How do I find the car’s depreciation?

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 25P: LO.2 Oak Corporation has the following general business credit carryovers. If the general business...

Related questions

Question

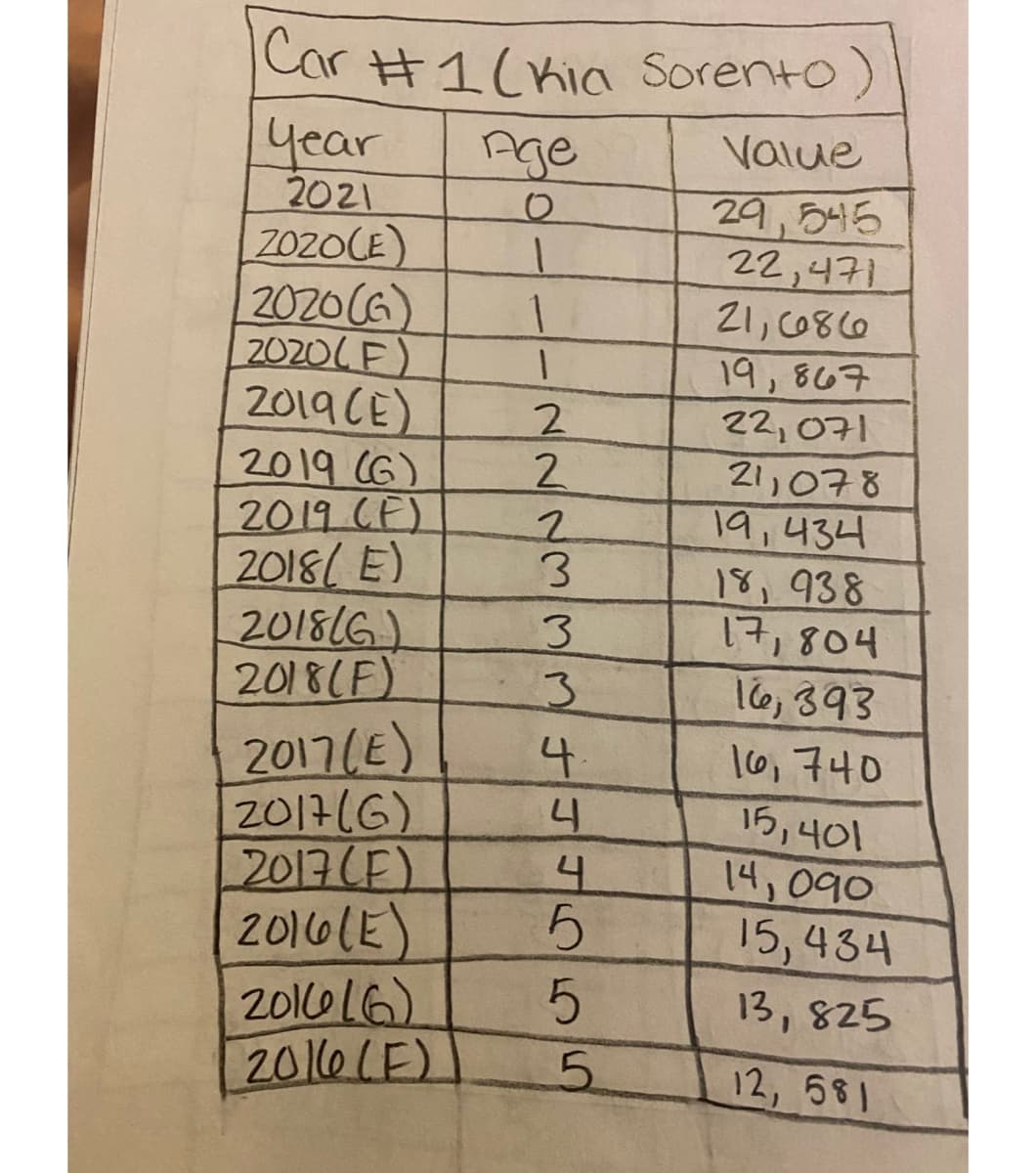

How do I find the car’s depreciation ?

Transcribed Image Text:Car H1(Kia Sorento)

year

2021

ZOZOCE)

2020(G)

2020LF)

2019CE)

2019 (G)

2019 CF)

20181 E)

201816

2018(F)

Age

Value

29,545

22,471

21, C080

19,867

22,071

1.

2.

21,078

19,434

18,938

1구, 80니

16,393

3.

2017(E)

2017(G)

2017(F)

2016(E)

201016)

2016LE)

4.

4

10,740

15,401

14, 090

15,434

13,825

5.

12, 581

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning