What is the cost of the asset being depreciated? What amount, if any, was used in the depreciation calculations for the salvage value for this asset?

What is the cost of the asset being depreciated? What amount, if any, was used in the depreciation calculations for the salvage value for this asset?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE: A machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years....

Related questions

Question

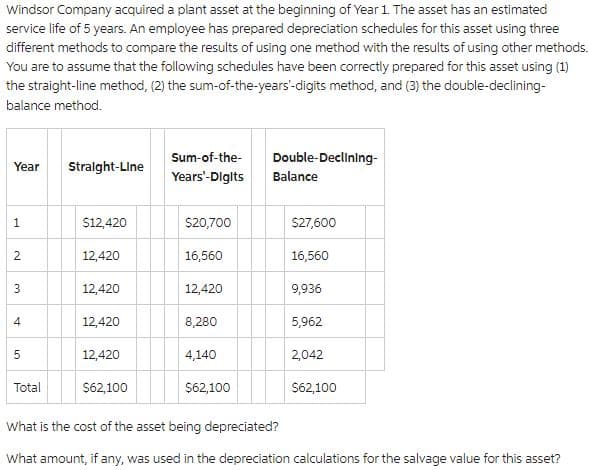

Transcribed Image Text:Windsor Company acquired a plant asset at the beginning of Year 1. The asset has an estimated

service life of 5 years. An employee has prepared depreciation schedules for this asset using three

different methods to compare the results of using one method with the results of using other methods.

You are to assume that the following schedules have been correctly prepared for this asset using (1)

the straight-line method, (2) the sum-of-the-years'-digits method, and (3) the double-declining-

balance method.

Year

1

2

3

4

5

Total

Straight-Line

$12,420

12,420

12,420

12,420

12,420

$62,100

Sum-of-the-

Years'-Digits Balance

$20,700

16,560

12,420

8,280

4,140

Double-Declining-

$62,100

$27,600

16,560

9,936

5,962

2,042

$62,100

What is the cost of the asset being depreciated?

What amount, if any, was used in the depreciation calculations for the salvage value for this asset?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College