Darren corp has the following details for one of its subsidiaries: Long-term debt: 9% payable for notes = $1,018,000 convertible bonds payable at 7% -5,048,000 Bonds payable at 9% -6,026,000 Total long-term debt-$12,092,000 Shareholders' equity: Preferred stock, 6% cumulative, $57 par value, 106,300 shares authorized, 26,575 shares issued and outstanding-$1,514,775 Common stock, $1 par, 10,075,000 shares authorized, 1,007,500 shares issued and outstanding 1,007,500 Additional paid-in capital=4,001,800 Retained earnings=6,018,900 Total shareholders' equity-$12,542,975 Options were granted on July 1, 2013, to purchase 203,700 shares at $18 per share. Although no options were exercised during fiscal year 2014, the average price per common share during fiscal year 2014 was $20 per share.

Darren corp has the following details for one of its subsidiaries: Long-term debt: 9% payable for notes = $1,018,000 convertible bonds payable at 7% -5,048,000 Bonds payable at 9% -6,026,000 Total long-term debt-$12,092,000 Shareholders' equity: Preferred stock, 6% cumulative, $57 par value, 106,300 shares authorized, 26,575 shares issued and outstanding-$1,514,775 Common stock, $1 par, 10,075,000 shares authorized, 1,007,500 shares issued and outstanding 1,007,500 Additional paid-in capital=4,001,800 Retained earnings=6,018,900 Total shareholders' equity-$12,542,975 Options were granted on July 1, 2013, to purchase 203,700 shares at $18 per share. Although no options were exercised during fiscal year 2014, the average price per common share during fiscal year 2014 was $20 per share.

Chapter12: Capital Structure

Section: Chapter Questions

Problem 3PROB

Related questions

Question

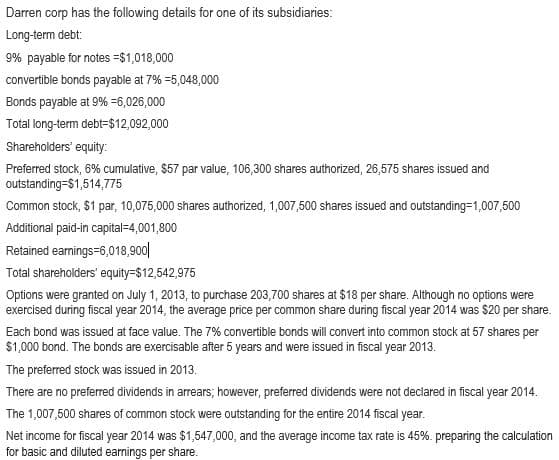

Transcribed Image Text:Darren corp has the following details for one of its subsidiaries:

Long-term debt:

9% payable for notes =$1,018,000

convertible bonds payable at 7% -5,048,000

Bonds payable at 9% -6,026,000

Total long-term debt-$12,092,000

Shareholders' equity:

Preferred stock, 6% cumulative, $57 par value, 106,300 shares authorized, 26,575 shares issued and

outstanding $1,514,775

Common stock, $1 par, 10,075,000 shares authorized, 1,007,500 shares issued and outstanding=1,007,500

Additional paid-in capital=4,001,800

Retained earnings=6,018,900|

Total shareholders' equity=$12,542,975

Options were granted on July 1, 2013, to purchase 203,700 shares at $18 per share. Although no options were

exercised during fiscal year 2014, the average price per common share during fiscal year 2014 was $20 per share.

Each bond was issued at face value. The 7% convertible bonds will convert into common stock at 57 shares per

$1,000 bond. The bonds are exercisable after 5 years and were issued in fiscal year 2013.

The preferred stock was issued in 2013.

There are no preferred dividends in arrears; however, preferred dividends were not declared in fiscal year 2014.

The 1,007,500 shares of common stock were outstanding for the entire 2014 fiscal year.

Net income for fiscal year 2014 was $1,547,000, and the average income tax rate is 45%. preparing the calculation

for basic and diluted earnings per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning