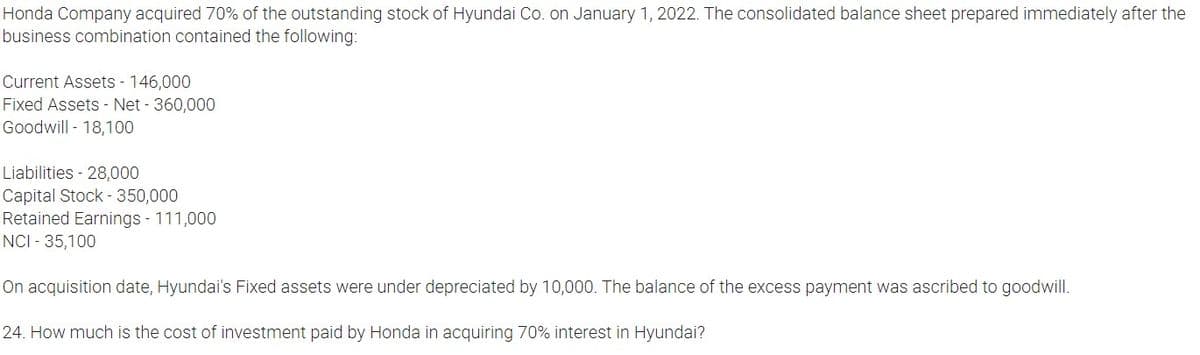

Honda Company acquired 70% of the outstanding stock of Hyundai Co. on January 1, 2022. The consolidated balance sheet prepared immediately after the business combination contained the following: Current Assets - 146,000 Fixed Assets - Net - 360,000 Goodwill - 18,100 Liabilities - 28,000 Capital Stock- 350,000 Retained Earnings - 111,000 NCI - 35,100 On acquisition date, Hyundai's Fixed assets were under depreciated by 10,000. The balance of the excess payment was ascribed to goodwill. 24. How much is the cost of investment paid by Honda in acquiring 70% interest in Hyundai?

Honda Company acquired 70% of the outstanding stock of Hyundai Co. on January 1, 2022. The consolidated balance sheet prepared immediately after the business combination contained the following: Current Assets - 146,000 Fixed Assets - Net - 360,000 Goodwill - 18,100 Liabilities - 28,000 Capital Stock- 350,000 Retained Earnings - 111,000 NCI - 35,100 On acquisition date, Hyundai's Fixed assets were under depreciated by 10,000. The balance of the excess payment was ascribed to goodwill. 24. How much is the cost of investment paid by Honda in acquiring 70% interest in Hyundai?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

Transcribed Image Text:Honda Company acquired 70% of the outstanding stock of Hyundai Co. on January 1, 2022. The consolidated balance sheet prepared immediately after the

business combination contained the following:

Current Assets - 146,000

Fixed Assets - Net - 360,000

Goodwill - 18,100

Liabilities - 28,000

Capital Stock - 350,000

Retained Earnings - 111,000

NCI - 35,100

On acquisition date, Hyundai's Fixed assets were under depreciated by 10,000. The balance of the excess payment was ascribed to goodwill.

24. How much is the cost of investment paid by Honda in acquiring 70% interest in Hyundai?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning