huctor Eopnant acqued on January ata cot of 30 ss0 han an estimated unete f years and an estatedeatvalef 10 Joumal Requred What was the annul amount of derecation fr Years 13ung he att e.mehod of deprecaton he antry recondr he sale Reter he chat of account for the eract wordng of he account CNOWpuma dot ue ne jounaleanaton Asumng that the equpment wan st on Jauary 3 of Year 4or 27250 ale Every ine on a jouma peused dor credlenres CNOWenal atcaly indetaedt entry when a ceat amount entered What was the book of the equpment on anary tof ear d Aungthal the equpment wa od on ay of ear 272.50. jumale the entry o record the sale Referthe chat of accounta the eat wordng of the account es CNOWma det e ines upumaexpao Every ine on aunal page ued trde or cedentries CNOW ns wi maticaly ndetacedtenty when a cet amount entered ACCOUNTNG EOUATION Asumng that the equpment had been sd on January 3 of War4 br00atead of 272.50 male he eney torecord the sa Heterthe chat of accous he et wordng of the account es CNOWunl det e ines trpumeplanatons Every ine ona pma pegeued dor cedtenes CNOW pu wautomaaly ndta credey whena cred amount tered JOURHAL TQuestons Whal wes he an anount of uaton as ng he stateetod ofdeprecaton Aung a he ne ad been on aay of arr 0 t of22 male heey to recond the e eeroe chat ol accoun for the etording ofe arcount NOWuna t e trpunpatone ery ne ona pe e rder or otete CNOW wi onataly nde actentry whe a cet amun tered Vear1 derecton pee Year 2 deprection epene vear3 deprecton erpense het was he took at a he e net on anary1Ve s

huctor Eopnant acqued on January ata cot of 30 ss0 han an estimated unete f years and an estatedeatvalef 10 Joumal Requred What was the annul amount of derecation fr Years 13ung he att e.mehod of deprecaton he antry recondr he sale Reter he chat of account for the eract wordng of he account CNOWpuma dot ue ne jounaleanaton Asumng that the equpment wan st on Jauary 3 of Year 4or 27250 ale Every ine on a jouma peused dor credlenres CNOWenal atcaly indetaedt entry when a ceat amount entered What was the book of the equpment on anary tof ear d Aungthal the equpment wa od on ay of ear 272.50. jumale the entry o record the sale Referthe chat of accounta the eat wordng of the account es CNOWma det e ines upumaexpao Every ine on aunal page ued trde or cedentries CNOW ns wi maticaly ndetacedtenty when a cet amount entered ACCOUNTNG EOUATION Asumng that the equpment had been sd on January 3 of War4 br00atead of 272.50 male he eney torecord the sa Heterthe chat of accous he et wordng of the account es CNOWunl det e ines trpumeplanatons Every ine ona pma pegeued dor cedtenes CNOW pu wautomaaly ndta credey whena cred amount tered JOURHAL TQuestons Whal wes he an anount of uaton as ng he stateetod ofdeprecaton Aung a he ne ad been on aay of arr 0 t of22 male heey to recond the e eeroe chat ol accoun for the etording ofe arcount NOWuna t e trpunpatone ery ne ona pe e rder or otete CNOW wi onataly nde actentry whe a cet amun tered Vear1 derecton pee Year 2 deprection epene vear3 deprecton erpense het was he took at a he e net on anary1Ve s

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.33E

Related questions

Question

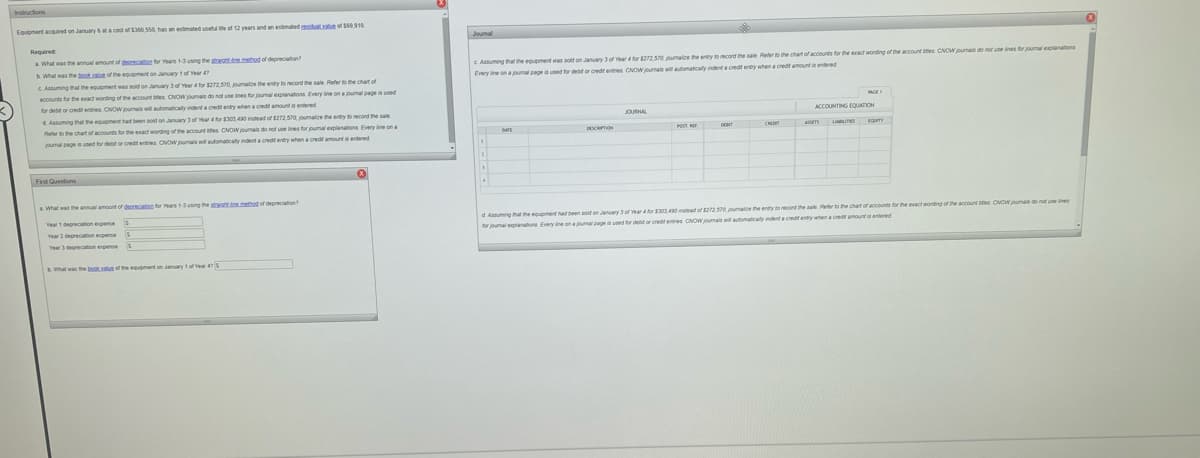

Transcribed Image Text:Instructions

Equpment acoired on January 6 at a cot of S360.550, has an estimated usetu e of 12 years and an estimated esidualvat of S910

Required

What was the annual amount of geoecaton for Years 13 usng the sttemetod of depreciation?

C Assuming that the equpment was aokt on Januay 3 of earfor $27250 umale the entry to ecord the sale Refer the chart of accounts for the eract wording of the account es CNOW puma do nor

b What was the booka of the equpment on anary 1 of Year 40

Every ine on a joumal page a used for debt or credr entres CNOWpumals atoaticaly indeta credtenty when a cred amounta entered

C Assuming that the equpment was sold on January 3 of Year 4tor $272,570, joumale the entry to record the sale Refer to the chart of

accounts for the exact wording of the account es CNOW joumas do not use ines for joumal explanatons Every ine on a pumal pages used

for debt or credt entres CNOW pumals wiltomaticaly indent a creditentry when a credit amountis entered

4Assuming that the equpment had been sold on January 3 of ear 4 for $300 0tead of $272.570 pumalce the eny to record the sale

JOURNAL

Reter othe chat of accounts for the eact wording of the account es CNOW ounals do not ue lines for pumal explanatons Every line ona

POS

pram

joumal pege e used for deb or credit entries CNOWpumas wil utomaticaly indente credt entry when a credt amount is entered

First Questions

aWhat wes the annual amount of depreciaton for Years 3 usng the straghtine.mettod of depreciation

d Asauming har he equpmet had been sof on January 3 of Year 4or002.490 nstead ol 272.50oumae he entry to record the aale efer to the chat of accounts for the exact woding of the account es CNOW mals donot ue nes

for joumal explanatone Every ine on ajoumal page a ed for debt or credtentres CNowoumals wilomatically ndent a credt entry when a credtamount entered

Year 1 deprecation epense

Year 2 deprecation epense

What was the bookvatn f the epment on January 1 of Year 4S

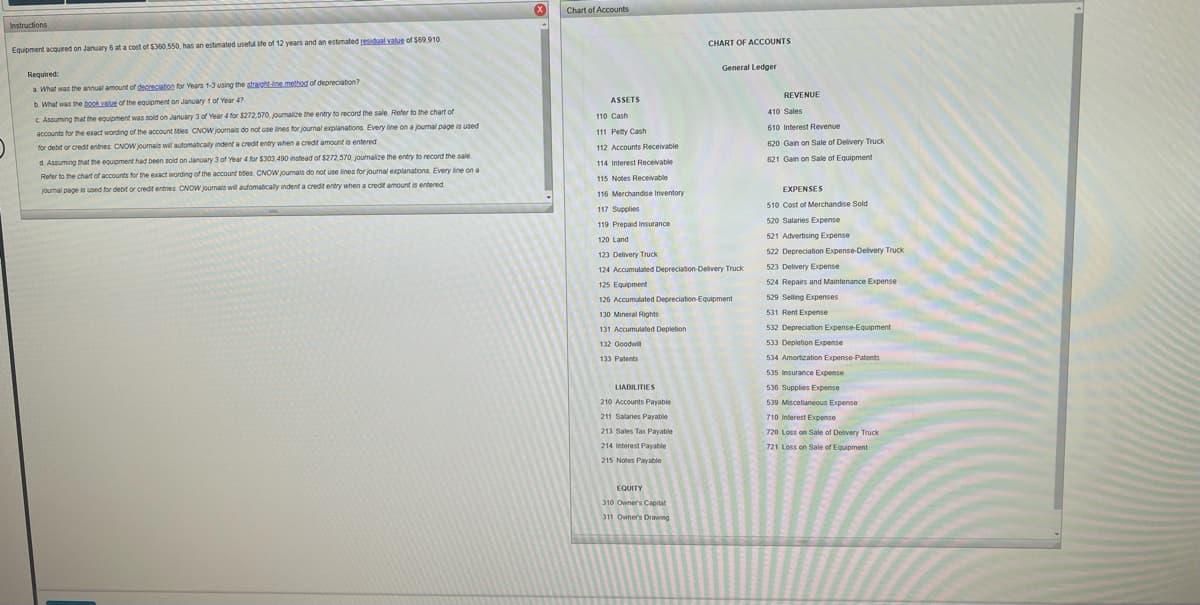

Transcribed Image Text:Chart of Accounts

Instructions

CHART OF ACCOUNTS

Equipment acquired on January 6 at a cost of $360,550, has an estimated useful ife of 12 years and an estimated residual value of $69.910

General Ledger

Required:

a. What was the annual amount of deoreciation for Years 1-3 using the straight-ine method of depreciation?

REVENUE

ASSETS

b. What was the book value of the equpment on January 1 of Year 47

410 Sales

110 Cash

c Assuming that the equipment was sold on January 3 of Year 4 for $272.570, journalize the entry to record the sale Refer to the chart of

610 Interest Revenue

accounts for the eract wording of the account ties CNOW journals do not use lines for journal explanations Every line on a journal page is used

111 Petty Cash

620 Gain on Sale of Delivery Truck

for debit or credt entnes CNOW journals wit automaticaly indent a credit entry when a credit amount is entered

112 Accounts Receivable

a. Assuming that the equipment had been sold on January 3 of Year 4 for $303,490 instead of $272.570 journalize the entry to record the sale

621 Gain on Sale of Equipment

114 Interest Receivable

Refer to the chart of accounts for the exact wording of the account tdes CNOW journals do not use lines for journal explanationa Every line on a

115 Notes Receivable

journal page is used for debt or credit entnes CNOW jounals will aufomatically indent a credit entry when a credit amount is entered

EXPENSES

116 Merchandise Inventory

510 Cost of Merchandise Sold

117 Supplies

520 Salaries Expense

119 Prepaid Insurance

521 Advertising Expense

120 Land

123 Delivery Truck

522 Depreciation Expense-Delivery Truck

124 Accumulated Depreciaton-Delivery Truck

523 Delivery Expense

125 Equipment

524 Repairs and Maintenance Expense

126 Accumulated Depreciation-Equipment

529 Selling Expenses

130 Mineral Rights

531 Rent Expense

131 Accumulated Depletion

532 Depreciation Expense-Equipment

132 Goodwill

533 Depletion Expense

133 Patents

534 Amortization Expense-Patents

535 Insurance Expense

LIABILITIES

536 Supplies Expense

210 Accounts Payable

539 Miscellaneous Expense

211 Salaries Payable

710 Interest Expense

213 Sales Tax Payable

720 Loss on Sale of Delivery Truck

214 Interest Payable

721 Loss on Sale of Equipment

215 Notes Payable

EQUITY

310 Owners Capital

311 Owners Drawng

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College