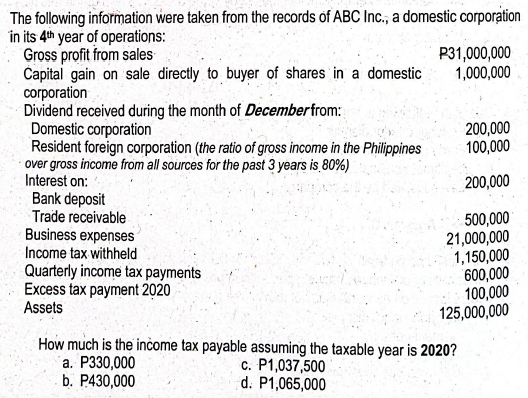

How much is the income tax payable assuming the taxable year is 2020?

Q: 2. Complete the below table to calculate income statement data in common-size percents. (Round your…

A: Common Size Income Statement:— It is Comparative income statement in which all items of income…

Q: On January 1, 2020, Sapphire Mining Company purchased land with valuable natural ore deposits for…

A: The depletion expense refers to the decrease in the value of the natural resource used in the…

Q: Mark Goldsmith's broker has shown him two bonds issued by different companies. Each has a maturity…

A: As per our guidelines only first question of the 3 asked here can be solved. So here is the solution…

Q: Using the following information: 1. The bank statement balance is $3,322. 2. The cash account…

A: Bank reconciliation statement is prepared to reconcile the bank balance to the cash balance…

Q: The trial balance before adjustment of saturn corp shows the following balances. Accounts Receivable…

A: Estimated bad debts on the assumption that allowance to provide for doubtful accounts on the basis…

Q: Rosy, Roland and Robert were partners with capital balances as at year end of P250,000; P350,000;…

A: The question is related to Partnership Accounting. In Partnership Net Income after taxes will be…

Q: How much is the book value per preference share assuming that preference shares are non-cumulative?

A: Book value per share refers to the ratio of total value available for preference shareholder and…

Q: Vernon Publications established the following standard price and costs for a hardcover picture book…

A: Here to calculate the details of the master Budget with the flexible budget which are incurred to…

Q: Problem 3-26 (Algo) Return on assets analysis [LO3-2] In January 2009, the Status Quo Company was…

A: Return on Asset=Income after taxesTotal Assets

Q: Statement of Financial Position Cash 10,000 Accounts payable $15,000 Accounts…

A: Note: As per our guidelines, we will solve the first three subparts for you. 1. Alternative #1…

Q: At year end,Elliott counted the office supplies on hand,which amounted to $1500.The firm had $900 of…

A: Supplies Expense - Supplies Expense is consider in the income statement only for the utilized…

Q: (b) Jasin Company projected operating income (based on sales of coming year as follows: [Syarikat…

A: Solution: Variable cost per unit = Total variable costs / Nos of units sold Contribution margin per…

Q: POPOL Company manufactures 100,000 units of Part P yearly as a major component for one of its…

A: Assumptions: we are considering fixed cost of 160,000 is unavoidable fixed cost. So this won't be…

Q: Lunox Corporation is composed of two major subunits: Wholesale and Retail. In December, Retail…

A: Calculations of profit for each segment Formula- sales revenue (-) variable costs (-) traceable…

Q: I – Non-adjusting event falling after date of authorization of FS issuance may or may not be…

A: Correct option is (d) Only statement II is true. It is recommended by the Standard that at most,…

Q: A company reports the following amounts at the end of the year: Total sales revenue = $560,000;…

A: Introduction: Net revenues: Deduction of sales returns , sales allowances , and sales discounts from…

Q: What is the reduction in total par value of shares to fully eliminate the deficit?

A: Quasi-reorganization was approved by the directors and the shareholders as the company was…

Q: Pearson ACT-Sole Proprietorship Google Chrome #act pearsoncmg.com/activity/2/7 Collected cash for…

A: Answer:- Collected cash for future services:- Account #1 Account Type…

Q: The following information on the utilization of a new computer programs was collected. No. of tasks…

A: Learning curve Theory states that when a task is done by a labor force repeatedly, the average time…

Q: During December, Moulding Corporation incurred ·26,000 of actual Manufacturing Overhead Cost. During…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: You and a few of your classmates decided to become entrepreneurs. You came up with a great idea for…

A: There are two users of information one is internal as well as external users where as external users…

Q: Quinn is single, age 52 and has the following income and expenses for 2020: Wages earned 40,000…

A: In the context of the given question, we are required to compute the adjusted gross total income of…

Q: PT. Manukdadali has $100 maximum in Petty Cash. On June 27, 2022 the Petty Cash of PT. Manukdadali…

A: Cash spend is $92

Q: Sedita Incorporated is working on its cash budget for July. The budgeted beginning cash balance is…

A: The excess cash available is determined by adding the beginning balance of cash and cash receipts…

Q: Beginning inventory Purchase (April 3) Sale (April 10) Purchase (April 18) Purchase (April 23) Sale…

A: Introduction: LIFO: LIFO stands for Last in First out. Which means last received inventory to be…

Q: Cloud Shoes Direct Materials Budget For the Month of March 2019 Terms March

A: Introduction: Direct material budget is a useful tool in analyzing and fulfilling production…

Q: Calculate the taxable value of the fringe benefit using the statutory formula in the following case…

A: It is given that : Purchase value - $ 45000 Days of use – 196 days Distance travelled – 15000 km…

Q: Do you believe that KFC would have been so successful in China today if executives had tried to make…

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: The adjusted trial balance for Chiara Company as of December 31 follows. Debit Credit Cash $…

A: INTRODUCTION: A financial statement is the balance sheet. It displays an entity's assets,…

Q: Units 100 50 80 40 60 120 Cost Beginning inventory Purchase (April 3) Sale (April 10) Purchase…

A: LIFO method is the method of inventory valuation where the goods which are purchased lately are sold…

Q: At the end of the current year, the accounts receivable account has a debit balance of $969,000 and…

A: Bad debts expense: Bad debts expense is recognized in the books of the company when a debtor is…

Q: Based on the following data, illustrate the break-even point by preparing a cost-volume-profit…

A: Marginal Costing - Marginal Costing is the method of computing operating profit by bifurcating…

Q: Liang Company began operations in Year 1. During its first two years, the company completed a number…

A: The allowance for doubtful accounts is created to maintain the balance for estimated bad debt…

Q: 2-a. Prepare a merchandise purchases budget for July, August, and September. Also compute total…

A: Working: Computation:

Q: Units Beginning inventory Purchase (April 3) Sale (April 10) Purchase (April 18) Purchase (April 23)…

A: Under lifo method of inventory units came in last will be sold first. In perpetual method inventory…

Q: Adams Manufacturing allocates overhead to production on the basis of direct labor costs. At the…

A: Variance is the result of the amount of expected value and actual results. It can be calculated by…

Q: Jasin Company projected operating income (based on sales of 450,000 units) for the coming year as…

A: 1) Calculation of Variable cost per unit :- Variable cost per unit = Total variable cost / out put…

Q: During 2021, Gamma Ltd discovered that some of their products sold during 2020 were incorrectly…

A: According to the given question, we are required to disclose the effect of the error in the…

Q: Balance sheety Liu Zhang operates Lawson Consulting, which began operations on June 1. The Retained…

A: Balance sheet is one of the important financial statement of business. It shows all assets, all…

Q: Briefly explain the "accrual basis assumption" and why financial statements are prepared under this…

A: As per our protocol we provide solution to the one question only but as you have asked multiple…

Q: March 31 is the end of PDT Co.'s monthly pay period. PDT Co. has one sole employee, Sally, with a…

A: Journal Entry: It the act through which economic or non-economic transactions are recorded .…

Q: National Company has 100,000 shares outstanding and just declared a 2-for-1 stock split. Before the…

A: This is a case of stock split. Hereby the shares already outstanding are split into 2 or more…

Q: Global Radio Company, which is trying to decide whether to introduce as a new product a wrist…

A: In the given question, first break-even point will be calculated. It is the point at which the sales…

Q: Liabilities a. possess service potential. O b. are things of value used by the business in its…

A: Liabilities: A person or corporation may be said to have a liability if they owe anything to another…

Q: REQUIRED: Prepare the journal entries relating to the reversal of the impairment loss in the 2021…

A: The formula used for calculating the impairment loss is as under: Impairment loss = Carrying cost -…

Q: Jasin Company projected operating income (based on sales of 450,000 units) for the coming year as…

A: Break-Even point in sales revenue = Fixed cost/Contribution margin ratio

Q: Sarah decides to open a cleaning and laundry service near the local college campus that will operate…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity. It…

Q: Darren corp has the following details for one of its subsidiaries: Long-term debt: 9% payable for…

A: Earnings per share= Net Income earned - Preferred dividends paid * / Weighted average number of…

Q: Nora, Vilma and Sharon are setting up the Past Stars Company and agreed to contribute cash and…

A: Share of partner in total capital Total capital*( ratio of that partner/ total of ratios of all…

Q: What is the asset turnover for 2021?

A: Introduction:- Ratio analysis used to analysis business performance. Ratios express the numerical…

Step by step

Solved in 2 steps

How about if the question is

How much is the income tax payable assuming the taxable year is 2021?

a. 330,000

b. 775,000

c. 800,000

d. 3,180,000

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.Goldfinger Corporation had account balances at the end of the currentyear as follows: sales revenue, $29,000; cost of goods sold, $12,000;operating expenses, $6,200; and income tax expense, $4,320. Assumeshareholders owned 4,000 shares of Gold finger's common stock duringthe year. Prepare Goldfinger's income statement for the current year.. The following are the amounts of Care Corporation’s assets and liabilities at May 31, 2010 and its revenue and expenses for the year ended on that date, listed in alphabetical order. Care Corporation had share capital of P50,000 and accumulated profits of P87,390 on June 1, the beginning of the fiscal year. During the year, the corporation paid cash dividends of P25,000. Accounts payable P 48,320 Accounts receivable 68,840 Advertising expense 14,600 Cash 40,150 Insurance expense 12,000 Land 150,000 Miscellaneous expense 3,140 Notes payable 22,000 Prepaid insurance 2,000 Rent…

- ABC Bank is a domestic bank. It reported the following information in preparation of its quarterly percentage tax return: Source of Income Amount Gross receipts on interest from lending (10 year) 5,000,000 Gross receipts on interest from lending (1 year) 10,000,000 Income from financial leasing 1,000,000 Dividends received from income of ABC Corp (subsidiary) 1,000,000 Rental income of ROPOA (acquired properties) 1,000,000 *year is period of maturity How much is the gross receipts tax due for the quarter?The Statement of Financial Position and the Statement of Profit and Loss of ABC Bank include the following main items (thousand UAH): Of 31 December 2021 Customer accounts– 4500; Share capital – 1700; Other components of equity – 200; Due to NBU – 1200; Due to banks – 800; Mandatory reserves – 600; Due from banks – 1300; Loans to customers – 1000; Investment securities– 5000; Assets held for sale – 2000; Other fin. liabilities – 1500 For the year ended 2021 Interest expense – 800; Interest income – 2400; Fee and commission income – 1500; Fee and commission expense – 900; Foreign exchange transaction losses – 700; Foreign exchange transaction gains – 300; Administrative and other operating expenses – 260; Income tax – 100; The task: Set up a T-account balance sheet for the bank, with assets, liabilities and equity. Which liabilities item is the largest and what is its share (in %) in the structure of (Liabilities + Equity)? Define and explain this type of Liabilities Calculate…On 31 December 20X2, the balances of Argon Enterprises Inc.’s shareholders’ equity accounts were as follows (all are credit balances): Capital stock $ 303,000 Contributed surplus 5,230 Retained earnings 105,400 Currency translation differences 1,400 Mark-to-market adjustments on available for sale investments 26,700 Cash flow hedges 2,000 Actuarial gains and losses 1,400 $ 445,130 Argon’s statement of comprehensive income for the year ending 31 December 20X3 showed the following amounts, from “net profit for the year” through “comprehensive income”: 31 December 20X3 31 December 20X2 Net profit for the year $ 44,900 $ 68,300 Other comprehensive income (loss) net of applicable income tax: Currency translation differences (4,200 ) 2,800 Mark-to-market adjustments on available for sale investments (34,300 ) 8,000 Actuarial gains (losses) 2,100 (6,500 ) Cash…

- . Franton Company, a calendar year, accrual basis corporation, reported $2,076,000 net income after tax on its current year financial statements prepared in accordance with GAAP. The corporation's financial records reveal the following information. Federal tax expense per books was $660,000. Franton received $22,400 of dividends from its < 1% investment in Microsoft and General Motors stock. Bad debt expense was $12,900, and write-offs of uncollectible accounts receivable totaled $16,300. Book depreciation was $110,890, and MACRS depreciation was $94,700. Franton paid a $50,000 fine to the City of Albany for illegal trash dumping. Compute Franton's regular tax liability. Hint: The correct answer should be $585,394During the current year, Thrasher (a calendar year, accrual basis S corporation) records the following transactions. Sales $1,500,000Cost of goods sold $900,000Long-term capital gain $11,000Short-term capital gain $5,000Salaries $210,000Qualified dividends from stock investments $30,000Rent expense $170,000Advertising expense $20,000Interest expense on business loan $15,000Section 1231 gain $25,000Organizational expenditures $3,000Charitable contributions $5,000Bad debt (trade account receivable deemed to be uncollectible) $10,000Cash dividend distributed to shareholders $120,000 Required: A. Determine Thrasher’s separately stated items for the current year B. Determine Thrasher’s ordinary business income for the current year DO NOT GIVE SOLUTION IN IMAGE FORMATThe general ledger trial balance of A Corporation includes the following statement of financial position accounts: Inventory (including inventory expected in the ordinary course of operations to be sold beyond 12 months amounting to P70,000) P110,000 Trade receivables 120,000 Prepaid insurance 8,000 Listed investments held for trading purposes at fair value 20,000 Available for sale investments 80,000 Cash and cash equivalents 30,000 Deferred tax asset 15,000 Bank overdraft 25,000 The amount that should be reported as current assets on A statement of financial position is

- On January 1, year 5, Olinto Corp., an accrual basis, calendar year C corporation, had $35,000 in accumulated earnings and profits. For year 5, Olinto had current earnings and profits of $15,000 and made two $40,000 cash distributions to its shareholders, one in April and one in September of year 5. What amount of the year 5 distributions is classified as dividend income to Olinto’s shareholders? a.$15,000 b.$35,000 c.$50,000 d.$80,000The following information on Dunway Ltd., a Canadian public company, is applicable to the year ending June 30, 2019: Sales Of Merchandise $825,000 Operating Expenses 533,000 Dividends From Controlled Subsidiary 17,500 Dividends From Non-Controlled Public Companies 15,000 Capital Gain On Investment Sale 22,000 Dividends Paid 182,000 Donation To Canadian Government 26,000Donations To Registered Canadian Charities 141,000 At the beginning of this fiscal year, the Company has available a net capital loss carry forward of $18,000 [(1/2)($36,000)] and a non-capital loss carry forward of $137,000. Dunway Ltd. does not anticipate having any capital gains in the foreseeable future. Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for Dunway Ltd. for the year ending June 30, 2019. Indicate the amount and type of any carry forwards that will be available for use in future yearsCompany B, a CCPC provides you with the following income data for this fiscal year: Aggregate Investment Income: $4,000 Active Business Income: $2,000 Canadian Dividends Connected (50% ownership, dividend refund received $1,500): $4,000 Canadian Dividends Non-connected: $3,000 What is Company's B's Taxable Income for this year ?