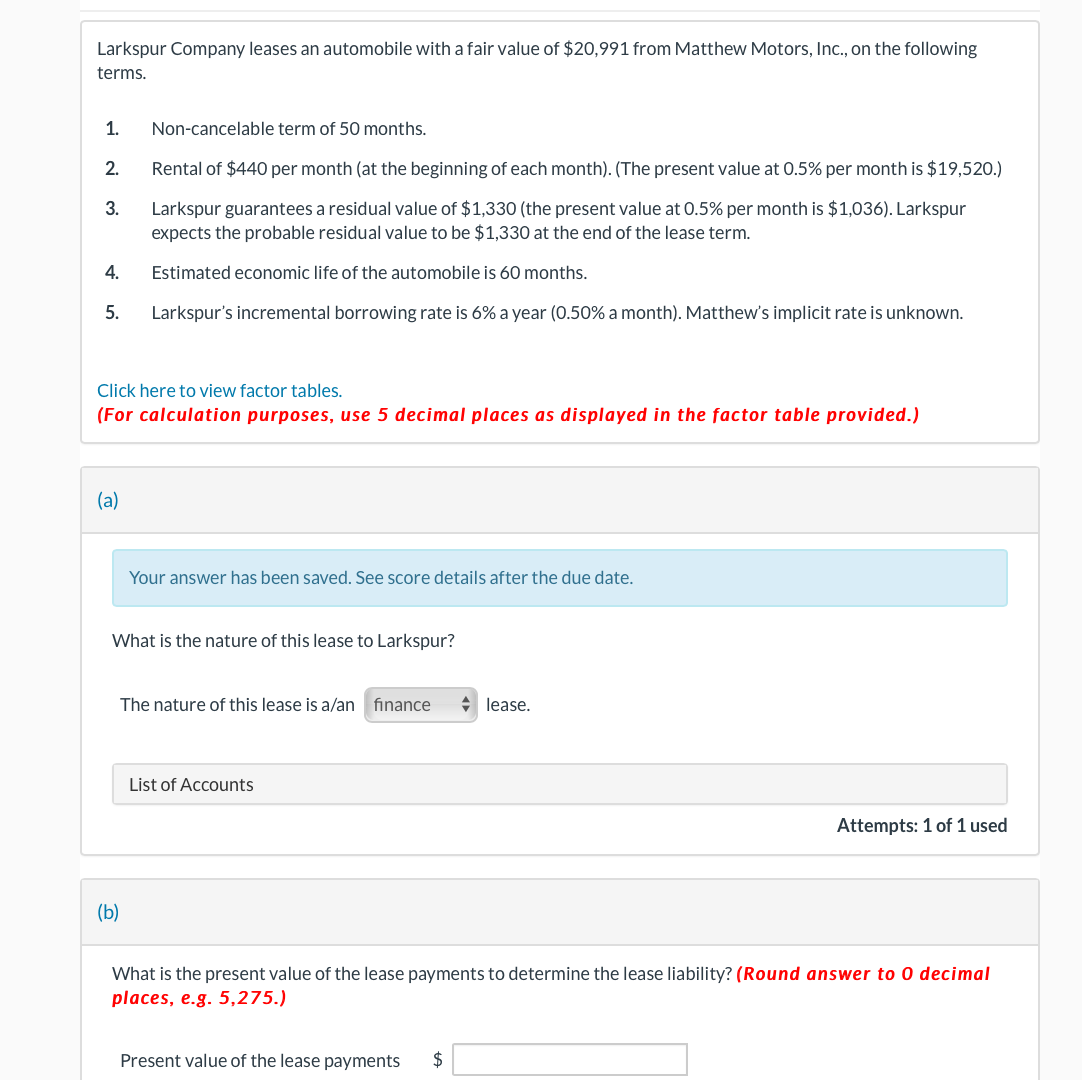

Larkspur Company leases an automobile with a fair value of $20,991 from Matthew Motors, Inc., on the following terms. 1. Non-cancelable term of 50 months. Rental of $440 per month (at the beginning of each month). (The present value at 0.5% per month is $19,520.) Larkspur guarantees a residual value of $1,330 (the present value at 0.5% per month is $1,036). Larkspur expects the probable residual value to be $1,330 at the end of the lease term. 4. Estimated economic life of the automobile is 60 months. 5. Larkspur's incremental borrowing rate is 6% a year (0.50% a month). Matthew's implicit rate is unknown. 2. 3. Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) (a) Your answer has been saved. See score details after the due date. What is the nature of this lease to Larkspur? (b) The nature of this lease is a/an finance List of Accounts lease. Present value of the lease payments $ Attempts: 1 of 1 used What is the present value of the lease payments to determine the lease liability? (Round answer to 0 decimal places, e.g. 5,275.)

Larkspur Company leases an automobile with a fair value of $20,991 from Matthew Motors, Inc., on the following terms. 1. Non-cancelable term of 50 months. Rental of $440 per month (at the beginning of each month). (The present value at 0.5% per month is $19,520.) Larkspur guarantees a residual value of $1,330 (the present value at 0.5% per month is $1,036). Larkspur expects the probable residual value to be $1,330 at the end of the lease term. 4. Estimated economic life of the automobile is 60 months. 5. Larkspur's incremental borrowing rate is 6% a year (0.50% a month). Matthew's implicit rate is unknown. 2. 3. Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) (a) Your answer has been saved. See score details after the due date. What is the nature of this lease to Larkspur? (b) The nature of this lease is a/an finance List of Accounts lease. Present value of the lease payments $ Attempts: 1 of 1 used What is the present value of the lease payments to determine the lease liability? (Round answer to 0 decimal places, e.g. 5,275.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10MC: On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring...

Related questions

Question

Transcribed Image Text:Larkspur Company leases an automobile with a fair value of $20,991 from Matthew Motors, Inc., on the following

terms.

1.

2.

3.

Non-cancelable term of 50 months.

Rental of $440 per month (at the beginning of each month). (The present value at 0.5% per month is $19,520.)

Larkspur guarantees a residual value of $1,330 (the present value at 0.5% per month is $1,036). Larkspur

expects the probable residual value to be $1,330 at the end of the lease term.

Estimated economic life of the automobile is 60 months.

5. Larkspur's incremental borrowing rate is 6% a year (0.50% a month). Matthew's implicit rate is unknown.

4.

Click here to view factor tables.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

(a)

Your answer has been saved. See score details after the due date.

What is the nature of this lease to Larkspur?

The nature of this lease is a/an finance ◆ lease.

(b)

List of Accounts

Attempts: 1 of 1 used

What is the present value of the lease payments to determine the lease liability? (Round answer to 0 decimal

places, e.g. 5,275.)

Present value of the lease payments $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College