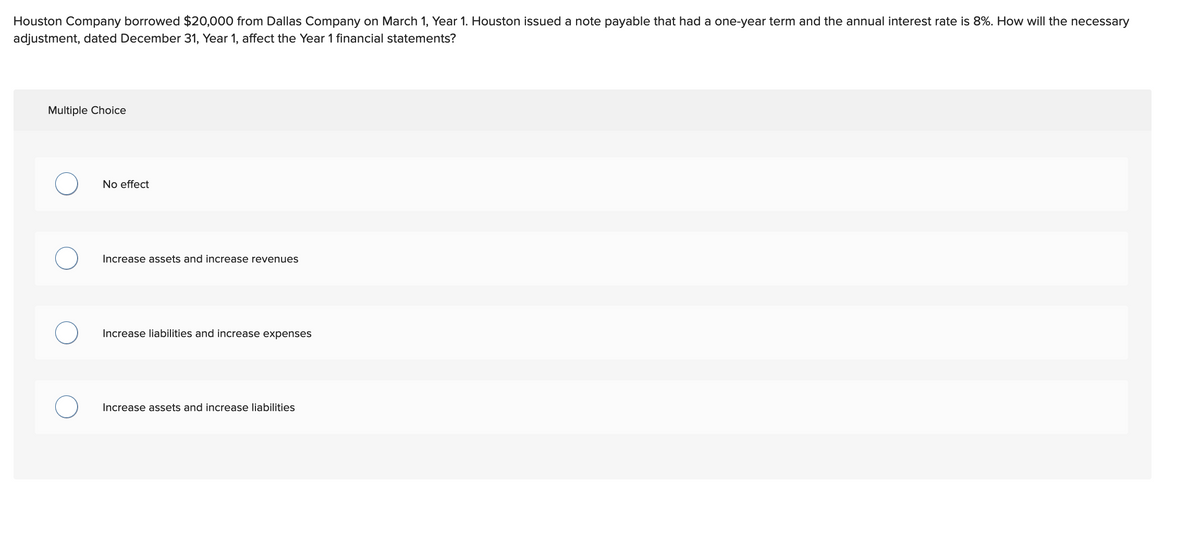

Houston Company borrowed $20,000 from Dallas Company on March 1, Year 1. Houston issued a note payable that had a one-year term and the annual interest rate is 8%. How will the necessary adjustment, dated December 31, Year 1, affect the Year 1 financial statements? Multiple Choice No effect Increase assets and increase revenues Increase liabilities and increase expenses Increase assets and increase liabilities

Houston Company borrowed $20,000 from Dallas Company on March 1, Year 1. Houston issued a note payable that had a one-year term and the annual interest rate is 8%. How will the necessary adjustment, dated December 31, Year 1, affect the Year 1 financial statements? Multiple Choice No effect Increase assets and increase revenues Increase liabilities and increase expenses Increase assets and increase liabilities

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 49P

Related questions

Question

100%

Transcribed Image Text:Houston Company borrowed $20,000 from Dallas Company on March 1, Year 1. Houston issued a note payable that had a one-year term and the annual interest rate is 8%. How will the necessary

adjustment, dated December 31, Year 1, affect the Year 1 financial statements?

Multiple Choice

No effect

Increase assets and increase revenues

Increase liabilities and increase expenses

Increase assets and increase liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning