DeliverItNow is a start-up operating in mid to large cities in the Eastern United States that coordinates food deliveries to businesses and individuals in a limited geographic area. Here is their Cash Flow Statement for the most recent quarter: 1. What is the Cash Flow from Operating Activities for DeliverItNow for the last 3 months? 2.Which of the following changes would be true about DeliverItNow?: Their revenues are negative Their revenues are greater than their expenses Their expenses are greater than their revenues Operations are generating positive cash flow None of the above. 3. What is DeliverItNow's Cash Flow from Investing Activities? 4. What is DeliverItNow's Net Cash Flow? 5. If DeliverItNow's Chief Financial Officer (CFO) was concerned about the company's negative cash flow and decided to sell shares of stock to make up the difference, how many shares would the company need to sell at a cost of $100 / share? 6. Why would a start-up company like DeliverItNow be likely to have negative net cash flow without issuing stock or borrowing funds?: Many start-ups have higher expenses than revenues at first Higher growth companies are likely to have increases in accounts receivable and inventory They are more likely to be making capital expenditures All of the above None of the above.

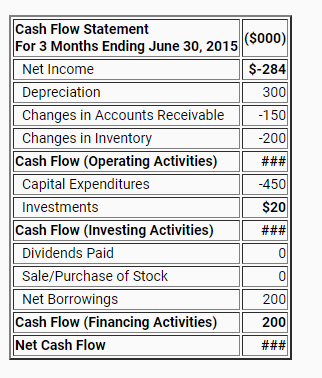

DeliverItNow is a start-up operating in mid to large cities in the Eastern United States that coordinates food deliveries to businesses and individuals in a limited geographic area. Here is their Cash Flow Statement for the most recent quarter:

1. What is the Cash Flow from Operating Activities for DeliverItNow for the last 3 months?

2.Which of the following changes would be true about DeliverItNow?:

- Their revenues are negative

- Their revenues are greater than their expenses

- Their expenses are greater than their revenues

- Operations are generating positive cash flow

- None of the above.

3. What is DeliverItNow's Cash Flow from Investing Activities?

4. What is DeliverItNow's Net Cash Flow?

5. If DeliverItNow's Chief Financial Officer (CFO) was concerned about the company's negative cash flow and decided to sell shares of stock to make up the difference, how many shares would the company need to sell at a cost of $100 / share?

6. Why would a start-up company like DeliverItNow be likely to have negative net cash flow without issuing stock or borrowing funds?:

- Many start-ups have higher expenses than revenues at first

- Higher growth companies are likely to have increases in accounts receivable and inventory

- They are more likely to be making capital expenditures

- All of the above

- None of the above.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps