How much in Social Security taxes should be deducted from Laruen E's check? *round to the nearest penny* How much Social Security will be withheld from Lauren's pay for the 51st pay (next week's pay)? How much in Medicare taxes should be deducted from Laruen E's check? *round to the nearest penny* What is Gabriel J's net (take home) pay? *round to the nearest penny*

How much in Social Security taxes should be deducted from Laruen E's check? *round to the nearest penny* How much Social Security will be withheld from Lauren's pay for the 51st pay (next week's pay)? How much in Medicare taxes should be deducted from Laruen E's check? *round to the nearest penny* What is Gabriel J's net (take home) pay? *round to the nearest penny*

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter11: Current Liabilities And Payroll

Section: Chapter Questions

Problem 11.9EX: Calculate payroll Diego Company has three employeesa consultant, a computer programmer, and an...

Related questions

Question

100%

How much in Social Security taxes should be deducted from Laruen E's check?

*round to the nearest penny*

How much Social Security will be withheld from Lauren's pay for the 51st pay (next week's pay)?

How much in Medicare taxes should be deducted from Laruen E's check?

*round to the nearest penny*

What is Gabriel J's net (take home) pay?

*round to the nearest penny*

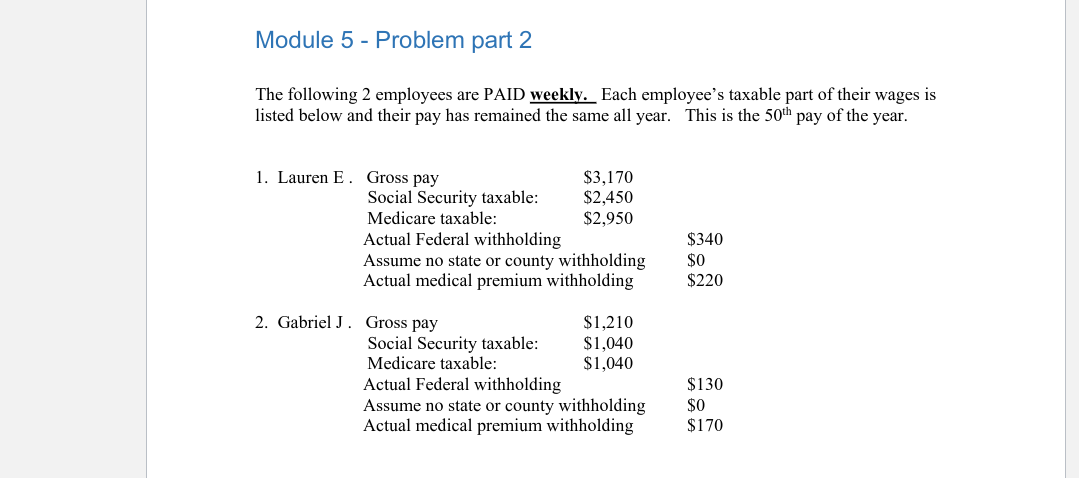

Transcribed Image Text:Module 5 - Problem part 2

The following 2 employees are PAID weekly. Each employee's taxable part of their wages is

listed below and their pay has remained the same all year. This is the 50th pay of the year.

1. Lauren E. Gross pay

Social Security taxable:

Medicare taxable:

Actual Federal withholding

Assume no state or county withholding

Actual medical premium withholding

2. Gabriel J. Gross pay

$3,170

$2,450

$2,950

Social Security taxable:

Medicare taxable:

$1,210

$1,040

$1,040

Actual Federal withholding

Assume no state or county withholding

Actual medical premium withholding

$340

$0

$220

$130

$0

$170

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning