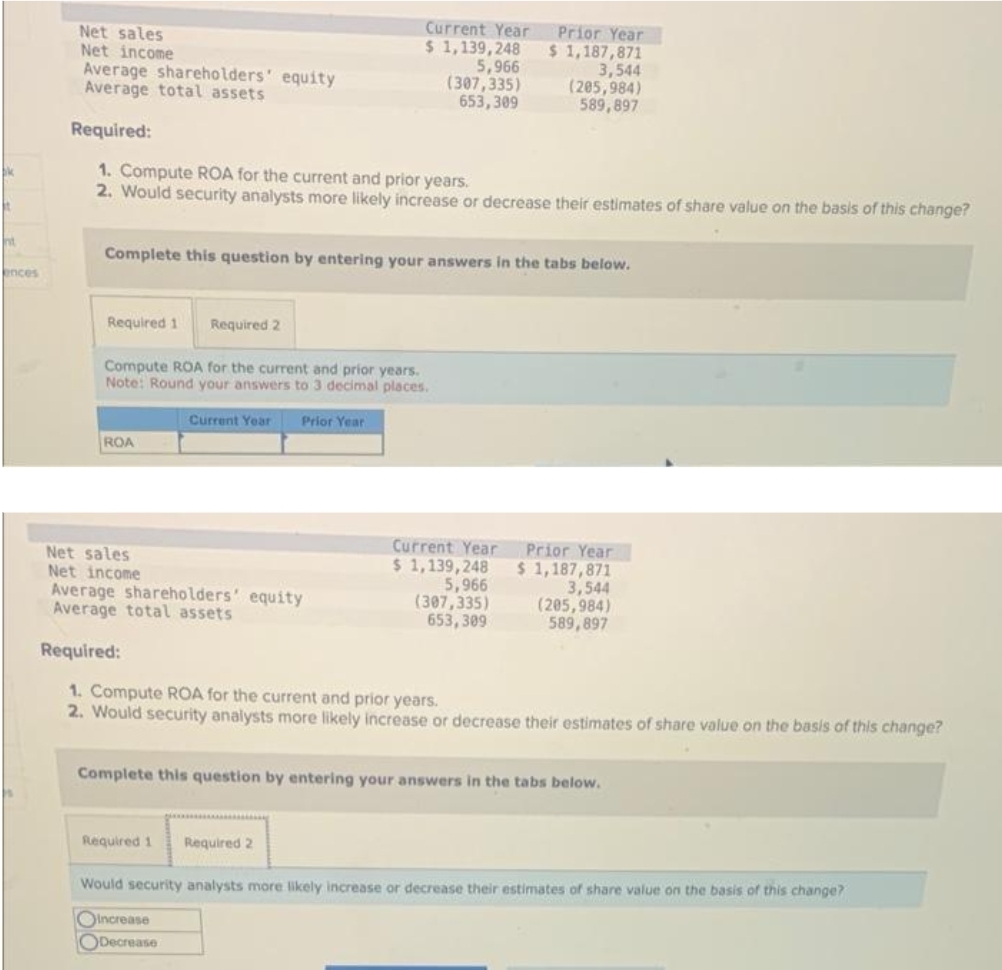

ht ences Net sales Net income Average shareholders' equity Average total assets Required: 1. Compute ROA for the current and prior years. 2. Would security analysts more likely increase or decrease their estimates of share value on the basis of this change? Required 1 Required 2 Complete this question by entering your answers in the tabs below. Compute ROA for the current and prior years. Note: Round your answers to 3 decimal places. Current Year Prior Year ROA Current Year $ 1,139,248 5,966 (307,335) 653,309 Net sales Net income Average shareholders' equity Average total assets Prior Year $ 1,187,871 3,544 (205,984) 589,897 Current Year $ 1,139,248 5,966 (307,335) 653,309 Increase Decrease Prior Year $ 1,187,871 3,544 (205,984) 589,897 Required: 1. Compute ROA for the current and prior years. 2. Would security analysts more likely increase or decrease their estimates of share value on the basis of this change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Would security analysts more likely increase or decrease their estimates of share value on the basis of this change?

ht ences Net sales Net income Average shareholders' equity Average total assets Required: 1. Compute ROA for the current and prior years. 2. Would security analysts more likely increase or decrease their estimates of share value on the basis of this change? Required 1 Required 2 Complete this question by entering your answers in the tabs below. Compute ROA for the current and prior years. Note: Round your answers to 3 decimal places. Current Year Prior Year ROA Current Year $ 1,139,248 5,966 (307,335) 653,309 Net sales Net income Average shareholders' equity Average total assets Prior Year $ 1,187,871 3,544 (205,984) 589,897 Current Year $ 1,139,248 5,966 (307,335) 653,309 Increase Decrease Prior Year $ 1,187,871 3,544 (205,984) 589,897 Required: 1. Compute ROA for the current and prior years. 2. Would security analysts more likely increase or decrease their estimates of share value on the basis of this change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Would security analysts more likely increase or decrease their estimates of share value on the basis of this change?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 63P: Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture...

Related questions

Question

Q 9

Transcribed Image Text:ht

ences

Net sales

Net income

Average shareholders' equity

Average total assets

Required:

1. Compute ROA for the current and prior years.

2. Would security analysts more likely increase or decrease their estimates of share value on the basis of this change?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute ROA for the current and prior years.

Note: Round your answers to 3 decimal places.

Current Year Prior Year

ROA

Net sales

Net income

Average shareholders' equity

Average total assets

Current Year Prior Year

$ 1,139,248

5,966

(307,335)

653,309

$ 1,187,871

3,544

(205,984)

589,897

Required 1

Current Year

$ 1,139,248

5,966

(307,335)

653,309

Required:

1. Compute ROA for the current and prior years.

2. Would security analysts more likely increase or decrease their estimates of share value on the basis of this change?

Required 2

Increase

Decrease

Prior Year

$1,187,871

Complete this question by entering your answers in the tabs below.

3,544

(205,984)

589,897

Would security analysts more likely increase or decrease their estimates of share value on the basis of this change?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning