How many years will it take to double your investment of $ 2000 if it has an interest rate of 6% compounded annually? Select one: а. 10 years b. 20 years С. 12 years d. 24 years 3 When dealing with uniform series, the normal situation is to have the series begins at the end of period 2 Select one: True False

How many years will it take to double your investment of $ 2000 if it has an interest rate of 6% compounded annually? Select one: а. 10 years b. 20 years С. 12 years d. 24 years 3 When dealing with uniform series, the normal situation is to have the series begins at the end of period 2 Select one: True False

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

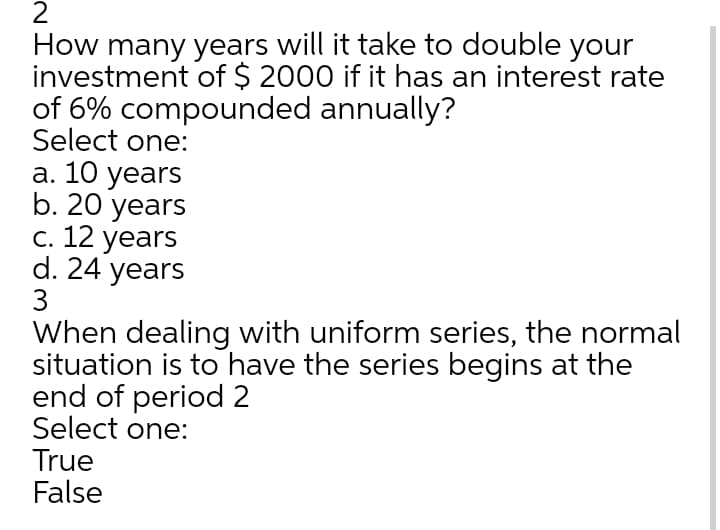

Transcribed Image Text:How many years will it take to double your

investment of $ 2000 if it has an interest rate

of 6% compounded annually?

Select one:

а. 10 years

b. 20 years

С. 12 years

d. 24 years

3

When dealing with uniform series, the normal

situation is to have the series begins at the

end of period 2

Select one:

True

False

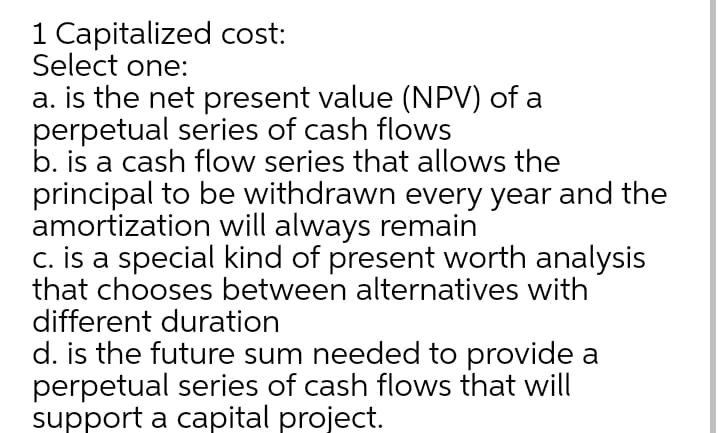

Transcribed Image Text:1 Capitalized cost:

Select one:

a. is the net present value (NPV) of a

perpetual series of cash flows

b. is a cash flow series that allows the

principal to be withdrawn every year and the

amortization will always remain

c. is a special kind of present worth analysis

that chooses between alternatives with

different duration

d. is the future sum needed to provide a

perpetual series of cash flows that will

support a capital project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning