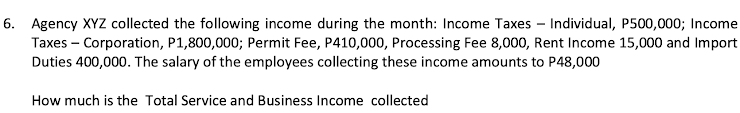

How much is the Total Service and Business Income collected

Q: What items are included in the company's operating income?

A: The performance of the company will be evaluated using the operating income of the company.…

Q: What is comprehensive income? How does comprehensive income differ from net income? Where do…

A: Comprehensive income:Comprehensive income represents the amount of net income plus other…

Q: Explain the components of income from continuing operations.

A: Continuing operations: The portions of the business which are expected to operate in the future are…

Q: How do you find gross profit in financial accounting?

A: Gross profit is the income earned by the company after deducting the cost of goods sold from the…

Q: The difference between revenues and expenses is net income. What is net income?

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting…

Q: * The report of company that shows overall profit on the sale of their goods or the ?provision of…

A: According to the given question, we need to find the correct option from the given available options…

Q: Which of the following statements regarding the income statement is true?a. The income statement…

A: The financial statements of the business are prepared for presenting the results of operations…

Q: which of the following would be considered in the calculation of gross profit? Sales and returns…

A: Gross Profit is the operating profit calculated by deducting the cost of goods sold from the revenue…

Q: How are organization expenses reported?

A: Expense: It can be defined as the cost of running a company's operations to generate or earn…

Q: The revenue cycle of a company generally includes which accounts?a. Inventory, accounts payable, and…

A: Revenue Cycle: Revenue cycle records all the transactions that originate from selling a product and…

Q: HOW DO I FIGURE OUT RETAINED EARNINGS on an income statement

A: Retained earnings is the amount retained from the profits of the company after deducting dividends…

Q: termine income from the operations?

A: Income from operations is also known as operating income (EBIT) (IFO). The profit created by a…

Q: How did they get the income summary?

A: Lets understand the basics. Income summary is summary which reflects the all the revenue and expense…

Q: how do you calculate the net income

A: Revenues: Revenues are earnings from operations of a business. The operating activities are sale of…

Q: The main difference between the income statements of a merchandising and a service type business is:…

A: SOLUTION EXPLANATION - A MERCHANDISING COMPANY ENGAGED IN PURCHASE AND RESALE OF TANGIBLE GOODS.…

Q: How can we determine the net income from operations and then adjust the net income?

A:

Q: Operating expenses are comprised of the following: O General and Administrative Expense, Cost of…

A: Operating Expenses (OpEx) are those expenses which are directly associated with the day to day…

Q: How does net income affect the operation of the business?

A: The bottom line of income statement is net income. It’s the outcome of sales and gains minus the…

Q: Prepare a detailed Statement of Comprehensive Income. Arrange the title of the following account in…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: What does an Income statement tell about a business?

A: An entity requires details about its operations such as profits, financial position and cash flows…

Q: How to calculate or compute the operating income and the net income

A: Operating Income: Income generated from the business operation is called operating income. In simple…

Q: * ?A financial statement that summarizes company revenue and expenses is Income statement Cash flow…

A: A financial statement seems to be a statement that shows the profitability, consistency, and…

Q: What criteria determine whether a company can recognize revenue over time?

A: Revenue is recognized over time if one of the following conditions is met: The customer…

Q: Using the following information, what is the amount of income from operations?

A: 1. Rent Revenue isn't operating income. That's why its not added to calculate income from…

Q: Distinguish between operating income and net income?

A: The main purpose of carrying on business operation is earning profits or income. It is the incentive…

Q: How do the Accountants measure the net income of a specified operating period?

A: Net income: The bottom line of the income statement which is the result of excess earnings from…

Q: he two companies: Sales to Y Sales to others Cost of goods sol Cost of goods sol

A: Intercompany sales mean that sales are made by one company of the group of companies to the other…

Q: What items are included in a company's income from continuing operations? How are these categorized…

A: A company or concern prepares income statement to know about the profit or loss from its all…

Q: Compute for the net sales that would be reported in LIVA company's Income Statemen

A: Net Sales are the total Sales after all adjustments made for any discounts made available to…

Q: How do I calculate Net Income & Net Profit Margin

A: Net income: The bottom line of income statement which is the result of excess of earnings from…

Q: is the segment of activity of a business which is responsible for both revenue and expenses. a.…

A: The segment which is responsible for revenue and expenses is the profit center but it is not…

Q: How does the type of business structure affect accounting, reporting, taxes, and liability?

A: Types of business are sole proprietorship, Partnership, LLC, Cooperative, Corporations.

Q: The amount of assets consumed during the performance of business operations in a period while…

A: Assets can be defined as any resource which has its own intrinsic economic value, owned and…

Q: What is the gross profit? | Select) How much is the operating expense? [ Select ] | Select) How much…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: record the share in the profit

A: A partnership is a form of business in which two or more persons come together with a common…

Q: How to find the net income? How to find the revenue expense?

A: Net Income Net Income is refer as the net profit or the profitability of the company. Net Income is…

Q: How is gross profit calculated, and what does it represent?

A: Gross profit is the difference of amount obtained by subtracting Cost of goods sold from Net…

Q: What do accountants mean by the term revenue?

A: Revenue is the sum that a corporation earns from selling products and/or supplying its clients and…

Q: How does comprehensive income differ from net income? Where do companiesreport it in a balance…

A: Definition: Comprehensive income: Comprehensive income represents the amount of net income plus…

Q: Identify which one of the following formula is used to calculate the net income of the service…

A: NET INCOME= REVENUE - EXPENSES.

Q: Explain the difference between NOPAT and net income. Which is a better measure of the performance of…

A: The net operating profits after taxes (NOPAT) is the operating profits after taxes. It includes all…

Q: entries and compute the company's gross profit.

A: Sales Revenue 840,000 Less Deductions Sales Returns and Allowances (10,000) Sales Discounts…

Q: what is the revenue and gross profit

A: Revenue is the amount or income which has been earned during particular period of time. Gross profit…

Step by step

Solved in 2 steps

- Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. Brandts income tax rate is 30%. Prepare Brandts multiple-step income statement for the current year.Marc Associates employs Janet Evanovich at its law firm. Her gross income for June is $7,500. Payroll for the month of June follows: federal income tax of $650, state income tax of $60, local income tax of $30, FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, health-care insurance premium of $300, donations to a charity of $50, and pension plan contribution of $200. The employee is responsible for covering 40% of his or her health insurance premium. A. Record the journal entry to recognize employee payroll for the month of June; dated June 30, 2017. B. Record remittance of the employees salary with cash on July 1.Toren Inc. employs one person to run its solar management company. The employees gross income for the month of May is $6,000. Payroll for the month of May is as follows: FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, federal income tax of $400, state income tax of $75, health-care insurance premium of $200, and union dues of $50. The employee is responsible for covering 30% of his or her health insurance premium. A. Record the journal entry to recognize employee payroll for the month of May, dated May 31, 2017. B. Record remittance of the employees salary with cash on June 1.

- Total earnings for the employees of Garys Grill for the week ended January 14, 20--, were 6,400. The following payroll taxes were levied on these earnings: Social Security 6.2% Medicare 1.45% FUTA 0.6% SUTA 5.4% Calculate Garys payroll taxes expense for the week ended January 14, 20--.Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.On January 21, the column totals of the payroll register for Great Products Company showed that its sales employees had earned 14,960, its truck driver employees had earned 10,692, and its office employees had earned 8,670. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, 3,975, and union dues, 560. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. Round amounts to the nearest penny.

- On January 21, the column totals of the payroll register for Great Products Company showed that its sales employees had earned 14,960, its truck driver employees had earned 10,692, and its office employees had earned 8,670. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, 3,975, and union dues, 560. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. Round amounts to the nearest penny.Cee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that it will owe 17,400 in property taxes for the year. On June 1, its property taxes are assessed at 17,000, which it pays immediately. Prepare the related journal entries for April 1, May 1, and June 1. Then compute the monthly property tax expense that Cee Co. would record during June through March.FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: a.Prepare an income statement. b.Compare your income statement with the income statement that is available at the FedEx Corporation Web site, (http://investors.fedex.com). Click on Annual Report and Download Annual Report. What similarities and differences do you see?