced with new debt). At the end of the year, Suz-Anna held recourse debt of $100,000 for partnership accounts payable (recourse to the partnership but not personally guaranteed by either of the partners) and qualified nonrecourse financing of $200,000. a. What is Suzy's basis in Suz-Anna after formation of the partnership? Anna's basis? Suzy's beginning basis in her partnership interest is $[ ) , and Anna's basis is $[ b. Enter the amounts for the following items that will appear on Suzy's Schedule K-1. Item Amount Ordinary income Short-term capital gain Tax-exempt interest income Charitable contributions Distribution received by Suzy What income, deduction, and taxes does Suzy report on her tax return? On her tax return, Suzy reports the ordinary income on . She reports the charitable contributions She reports the short-term capital gain on with her personal charitable contributions. Suzy might also be eligible for the qualified business income deduction; the partnership needs to provide additional information regarding subject to self-employment taxes. so that Suzy can calculate the deduction. Suzy c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy's basis and amount at risk in her partnership interest? Suzy's year-end basis in her partnership interest is s[ , and Suzy's amount at risk is $ d. Assume that Suz-Anna prepares the capital account rollforward on the partners' Schedules K-1 on a tax basis. What are Suzy's capital account balances at the beginning and end of the tax year? what accounts for the difference between Suzy's ending capital account and her ending tax basis in the partnership interest?

Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna GP (a general partnership in which both partners are active owners). Anna contributed land and a building valued at $640,00o (basis of $380,000) in exchange for the remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. Sales $560,000 Utilities, salaries, depreciation, and other operating expenses 360,000 Short-term capital gain 10,000 Tax-exempt interest income 4,000 Charitable contributions (cash) 8,000 Distribution to Suzy 10,000 Distribution to Anna 20,000 During the current tax year, Suz-Anna refinanced the land and building (i.e., the original $100,000 debt was repaid and replaced with new debt). At the end of the year, Suz-Anna held recourse debt of $100,000 for partnership accounts payable (recourse to the partnership but not personally guaranteed by either of the partners) and qualified nonrecourse financing of $200,000. a. What is Suzy's basis in Suz-Anna after formation of the partnership? Anna's basis? Suzy's beginning basis in her partnership interest is $[ ) , and Anna's basis is $[ b. Enter the amounts for the following items that will appear on Suzy's Schedule K-1. Item Amount Ordinary income Short-term capital gain Tax-exempt interest income Charitable contributions Distribution received by Suzy What income, deduction, and taxes does Suzy report on her tax return? On her tax return, Suzy reports the ordinary income on . She reports the charitable contributions She reports the short-term capital gain on with her personal charitable contributions. Suzy might also be eligible for the qualified business income deduction; the partnership needs to provide additional information regarding subject to self-employment taxes. so that Suzy can calculate the deduction. Suzy c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy's basis and amount at risk in her partnership interest? Suzy's year-end basis in her partnership interest is s[ , and Suzy's amount at risk is $ d. Assume that Suz-Anna prepares the capital account rollforward on the partners' Schedules K-1 on a tax basis. What are Suzy's capital account balances at the beginning and end of the tax year? what accounts for the difference between Suzy's ending capital account and her ending tax basis in the partnership interest?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 18P

Related questions

Question

See attached

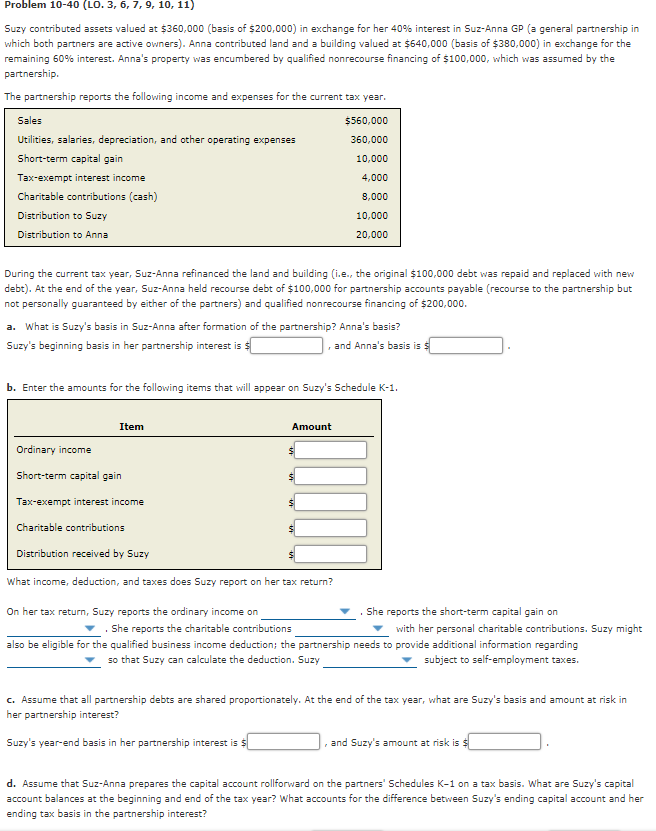

Transcribed Image Text:Problem 10-40 (LO. 3, 6, 7, 9, 10, 11)

Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna GP (a general partnership in

which both partners are active owners). Anna contributed land and a building valued at $640,000 (basis of $380,000) in exchange for the

remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the

partnership.

The partnership reports the following income and expenses for the current tax year.

Sales

$560,000

Utilities, salaries, depreciation, and other operating expenses

360,000

Short-term capital gain

10,000

Tax-exempt interest income

4,000

Charitable contributions (cash)

8,000

Distribution to Suzy

10,000

Distribution to Anna

20,000

During the current tax year, Suz-Anna refinanced the land and building (i.e., the original $100,000 debt was repaid and replaced with new

debt). At the end of the year, Suz-Anna held recourse debt of $100,000 for partnership accounts payable (recourse to the partnership but

not personally guaranteed by either of the partners) and qualified nonrecourse financing of $200,000.

a. What is Suzy's basis in Suz-Anna after formation of the partnership? Anna's basis?

Suzy's beginning basis in her partnership interest is $

and Anna's basis is $

b. Enter the amounts for the following items that will appear on Suzy's Schedule K-1.

Item

Amount

Ordinary income

Short-term capital gain

Tax-exempt interest income

Charitable contributions

Distribution received by Suzy

What income, deduction, and taxes does Suzy report on her tax return?

On her tax return, Suzy reports the ordinary income on

She reports the short-term capital gain on

. She reports the charitable contributions

with her personal charitable contributions. Suzy might

also be eligible for the qualified business income deduction; the partnership needs to provide additional information regarding

subject to self-employment taxes.

so that Suzy can calculate the deduction. Suzy

c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy's basis and amount at risk in

her partnership interest?

Suzy's year-end basis in her partnership interest is $

and Suzy's amount at risk is $

d. Assume that Suz-Anna prepares the capital account rollforward on the partners' Schedules K-1 on a tax basis. What are Suzy's capital

account balances at the beginning and end of the tax year? What accounts for the difference between Suzy's ending capital account and her

ending tax basis in the partnership interest?

Expert Solution

Step 1

Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and specify the other subparts (up to 3) you’d like answered.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,