Q: 5 Position Type 6 Executives 7 Managers 8 Professionals 9 Interim 10 Total 11 12 Percentage per…

A: In the given case, the monthly contribution of sales in total sales is calculated. In other words,…

Q: Tried and tested Ltd. has bond issue with an after-tax YTM of 6%. 5 years from now, they have 25…

A:

Q: Which of the following limits the market from becoming a fully efficient market? New…

A: Market efficiency is the ability of markets to process the information quickly and generate the…

Q: Which of the following is not a dominant risk that might affect the price of a bond? A Deferred…

A: Bond is a fixed income instrument. Bond represent a loan made to corporate and government in return…

Q: Adriana is financially responsible for her aged parents. She has a 5 year old son and wants to…

A: Life insurance is a contract between a policy holder and an insurance company that states that, in…

Q: Find the effective rate to the nearest hundredth for nominal interest rate. 5% compounded…

A: The nominal interest rate and the effective interest rate are the two variations of an interest…

Q: Behavioral finance is an area of study focused on how psychological influences can affect market…

A: We have to discuss about behavioral finance here and how psychological influences can affect market…

Q: If a certain stock sells for 626.659 dollars on the NYSE, how much will it sell for, in dollars, on…

A: 1) If a Stock trades at more than one stock exchange, then the price at all the stock exchanges will…

Q: A company is evaluating whether a new potential project should be taken on. The project will require…

A: Life of project is 6 years Cost of Capital is 9% To Find: Discounted payback period Net present…

Q: Critically evaluate how the Representativeness heuristic influences investment decision-making.

A: Investment The process of investing money with an aim of obtaining a profit or gain is known as…

Q: apley Dental Supply Company has the following data: Net income: $240 Sales: $10,000 Total assets:…

A: Return on Equity is the ratio that shows the profitability of the business by the use of owner's…

Q: Please Show ALL Workings VERY Clearly in FULL! Assuming that an investor enters into a short…

A: A short forward contract is a customized agreement for the purchase or sale of an underlying asset…

Q: If a coupon bond is issued at 13% coupon rate, has a par value of $1,000 with the required rate of…

A: Coupon rate = 0.13 or 13% Required rate = 0.10 or 10% Par value = $1000 When the coupon rate is…

Q: Boris is saving for the down payment on a house. He deposits $13,750.00 today, $6,000.00 in 5…

A: The Future Value of a lumpsum deposit: An amount deposited earns an interest over its investment…

Q: You are bullish on Zhu Que, Incorporated. You invest $10,000 of your own money and borrow $10,000…

A: The investor takes a leveraged buy position in a stock. We have to find the (a) number of shares the…

Q: USE 4 DECIMAL PLACES Nominal Rate 5% compounded semi annually 5% compounded quarterly Effective rate…

A: When stated nominal rate compounding is different than the effective rate compounding, the following…

Q: Antonio Sanchez had taxable income of $35,950 in 2021. He will file a return using the single filing…

A: A tax payer has earned interest income. We have to find out what quantum of interest income he must…

Q: Solve the following problems involving real rates of return and interest. a) Find it with 5.5%…

A: Here, To Find: Part A. Real rate of interest =? Part B. Nominal rate of interest =? Part C. Average…

Q: The present value of a deferred annuity of P4,800 every six months for 7 years, with the first…

A: Semi annual payment (P) = P4800 Period = 7 years Number of semi annual payments (n) = 7*2 = 14…

Q: QUESTION IS IN IMAGE Your company has been doing well, reaching $1.09 million in earnings, and is…

A: In the NPV analysis, we compute the present value of all future benefits. This present value is then…

Q: Bond X has a higher yield than Bond Y, what can be the reason? A Bond X has a longer history of…

A: Yield on a bond is the return that a bond holder can expect. This is at rate at which the coupons…

Q: The normal yield curve states that long-term investors are compensated for which risk? A Maturity…

A: A normal yield curve is upward sloping. We need to find out compensation towards which risk,…

Q: You are a fixed income investor who is expecting an upcoming recession (inverted yield curve). What…

A: Solution:- Inverted yield curve is a situation when long term interest rates fall below the short…

Q: What was the annual (simple) interest rate?

A: Simple interest rate is used to calculate the interest amount on the borrowed capital. We calculate…

Q: Please answer question 2 & 3 after reading the scenario thank you. Question at the end Stephanie…

A: Dividend discount model with fixed growth in dividends With required rate of return (r), current…

Q: You, as a real estate agent, sell a property for $225,000.

A: Sale Price: $2,25,000 Commission Rate = 6% Real Estate Agent Commission:

Q: The year-end 2015 balance sheet of XYZ Inc. listed common stock and other paid-in capital at…

A: Data given: Retained Earnings (2015) = $3,500,000 Net income (2016) = $700,000 Retained Earnings…

Q: Harmon just turned 67 years old. His AIME is $5,197. Harmon's wife, Lolita, also just reached age 67…

A: We know the AMIE and the bend points. We have to find the PIA amount and then the monthly retirement…

Q: The ratio that tells you how much income is used up by expenses is the Return on Assets ratio. True…

A: A financial ratio called return on assets (ROA) describes how lucrative a business is in comparison…

Q: You are analyzing a stock. The stock's most recent dividend paid was $2.6 per share. You expect that…

A: Given The recent dividend is $2.6 per share Required return is 6%

Q: The beneficiary of a life insurance policy is to receive $2000 a year for 5 years, the first payment…

A: Value of the annuity at the time of the death is calculated as the present value of annuity due…

Q: If a certain stock sells for 33.812 dollars on the NYSE, how much will it sell for, in dollars, on…

A: 1) If a Stock is listed at more than one stock exchange, then the price traded at all the stock…

Q: On 2019-03-23, xeniya deposits $814.22 in an account paying a simple interest rate 5.540%. Calculate…

A: We have to calculate the force of interest for an account earning simple interest.

Q: warning signs associated with development of problem loan

A: Problem loan means lender is not able to recover the principal and interest from borrower & is…

Q: What is a financial failure and what causes financial failures?

A: Financial failure is one of the most common issues in the market. Companies can face it because of…

Q: Find the expected monetary value when baking 25 loaves. EMV = S (Type an integer or a decimal.) Find…

A: To determine the expected monetary value (EMV), we first need to calculate the profit on each loaf…

Q: Ridge Clinic financial statements for 2018 and 2019 are presented below. Select the answers that…

A: Data given: December 31, 2018 Asset ($) 300000 Liabilities ($) 120000 Equity ($)…

Q: You currently have $5,300. First United Bank will pay you an annual interest rate of 8.8, while…

A: As per the given information: Future value - $13,000 Present value - $5,300 Rate of interest - 8.8…

Q: You Answered Correct Answer Unfortunately, your project just incurred a direct cost of $25,777 for…

A: A project has incurred an additional, unplanned cost. If it intends to earn the same budgeted margin…

Q: Lean systems require large batch sizes to gain economies of scale. Question content area…

A: Lean system are designed to produce output with fewer resources than traditional planning.…

Q: A disadvantage of holding TIPS is A If inflation does not occur then the value of holding TIPS…

A: Several statements have been given as disadvantages of TIPS. We have to find the correct one.

Q: For ethical reasons, researchers can begin analyzing data prior to establishing the p-value criteria…

A: A p-value of less than 0.05 is considered statistically significant, and the null hypothesis should…

Q: If Epic, Inc. has an ROE = 29%, equity multiplier = 3.6, a profit margin of 12.4%, what is the total…

A: Information Provided: ROE = 29% Equity multiplier = 3.6 Profit margin = 12.4%

Q: Lassiter Industries has annual sales of $220,000 with 12,000 shares of stock outstanding. The firm…

A: Price earning Ratio - In simple words we can say how much money investor pay for the stock to earn…

Q: QUESTION 4 John finances his daughter's college education by making deposits into a fund earning…

A: The PV of a payment series is the value of its cash flows today assuming that they are discounted at…

Q: All else equal, when deciding between two loan offers the loan that should be accepted is the one:…

A: We have a multiple choice question on the key factor influencing the decision between two loan…

Q: Everybody’s Fitness's 2021 income statement is reported below (in millions of dollars) (Use…

A: 1) Tax liability Maximum interest allowed = EBITDA * 30% = 1190 Million * 30% = 357 Tax Liability…

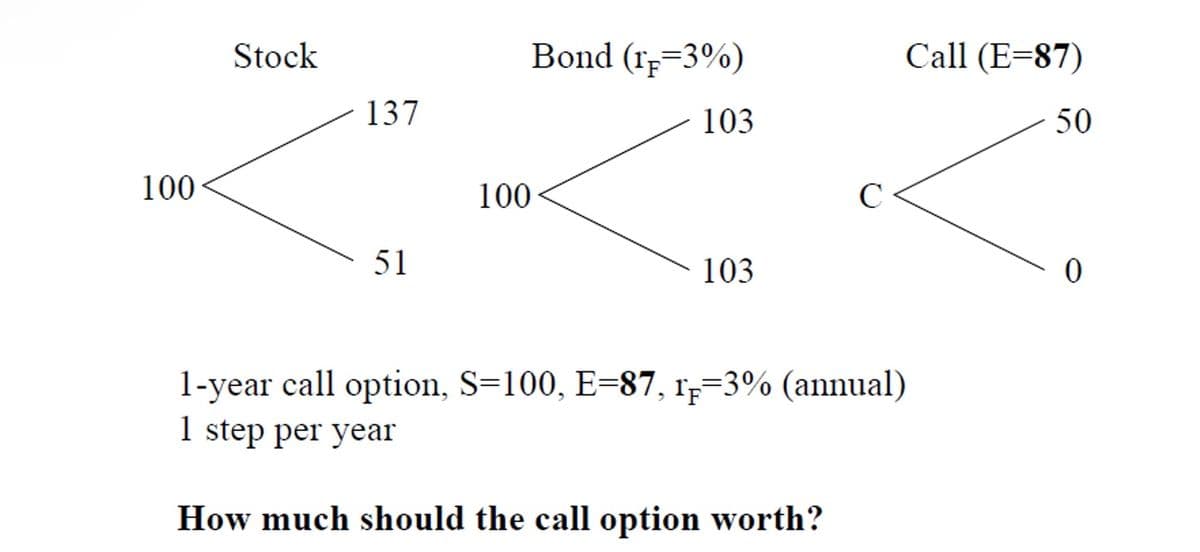

Question is attached.

Step by step

Solved in 2 steps with 2 images

- How much would you invest today in order to receive $30,000 in each of the following (for further Instructions on present value In Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at 15% D. 19 years at 18%If you invest $15,000 today, how much will you have in (for further instructions on future value in Excel, see Appendix C): A. 20 years at 22% B. 12 years at 10% C. 5 years at 14% D. 2 years at 7%In the compound interest example on P.344. Calculate S20 and T240. Which is the better investment after 20 years?

- The buyer of a certain machine may pay either P50k cash down payment & P10k annually for the next 6 years every beg’g of the year, or pay P60k cash & P10k annually for the next 5 years, 2 years after. If money is worth 12% compounded annually, what is the value of the 1st option? a). P69,047.762 b). P96,047.762 c). P66,047.762 d). P96,407.672If the current rate of interest is 8%, then the present value of an investment that pays $1000 per year and lasts 20 years is closest to: Group of answer choices $18,519 $20,000 $45,716 $9,81810.) Consider the following investment options. Option 1: invest $5000 for 8 years at 6% compound annually Option 2: invest $5000 for 8 years compounded continuously at 5%

- How much willan investment of GH< 20.000 be worth in 10 years at an interest rate of 10%% per annum payable semi-annually? A) GH¢ 54,304.89 B) GH 67,980.98 C) GH¢ 53,065.95 D) GH¢ 69,603.44 E) GH¢ 65,056.59Which One is the most Valuable Investment option? Assume Annual Compounding at an Interest rate of 12.00%. Group of answer choices $10,000 Today $40,000 in 18 years $20,000 in 9 years They are All the SameThe spot price of an investment asset is $50. The asset pays sure income of $5 in 6 months and the annual effective risk-free rate is 3%. What is the three-year forward price? a. $46.35 b. $54.63 c. $$49.25 d. $60.02 e. None of the above

- What is the initial value of an investment that has a value of $6245.30 after 6 years at a 5.5% annual interest rate with quarterly compounding? $4300 $4400 $4500 $4600If $3000.00 is invested for seven years and seven months at 6% p.a. compounded quarterly, calculate the maturity value. Question 11 options: A) $4712.57 B) $4882.57 C) $4745.43 D) $3776.32 E) $3763.18Heba is expecting to get OMR 50000 at the end of 5 years. How much will be the value today if: Option a: The discount rate is 9.02% half yearly Option b: The discount rate is 12.8% quarterly Select one: a. Option a: 32500.20 Option b: 32000.50 b. Option a: 65000.35 Option b: 49002.45 c. Option a: 32000.25 Option b: 36000.55 d. Option a: 32165.59 Option b: 32009.50