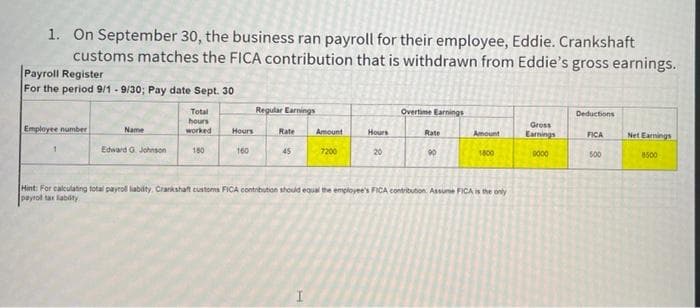

1. On September 30, the business ran payroll for their employee, Eddie. Crankshaft customs matches the FICA contribution that is withdrawn from Eddie's gross earnings.

1. On September 30, the business ran payroll for their employee, Eddie. Crankshaft customs matches the FICA contribution that is withdrawn from Eddie's gross earnings.

Chapter6: Analysing And Journalizing Payroll

Section: Chapter Questions

Problem 6PA

Related questions

Question

100%

Transcribed Image Text:1. On September 30, the business ran payroll for their employee, Eddie. Crankshaft

customs matches the FICA contribution that is withdrawn from Eddie's gross earnings.

Payroll Register

For the period 9/1-9/30; Pay date Sept. 30

Employee number

Name

Edward G. Johnson

Total

hours

worked

150

Hours

160

Regular Earnings

Rate

45

Amount

7200

Hours

20

Overtime Earnings

Rate

90

Amount

1800

Hint: For calculating total payroll liability, Crankshaft customs FICA contribution should equal the employee's FICA contribution. Assume FICA is the only

payrol tax liability

Gross

Earnings

9000

Deductions

FICA

500

Net Earnings

8500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub