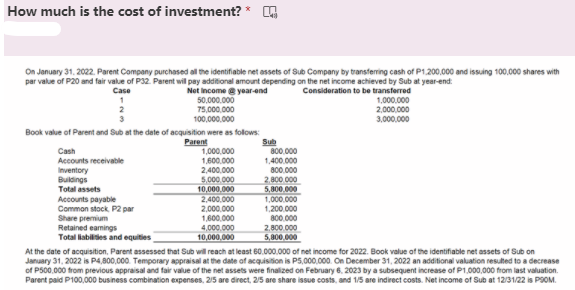

How much is the cost of investment? * L4 On January 31. 2022. Parent Company purchased al the identifiable net assets of Sub Company by transfering cash of P1.200.000 and issuing 100.000 shares with per value of P20 and fair value of P32. Perent will pay additional amount depending on the net income achieved by Sub at yearend Net income e yearend 50.000.000 75.000.000 Case Consideration to be transterred 1.000.000 2.000.000 100.000.000 3.000.000 Book value of Parent and Sub at the dete of acquisition were as folows Paret 1,000.000 1.600.000 2.400.000 5.000 000 10,000.000 2,400.000 2.000.000 1,600.000 4,000.000 10,000.000 B00.000 1,400.000 Cash Accounts receivable Inventory Buldings Total assets 800.000 2 800 000 5.800.000 Accounts payable Common stock. P2 par Share premium Retained eamings Total abilses and equities 1,000.000 1.200.000 800.000 2800 000 5,00.000 At the date of acquisition, Parent assessed that Sub will reach at least 60.000.000 of net income for 2022. Book value of the identifiable net assets of Sub on January 31, 2022 is P4800.000. Temporary appraisal at the date of acquisition is P5.000.000. On December 31, 2022 an addtional valuation resuted to a decrease of PS00.000 trom previous appraisal and fair value of the net assets were finalized on February 6, 2023 by a subsequent increase of P1.000.000 from last valuation.

How much is the cost of investment? * L4 On January 31. 2022. Parent Company purchased al the identifiable net assets of Sub Company by transfering cash of P1.200.000 and issuing 100.000 shares with per value of P20 and fair value of P32. Perent will pay additional amount depending on the net income achieved by Sub at yearend Net income e yearend 50.000.000 75.000.000 Case Consideration to be transterred 1.000.000 2.000.000 100.000.000 3.000.000 Book value of Parent and Sub at the dete of acquisition were as folows Paret 1,000.000 1.600.000 2.400.000 5.000 000 10,000.000 2,400.000 2.000.000 1,600.000 4,000.000 10,000.000 B00.000 1,400.000 Cash Accounts receivable Inventory Buldings Total assets 800.000 2 800 000 5.800.000 Accounts payable Common stock. P2 par Share premium Retained eamings Total abilses and equities 1,000.000 1.200.000 800.000 2800 000 5,00.000 At the date of acquisition, Parent assessed that Sub will reach at least 60.000.000 of net income for 2022. Book value of the identifiable net assets of Sub on January 31, 2022 is P4800.000. Temporary appraisal at the date of acquisition is P5.000.000. On December 31, 2022 an addtional valuation resuted to a decrease of PS00.000 trom previous appraisal and fair value of the net assets were finalized on February 6, 2023 by a subsequent increase of P1.000.000 from last valuation.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 92.3C

Related questions

Question

45

Transcribed Image Text:How much is the cost of investment? *

On January 31. 2022. Parent Company purchased al the identifiable net assets of Sub Company by transferring cash of P1.200,000 and issuing 100,000 shares with

par value of P20 and fair value of P32. Parent will pay additional amount depending on the net income achieved by Sub at year-end:

Not income e year-end

50,000.000

75,000.000

100,000.000

Consideration to be transferred

1.000.000

2,000.000

Case

3,000.000

Book value of Parent and Sub at the date of acquisition were as folows:

Sub

800,000

1,400.000

Parent

1,000.000

1,600.000

2,400.000

5.000.000

10,000.000

2,400.000

2,000.000

1,600,000

Cash

Accounts receivable

Inventory

Buldings

Total assets

800.000

2,800.000

5,800.000

1,000.000

Accounts payable

Common stock P2 par

Share premium

Retained eamings

Total kabilies and equities

1,200.000

800.000

2,800.000

5,800.000

4,000.000

10,000.000

At the date of acquisition, Parent assessed that Sub will reach at least 60.000.000 of net income for 2022. Book value of the identifiable net assets of Sub on

January 31, 2022 is P4,800,000. Temporary appraisal at the date of acquisition is P5,000,000. On December 31, 2022 an additional valuation resulted to a decrease

of P500.000 from previous appraisal and fair value of the net assets were finalized on February 6, 2023 by a subsequent increase of P1,000,000 from last valuation.

Parent paid P100,000 business combination expenses, 2/5 are direct, 2/5 are share issue costs, and 1/5 are indirect costs. Net income of Sub at 12/31/22 is PSOM.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT