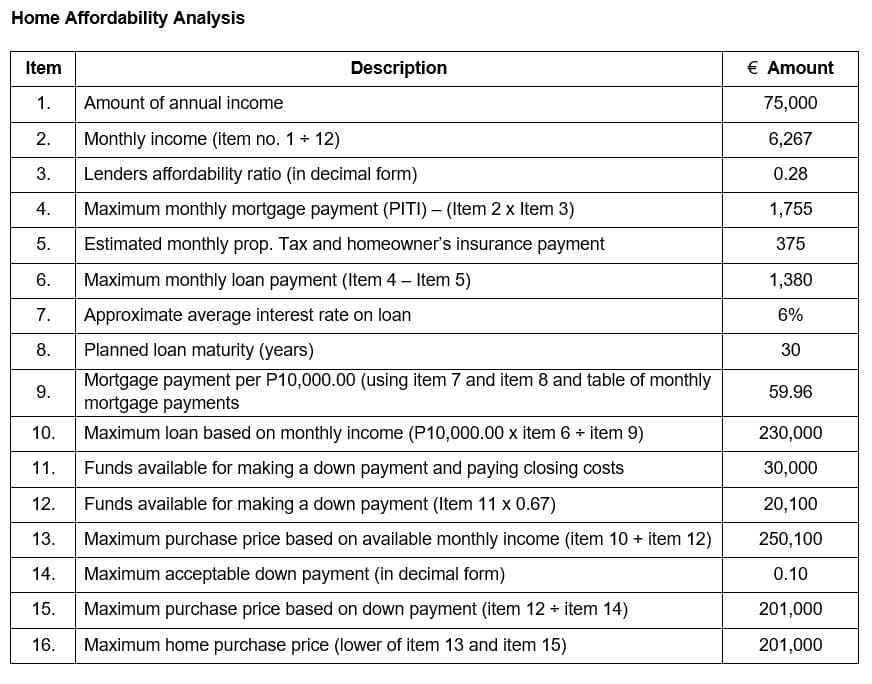

Home Affordability Analysis Item 1. Amount of annual income 2. Monthly income (item no. 1 + 12) 3. Lenders affordability ratio (in decimal form) 4. Maximum monthly mortgage payment (PITI) - (Item 2 x Item 3) 5. Estimated monthly prop. Tax and homeowner's insurance payment 6. Maximum monthly loan payment (Item 4 - Item 5) 7. Approximate average interest rate on loan 8. 9. 10. 11. 12. 13. 14. 15. 16. Description Planned loan maturity (years) Mortgage payment per P10,000.00 (using item 7 and item 8 and table of monthly mortgage payments Maximum loan based on monthly income (P10,000.00 x item 6 + item 9) Funds available for making a down payment and paying closing costs Funds available for making a down payment (Item 11 x 0.67) Maximum purchase price based on available monthly income (item 10 + item 12) Maximum acceptable down payment (in decimal form) Maximum purchase price based on down payment (item 12 + item 14) Maximum home purchase price (lower of item 13 and item 15) € Amount 75,000 6,267 0.28 1,755 375 1,380 6% 30 59.96 230,000 30,000 20,100 250,100 0.10 201,000 201,000

Home Affordability Analysis Item 1. Amount of annual income 2. Monthly income (item no. 1 + 12) 3. Lenders affordability ratio (in decimal form) 4. Maximum monthly mortgage payment (PITI) - (Item 2 x Item 3) 5. Estimated monthly prop. Tax and homeowner's insurance payment 6. Maximum monthly loan payment (Item 4 - Item 5) 7. Approximate average interest rate on loan 8. 9. 10. 11. 12. 13. 14. 15. 16. Description Planned loan maturity (years) Mortgage payment per P10,000.00 (using item 7 and item 8 and table of monthly mortgage payments Maximum loan based on monthly income (P10,000.00 x item 6 + item 9) Funds available for making a down payment and paying closing costs Funds available for making a down payment (Item 11 x 0.67) Maximum purchase price based on available monthly income (item 10 + item 12) Maximum acceptable down payment (in decimal form) Maximum purchase price based on down payment (item 12 + item 14) Maximum home purchase price (lower of item 13 and item 15) € Amount 75,000 6,267 0.28 1,755 375 1,380 6% 30 59.96 230,000 30,000 20,100 250,100 0.10 201,000 201,000

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter6: Using Credit

Section: Chapter Questions

Problem 3FPE

Related questions

Question

Please make a detailed explanation on how to get the speficific items : 1,3,5,7,8,9,11,14 and 16

Format:

Given :

________

________

Formula:

________

________

Solution:

________

________

Transcribed Image Text:Home Affordability Analysis

Item

1.

Amount of annual income

2.

Monthly income (item no. 1 + 12)

3.

Lenders affordability ratio (in decimal form)

4. Maximum monthly mortgage payment (PITI) - (Item 2 x Item 3)

5. Estimated monthly prop. Tax and homeowner's insurance payment

6.

Maximum monthly loan payment (Item 4 - Item 5)

7.

Approximate average interest rate on loan

8.

9.

10.

11.

12.

13.

14.

15.

16.

Description

Planned loan maturity (years)

Mortgage payment per P10,000.00 (using item 7 and item 8 and table of monthly

mortgage payments

Maximum loan based on monthly income (P10,000.00 x item 6 + item 9)

Funds available for making a down payment and paying closing costs

Funds available for making a down payment (Item 11 x 0.67)

Maximum purchase price based on available monthly income (item 10 + item 12)

Maximum acceptable down payment (in decimal form)

Maximum purchase price based on down payment (item 12 + item 14)

Maximum home purchase price (lower of item 13 and item 15)

€ Amount

75,000

6,267

0.28

1,755

375

1,380

6%

30

59.96

230,000

30,000

20,100

250,100

0.10

201,000

201,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning