Honda Motor Company is considering offering a $1,900 rebate on its minivan, lowering the vehicle's price from $30,100 to $28,200. The marketing group estimates that this rebate will increase sales over the next year from 39,000 to 53,800 vehicles. Suppose Honda's profit margin with the rebate is $5,470 per vehicle. If the change in sales is the only consequence of this decision, what are its costs and benefits? Is it a good idea? Hint: View this question in terms of incremental profits. The cost of the rebate will be $ million. (Round to one decimal place.) million. (Round to one decimal place.) The benefit of the rebate will be $ Is it a good idea? (Select from the drop-down menu.) Offering the rebate (1) (1) does not O does look attractive.

Honda Motor Company is considering offering a $1,900 rebate on its minivan, lowering the vehicle's price from $30,100 to $28,200. The marketing group estimates that this rebate will increase sales over the next year from 39,000 to 53,800 vehicles. Suppose Honda's profit margin with the rebate is $5,470 per vehicle. If the change in sales is the only consequence of this decision, what are its costs and benefits? Is it a good idea? Hint: View this question in terms of incremental profits. The cost of the rebate will be $ million. (Round to one decimal place.) million. (Round to one decimal place.) The benefit of the rebate will be $ Is it a good idea? (Select from the drop-down menu.) Offering the rebate (1) (1) does not O does look attractive.

Chapter4A: Nopat Breakeven: Revenues Needed To Cover Total Operating Costs

Section: Chapter Questions

Problem 1EP

Related questions

Concept explainers

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

Question

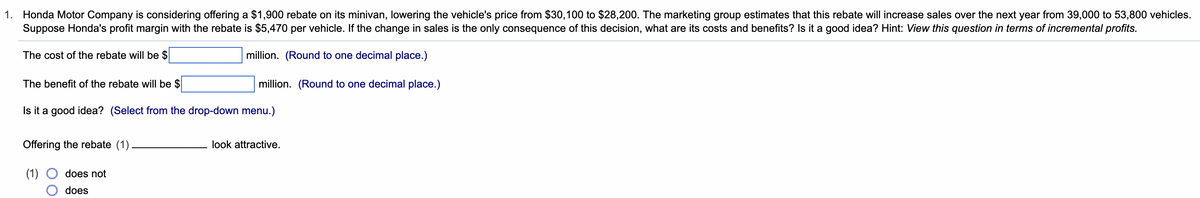

Transcribed Image Text:1. Honda Motor Company is considering offering a $1,900 rebate on its minivan, lowering the vehicle's price from $30,100 to $28,200. The marketing group estimates that this rebate will increase sales over the next year from 39,000 to 53,800 vehicles.

Suppose Honda's profit margin with the rebate is $5,470 per vehicle. If the change in sales is the only consequence of this decision, what are its costs and benefits? Is it a good idea? Hint: View this question in terms of incremental profits.

The cost of the rebate will be $

million. (Round to one decimal place.)

million. (Round to one decimal place.)

The benefit of the rebate will be $

Is it a good idea? (Select from the drop-down menu.)

Offering the rebate (1)

(1)

does not

does

look attractive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College