How can we compute incremental cash flow, and IRR?

Incremental cash flows and IRR, both are the terms of Capital Budgeting decisions. Incremental cash flows are taken into account to find out the net addition in cash flows due to the acceptance of a project.

IRR or Internal Rate of Return is a technique of discounting cash flow. It uses the NPV concept to calculate the rate of return that the company expects to earn on an investment.

Computation of Incremental cash flows involves the following steps-

1. Calculation of incremental operating revenue-

Deduct the regular operating revenue from existing business from the total estimated operating revenue after accepting the project.

2. Calculation of incremental operating expenses-

Deducting the regular operating expenses from existing business from the total estimated operating expenses after accepting the project.

3. Calculation of change in non-cash operating expenses(such as depreciation)-

Deduct the existing non-cash operating expense from the estimated total non-cash operating expense.

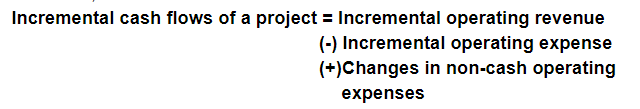

4. Deduct the incremental operating expense(calculated in Step 2) from the incremental operating revenue(calculated in Step 1) and add back the changes in non-cash operating expenses(calculated in Step 3).

5. Consider any opportunity costs in an existing business, if any, which will be incurred on acceptance of the project.

Therefore,

Step by step

Solved in 3 steps with 2 images