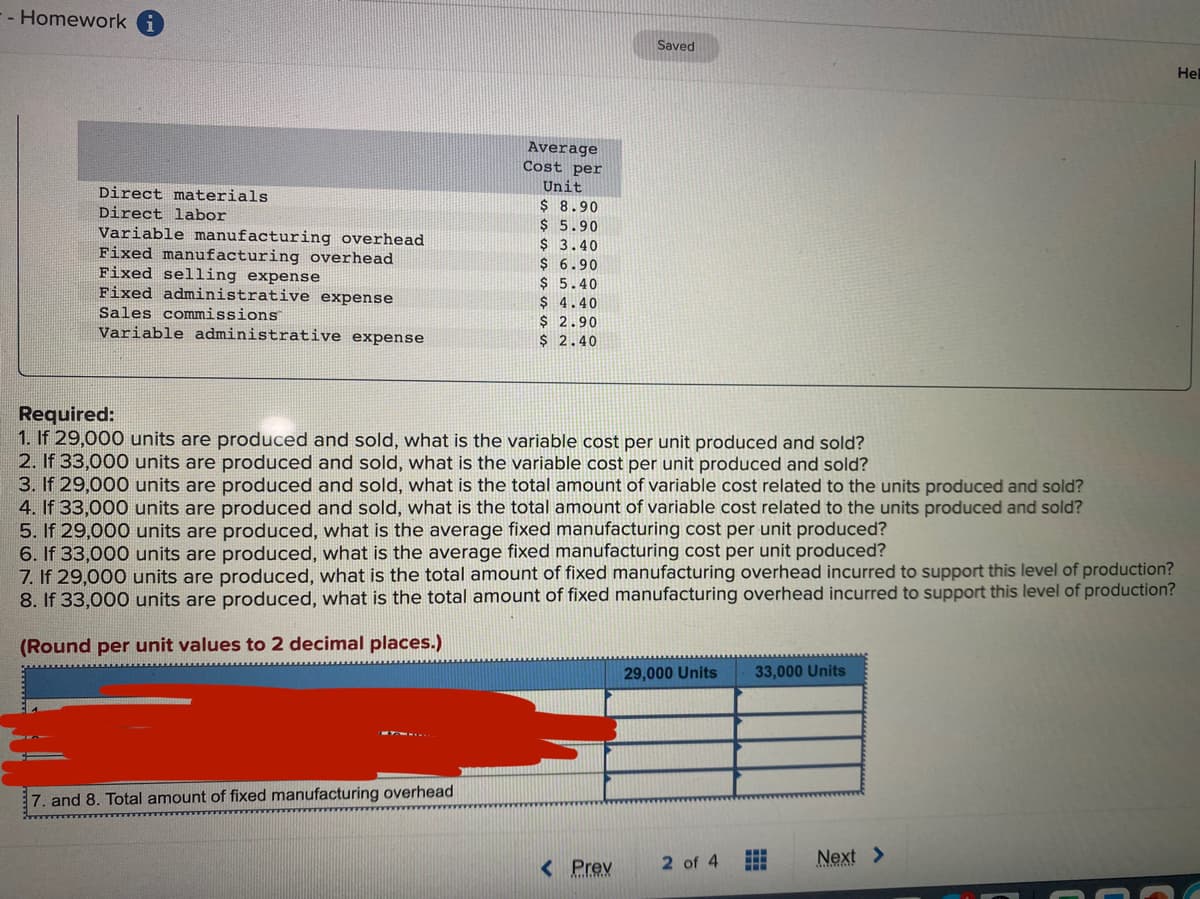

-- Homework Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $ 8.90 $ 5.90 $ 3.40 $ 6.90 $ 5.40 $ 4.40 $ 2.90 $ 2.40 Saved Required: 1. If 29,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 33,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 29,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 33,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 29,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 33,000 units are produced, what is the average fixed manufacturing cost per unit produced? 7. If 29,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? 8. If 33,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? (Round per unit values to 2 decimal places.) 29,000 Units 33,000 Units He

-- Homework Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $ 8.90 $ 5.90 $ 3.40 $ 6.90 $ 5.40 $ 4.40 $ 2.90 $ 2.40 Saved Required: 1. If 29,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 33,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 29,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 33,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 29,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 33,000 units are produced, what is the average fixed manufacturing cost per unit produced? 7. If 29,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? 8. If 33,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? (Round per unit values to 2 decimal places.) 29,000 Units 33,000 Units He

Chapter5: Process Costing

Section: Chapter Questions

Problem 1PB: The following product costs are available for Stellis Company on the production of erasers: direct...

Related questions

Question

Kubins company’s relevant information range of production is 29000 to 33000 units. When it sells 31000 it’s average cost per unit are as follows

Question 7 and 8 only please

Transcribed Image Text:-- Homework

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Fixed selling expense

Fixed administrative expense

Sales commissions

Variable administrative expense

Average

Cost per

Unit

$ 8.90

$ 5.90

$ 3.40

$ 6.90

$ 5.40

$ 4.40

$ 2.90

$ 2.40

Required:

1. If 29,000 units are produced and sold, what is the variable cost per unit produced and sold?

2. If 33,000 units are produced and sold, what is the variable cost per unit produced and sold?

Saved

3. If 29,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold?

4. If 33,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold?

5. If 29,000 units are produced, what is the average fixed manufacturing cost per unit produced?

6. If 33,000 units are produced, what is the average fixed manufacturing cost per unit produced?

7. and 8. Total amount of fixed manufacturing overhead

7. If 29,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production?

8. If 33,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production?

(Round per unit values to 2 decimal places.)

< Prev

29,000 Units

2 of 4

33,000 Units

FE

Next >

He

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub