What is the carrying amount of the investment in At the date of acquisition, Free Company's net assets had a At the excess of carrying amount. The land was sold during the of the outstanding ordinary shares of Free Company for P5,000,000 cash. Cyber Company accounts for this investment Free Company owned land with a fair value of P1,000,000 in Cybér Company bought 30% by the equity method. carrying amount of P12,000,000. a current year. The remaining difference between the purchase price and the carrying amount of the underlying equity cannot be ttributed to any identifiable tangible or intangible asset. Accordingly, the remaining difference is allocated to goodwill. Free Company reported net income of P6,000,000 and paid -ash dividend of P1,500,000 during the current year. 1. What is the implied goodwill from the acquisition? a. 1,400,000 b. 1,000,000 1,100,000 d. с. What amount should be reported as investment income for the current year? а. 2,100,000 b. 1,950,000 c. 1,500,000 d. 1,800,000 associate at year-end? a. 5,000,000 b. 6,500,000 C. 6,050,000- d. 6,350,000

What is the carrying amount of the investment in At the date of acquisition, Free Company's net assets had a At the excess of carrying amount. The land was sold during the of the outstanding ordinary shares of Free Company for P5,000,000 cash. Cyber Company accounts for this investment Free Company owned land with a fair value of P1,000,000 in Cybér Company bought 30% by the equity method. carrying amount of P12,000,000. a current year. The remaining difference between the purchase price and the carrying amount of the underlying equity cannot be ttributed to any identifiable tangible or intangible asset. Accordingly, the remaining difference is allocated to goodwill. Free Company reported net income of P6,000,000 and paid -ash dividend of P1,500,000 during the current year. 1. What is the implied goodwill from the acquisition? a. 1,400,000 b. 1,000,000 1,100,000 d. с. What amount should be reported as investment income for the current year? а. 2,100,000 b. 1,950,000 c. 1,500,000 d. 1,800,000 associate at year-end? a. 5,000,000 b. 6,500,000 C. 6,050,000- d. 6,350,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:3. What is the carrying amount of the investment in

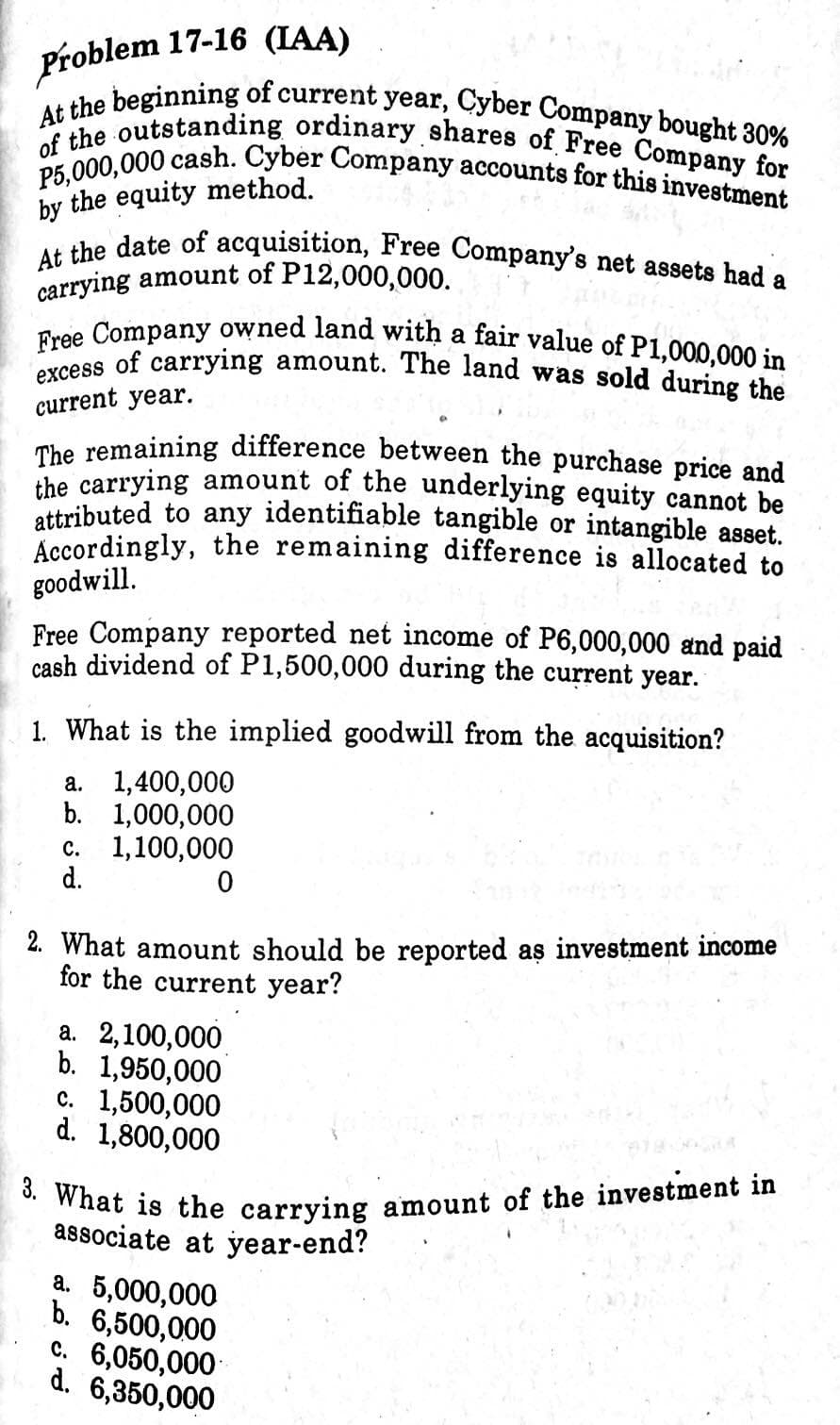

of the outstanding ordinary shares of Free Company for

P5,000,000 cash. Cyber Company accounts for this investment

At the date of acquisition, Free Company's net assets had a

excess of carrying amount. The land was sold during the

Free Company owned land with a fair value of P1,000,000 in

At the beginning of current year, Cyber Company bought 30%

Problem 17-16 (IAA)

by the equity method.

carrying amount of P12,000,000.

a

current year.

The remaining difference between the purchase price and

ihe carrying amount of the underlying equity cannot be

attributed to any identifiable tangible or intangible asset.

Accordingly, the remaining difference is allocated to

goodwill.

Free Company reported net income of P6,000,000 and paid

cash dividend of P1,500,000 during the current year.

1. What is the implied goodwill from the acquisition?

a. 1,400,000

b. 1,000,000

с. 1,100,000

d.

2. What amount should be reported as investment income

for the current year?

а. 2,100,000

b. 1,950,000

c. 1,500,000

d. 1,800,000

associate at year-end?

a. 5,000,000

b. 6,500,000

c. 6,050,000

d. 6,350,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning