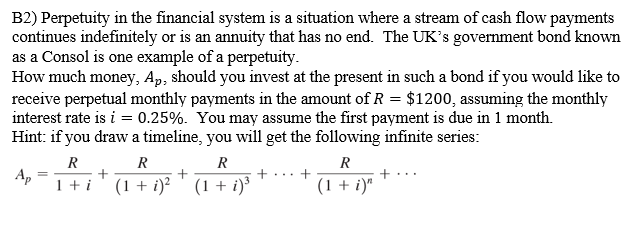

How much money, Ap, should you invest at the present in such a bond if you would like to receive perpetual monthly payments in the amount of R = $1200, assuming the monthly interest rate is i = 0.25%. You may assume the first payment is due in 1 month.

Q: Why aren't more resources committed to proper financial system prudential oversight to curb excessiv...

A: Deception with the goal of securing an unlawful profit for the perpetrator or depriving a victim of ...

Q: Suppose you bought the portfolio in (1), and suppose further that Firm A's share price increased to ...

A: Firm A's new share price increase = PHP 36 Firm B's new share price falls = PHP 38 Number of share...

Q: Assess the following statements: I. Default risk is the risk that a security issuer will default on ...

A: The risk that a lender assumes in the event that a borrower is unable to make the required payments ...

Q: How much are the total earnings will be available for common stockholders? Calculate the Earnings pe...

A: The equity of a company consist of both common stock and preferred stock. Where common stock holders...

Q: Shaylea, age 22, just started working full-time and plans to deposit $4,500 annually into an IRA ear...

A: Case 1 ) Shaylea started investing $4500 annually at beginning of the year into IRA earning 9% p.a c...

Q: Solve the following word problems with NEAT and COMPLETE SOLUTIONS. Answers should be rounded off to...

A: Annuity means a set of payments which are the same in size and made in equal time gaps for a certain...

Q: You have already $5,000 in your savings account today. You want to have $50,000 in your savings acco...

A: Data given: FV= $50,000 n= 10 years i= 5% p.a. Amount in savings account = $ 5000 Required: Amount...

Q: At what rate converted annually will make Php 3,253 accumulate to Php 3,982 in 4 years? Please ans...

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified...

Q: Financial Market is a market in which financial assets (securities) such as stocks and bon can be pu...

A: A financial market is a place where buyers and sellers of financial securities meet together in orde...

Q: CSM Machine shop is considering a four-year project to improve its production efficency. Buying a ne...

A: Net present value is the difference between the present value of benefits and net present value of c...

Q: Philo needs to borrow $310,000 to purchase a home. He is able to obtain a fifteen year mortage with ...

A: Loan Amount 310000 Time Period 15 Interest Rate 12%

Q: o coupon bond has more interest rate risk than a comparable coupon bond. true or false

A: Zero coupon bond do not have any coupon payment and face value is paid on the maturity and in coupon...

Q: Brett has almond orchards, but he is sick of almonds and prefers to eat walnuts instead. The owner o...

A: Market value of crops = Production in tons x Market price per ton

Q: (Common stock valuation) You intend to purchase Dorchester common stock at $51.00 per share, hold it...

A: Purchase price of stock (P0) = $51.00 Dividend (D1) = $6.25 Required return (r) = 15%

Q: A 90-day Commercial Paper (CP) is trading at 7%. CP yield is usually quoted to a rear-end basis and ...

A: Given: Period = 90 days Yield = 7% Assumed: Number of days in a year = 365 Face value = $100

Q: and now spent a total of $35 on a combination of small and large coffees in march, how many small an...

A: Selling price can be defined as the price which a customer pays for something. It includes both cost...

Q: A bond will be priced at a discount to par value if its coupon rate is less than its yield-to-maturi...

A: Bond prices have an inverse relationship with interest rates, with the price of the current bond fal...

Q: A 7-year, 10% annual-pay bond has a par value of $1,000. If its yield-to-maturity (YTM) is 12.4%, th...

A: Here, Par Value of Bond is $1,000 Time to Maturity is 7 years Coupon Rate is 10% Therefore, Coupon A...

Q: Jane Evans receives payments of $900 at the beginning of each month from a pension fund of $72,500. ...

A: We will apply the annuity formula to find the number of payments and the size of final payment.

Q: WMT’s bonds currently sell for $1,190. They pay a $192 semi-annual coupon payment, have a 31-year ma...

A: Yield to call is a return on the bond which is redeemed before the maturity also known as the callab...

Q: What is the importance of insurance companies?

A: Mainly importance of insurance companies is financial stability. large investors in financial market...

Q: Macaulay duration and the modified duration

A: Given information: Period: 2 year Face value: $1,000 Coupon rate: 6% Coupon amount semiannual: $1,0...

Q: An investment of 500 will increase to 4000 at the end of 20 years. Find the resent values of three p...

A: We will use the concept of time value of money here.

Q: Improved methods of oil and gas recovery, including fracking, have renewed interest in mineral royal...

A: Present Value The present value is the value of cash flow stream or the fixed lump sum amount at tim...

Q: Why is treasury considered a profit centre. What are the revenues and expense

A: In finance profit center refers to that branch or division that adds, in a direct manner, to an enti...

Q: 3a) The company issues a note to an entity to borrow cash for five years and will pay $500,000 to th...

A: Present Value The present value is the value of cash flow stream or the fixed lump sum amount at tim...

Q: 9. The day Anna was born, her father invested P5000 at 9% converted quarterly. Find the value of the...

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any sp...

Q: what should be the price of this European put option

A: Options are kind of derivative instruments. That is value of options is derived from the value of so...

Q: Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate b...

A: The price for bond implies to the consideration amount paid by investor for purchasing bond. In prov...

Q: Explain the similarities and the differences between the lockbox system and regional collection offi...

A: Both the lockbox system and the regional collection offices have some similarities and some differen...

Q: Suppose you have a 40% chance of making $30 and a 60% change of making $70. If your Utility Function...

A: A risk premium is the yield on the asset which is more than the risk free rate of return. This premi...

Q: What is the value of the firm?

A: FCF = EBIT + (1-tax)+ depreciation - capital expenditure = $59,000,000*(1-21%) + 5,900,000-7,300,000...

Q: What is the duration of a 5-year par value zero coupon bond yielding 10 percent annually?

A: A type of bond that does not provide periodic coupon payment to its holder during its holding period...

Q: Prepare a flexible budget for the production of 80% and 100% activity on the basis of the following ...

A: Flexible budget is the budget by which recognizing the difference between fixed, variable and semi-v...

Q: o. What is the yield to maturity of each bond? (Do not round intermediete calculations. Enter your a...

A: Maturity period = 10 years Face value = $100 The bond coupon is 3% then the price is 89% The The bon...

Q: You will retire in 26 years and can afford to put away 11 % of your salary each year. You make payme...

A:

Q: Calculate the 2017 total tax for Gordon Geist, a single taxpayer without dependents and no itemized ...

A: Data given: Active income = $44000 Short term capital gain = $3500 Book royalty = $8400 Required...

Q: TERM FINANCING II. Directions: Solve the following 1. Princess trading ordinarily purchases raw mate...

A: Trade credit is the facility provided by the supplier to allow the delayed payment. The discount i...

Q: Suppose you inherited P100, 000 and invested it at 7% per year. What is the most you could withdraw ...

A: The amount of withdrawal can be calculated by dividing the present value of investment by the presen...

Q: What mean finance

A: Finance is a broad term that can mean management of large amounts of money in a general sense.

Q: 1. A Fast-Moving Consumer Goods (FMCG) Company produces certain items at a labor cost of P 115 each,...

A: 1) Let the units for breakeven = X Unit sales price (s) = P 600 Unit variable cost (c) = P 115 + P 7...

Q: List three functions of an integrated treasury department

A: Treasury management is one of the most important function of banks. Its helps in proper deployment o...

Q: Solve the following word problems with NEAT and COMPLETE SOLUTIONS. Answers should be rounded off to...

A: The amount of annual scholarship can be found by using the EXCEL PMT function. The formula of the sa...

Q: 9. Calculating Annuity Values If you deposit $5,000 at the end of each year for the next 20 years in...

A: This is the question of the annuity. The future value of annuity has to be computed in this question...

Q: Allstate issued a 10-year, 10% semiannual coupon bond selling for $1,135.90 can be called in 4 years...

A: Yield to call refers to the total return earned by the bondholders if the bond is held until the cal...

Q: What is the horizon value at Year 4? What is the total net operating capital at Year 4? Which is lar...

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question...

Q: PART II - Below are 2019 FMT Company Cash flow accounts. Increase in bonds 170.0 Net income 117.5 In...

A: Cash flows from operating activities is cash inflows and outflows from day to day operations of enti...

Q: 4. A company has 80 million shares outstanding with an equity value of Kshs. 6 billion. The company ...

A: Capital restructuring is the process adopted by the companies to optimize their profitability or in ...

Q: 5.1 Annuity Period As you inc case the length to the present value of an annuity? What happens to th...

A: Present value- It is the current value of the future sum of cash flow at a given rate of return. For...

Q: preceding one Posit.

A: Accumulation in finance refers to growing the size of a single asset position, the number of assets ...

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Which of the following statements is CORRECT? Question 2 options: a) The proportion of the payment that goes toward interest on a fully amortized loan increases over time. b) An investment that has a nomiral rate of 6% with semiannual payments will have an effective rate that is smaller than 6%. c) If a loan or investment has annual payments, then the effective, periodic, and nominal rates of interest will all be different. d) The present value of a 3-year, $150 ordinary annuity will exceed the present value of a 3-year, $150 annuity due. e) if a loan has a nominal annual rate of 7%, then the effective rate will never be less than 7%.Please answer this question: What is the value at the end of Year 3 of the following cash flow stream if interest is 4% compounded semiannually? (Hint: you can use the EAR and treat the cash flows as an ordinary annuity or use the periodic rate and compound the cash flows individually.) What is the PV? What would be wrong with your answer to parts I(1) and I(2) if you used the nominal rate, 4%, rather than the EAR or the periodic rate, I sow /2=4%/2=2%, to solve the problems?What do we know about a loan, which is said to have annuity payments? a. This loan has annual cashflows only. b. This loan has only interest payments before maturity. c. This loan should be a mortgage loan. d. This loan has equal payment cashflows in all periods along its maturity.

- 1. What is the different between an ordinary annuity and an annuity due? Which occursmore in practice? Give a common example of both. 2. Using the example of a savings account, explain the difference between the effectiveannual rate and the annual percentage rate. 3. A mortgage instrument pays $1.5 million at the end of each of the next two years. Aninvestor has an alternative investment with the same amount of risk that will payinterest at 8% compounded semiannually. what the investor should pay for themortgage instrument?Which of the following statement is true? a) An ordinary annuity is an annuity in which the cash flow occurs at the start of each period b) None of the above c) A deferred annuity is an annuity in which the first cash flow occurs at the end of the time period between each subsequent cash flow d) with a credit foncier loan ( a loan for a fixed period with regular repayments) as time passes a smaller proportion of each repayment goes to paying off the interest on the loan1. Which statement is FALSE? A. Future value annuity is an example of annuity. B. A perpetuity is an annuity that has maturity period. C. An annuity is a series of equal payment made for a specified number of years. D. Ordinary annuity is an annuity in which the cash flows occur at the end of each period.

- Suppose you are going to receive $12,700 per year for six years. The appropriate interest rate is 7.6 percent. a-1. What is the present value of the payments if they are in the form of an ordinary annuity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a-2.What is the present value if the payments are an annuity due? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-1. Suppose you plan to invest the payments for six years. What is the future value if the payments are an ordinary annuity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-2. Suppose you plan to invest the payments for six years. What is the future value if the payments are an annuity due? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)Suppose you are going to receive $14,500 per year for five years. The appropriate interest rate is 8 percent. a-1. What is the present value of the payments if they are in the form of an ordinary annuity? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a-2. What is the present value of the payments if the payments are an annuity due? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-1. Suppose you plan to invest the payments for five years. What is the future value if the payments are an ordinary annuity? Note: Do not round intermediate..Which of the following statements is CORRECT? An investment that has a nominal rate of 6% with semiannual payments will have an effective rate that is smaller than 6%. If a loan has a nominal annual rate of 8%, then the effective rate can never be greater than 8%. If a loan or investment has annual payments, then the effective, periodic, and nominal rates of interest will all be different. The present value of a 3-year, $150 annuity due will exceed the present value of a 3-year, $150 ordinary annuity.

- Which of the following statements is CORRECT? 1. If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity. 2. The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month. 3. If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity. 4. The cash flows for an annuity due must all occur at the ends of the periods. 5. The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods.An annuity that goes on indefinitely is called a perpetuity. The payments of a perpetuity constitute a/an -Select-finiteinfiniteCorrect 1 of Item 1 series. The equation is: A -Select-preferredcommonCorrect 2 of Item 1 stock with no maturity is an example of a perpetuity. Quantitative Problem: You own a security that provides an annual dividend of $160 forever. The security’s annual return is 7%. What is the present value of this security? Round your answer to the nearest cent.$Suppose you just bought an annuity with 11 annual payments of $16,400 at a discount rate of 13.5 percent per year. What is the value of the investment at the current interest rate of 13.5 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. What happens to the value of your investment if interest rates suddenly drop to 8.5 percent? Note: Do not round intermediate calculations and round