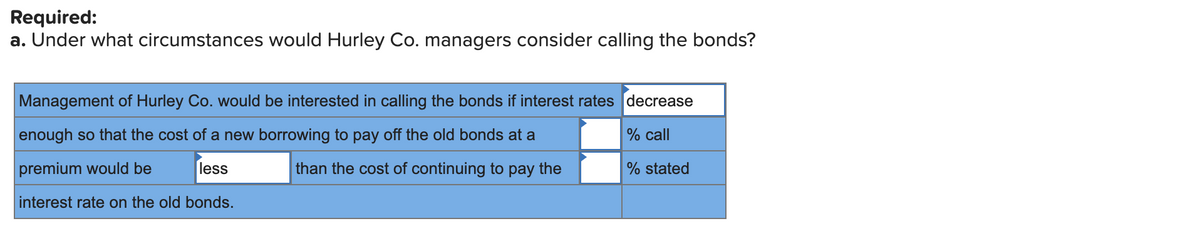

Hurley Co. has outstanding $420 million face amount of 9% bonds that were issued on January 1, 2007, for $409,500,000. The 20-year bonds mature on December 31, 2026, and are callable at 102 (i.e., they can be paid off at any time by paying the bondholders 102% of the face amount).

Q: Annual cash interest of 8 percent ($84,000) was to be paid on this debt. The bonds were issued at a…

A: Consolidation entry refers to the process of grouping the financial entries of a parent company with…

Q: Sarasota Inc. issued $4,170,000 of 10%, 10-year convertible bonds on June 1, 2020, at 97 plus…

A: Solution: When a bond is sold at a discount, the amount of the bond discount must be amortized to…

Q: Lowfood Corporation issued 10-year USD5,000,000 8 percent bonds on March 1, 2012, with a maturity…

A: The bonds are treated as a long-term liability because there are to be paid in more than a year. The…

Q: On May 1, 2020, Ceylon Corporation sold $90,000 of its 15%, five-year bonds dated January 1, 2020,…

A: Interest accrued=Value of bonds×Rate×412=$90,000×15%×412=$4,500

Q: On August 1, 2016, Limbaugh Communications issued $30 million of 10% nonconvertible bonds at 104.…

A: a) Step 1: Prepare the journal entry to record the issuance of the bonds by Limbaugh

Q: Waterway Inc. issued $15,400,000 of 12%, 40-year convertible bonds on November 1, 2020, at 98 plus…

A: a). Date Account title & Explanation Debit($) Credit($) December 31,2020 interest payable…

Q: On January 1, 2017, Sydney Inc. issued P 5,000,000 face value, 5-year bonds at 109. Each P1,000 bond…

A: Compound financial instruments are instruments that have both debt and equity components. Both the…

Q: On January 1, 2010, Rambutan Corporation purchased debt securities for cash of P765,540. The…

A: Rambutan Corporation purchased debt securities at P765,540 which carries the interest rate of 10%…

Q: On August 1, 2021, National Corporation issued $200,000 of 8% bonds at 99. The bonds mature in 10…

A: 1.

Q: On May 1, 2018, Luzon Company issued P2,000,000, 5 year, 10% bonds for P2,300,000. Each P1,000 bonds…

A: Share warrants means rights attached with the issue of bonds by which person has the right to…

Q: Sandhill Co. issued $4,100,000 of 12%, 5-year convertible bonds on December 1, 2020 for $4,122,360…

A: When the bonds are issued at premium, the amortisation premium needs to be adjusted against the…

Q: Several years ago Brant, Inc., sold $950,000 in bonds to the public. Annual cash interest of 8…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Several years ago Brant, Inc., sold $780,000 in bonds to the public. Annual cash interest of 9…

A: Prepare Consolidation Entry B to account for these bonds on December 31, 2019

Q: On April 1, 2017, Seminole Company sold 15,000 of its 11%, 15-year, $1,000 face value bonds at 97.…

A: “Hey, since there are multiple questions posted, we will answer first three questions If you want…

Q: Prepare all the necessary journal entries assuming the share warrants are fully exercised.

A: Issue price of bonds with warrants (5,000,000 x 103) = 515,000,000 Market value of bonds without…

Q: Several years ago Brant, Inc., sold $800,000 in bonds to the public. Annual cash interest of 8…

A: Journal Entry - It is record of every business transactions whether it is economic or non economic…

Q: Brazzle Inc. issued $ 200,000 face value bonds at a discount and received $ 185,000 . At the end of…

A: Net liability at year end = face value of bonds - Discount on Bonds Payable

Q: On August 31, 2015, Chickasaw Industries issued $25 million of its 30-year, 6% convertible bonds…

A: 1.

Q: Bramble Company sells 8% bonds having a maturity value of $2,000,000 for $1,848,366. The bonds are…

A:

Q: On April 1, 2020, Seminole Company sold 15,000 of its 11%, 15-year, $1,000 face value bonds at 97.…

A: Since we only answer up to 3 sub-parts, we’ll answer the first three. Please resubmit the question…

Q: On April 1, 2020, Waterway Company sold 17,100 of its 12%, 15-year, $1,000 face value bonds at…

A: Working Notes: 1. Calculate the discount on bonds payable as shown below:Discount on bonds payable =…

Q: During 2018, QQ Corporation issued at 95, 1,000 of its 8%, P5,000 bonds due in ten years. One…

A: Solution- Market price of bond= 50000* 1000 * .06 ( 60 * 10%)= 3000000 Market value of stock warrent…

Q: Aubrey Inc. issued $4,000,000 of 10%, 10-year convertible bonds on June 1, 2020, at 98 plus accrued…

A: Given information is: Aubrey Inc. issued $4,000,000 of 10%, 10-year convertible bonds on June 1,…

Q: Barbie originally issued 5,000,000 face value bonds at 105 or a premium of 250,000. Subsequently,…

A: Bond Bond is an instrument which are issued by the federal authority which is used by the corporate…

Q: Sandhill Co. issued $4,100,000 of 12%, 5-year convertible bonds on December 1, 2020 for $4,122,360…

A: Convertible bonds are a type of bonds issued by the organization, where at the time of maturity of…

Q: California, Inc. had outstanding 10%, P1 million face value, convertible bonds maturing on December…

A: Conversion of Bonds:-Convertible Bond It a type of debt issued by company for which company pays…

Q: On June 30, 2021, Marc Industries had outstanding $800 million of 8% convertible bonds that mature…

A: From the question we get the following data: Face value of the bond converted = $800 million * ½ =…

Q: On December 30, 2021, First Company issued 5,000 of 8%, 10-year, P 1,000 face value bonds with share…

A: Bond Payable There are different type of bond can be issued like discount on bond, par value on bond…

Q: On January 1, 2016, Case Company issued P5,000,000 of 12% nonconvertible bonds at 103 which are due…

A: The proceeds of issue is allocated based on their relative fair value of warrants and bonds Fair…

Q: On April 1, 2020, Cat Company sold 12,000 of its ₱1,000 11%, 5-year face value bonds at 96. The…

A: Total discount on bonds issue = Face value of bonds x (100- issue price)/100 = ₱12,000,000 x (100 -…

Q: On January 1, 2010, Huber Co. sold 12% bonds with a face value of $600,000. The bonds mature in five…

A: Amortization of bond: The process of allocation and reduction of the discount or premium on bonds to…

Q: On December 31, 2021, HULK Corporation had outstanding ₱20,000,000 face value convertible bonds…

A: SOLUTION- WORKING NOTE- CALCULATION OF AMOUNT TO BE DEBITED FROM SHARE PREMIUM ACCOUNT- THE VALUE OF…

Q: Several years ago Brant, Inc., sold $900,000 in bonds to the public. Annual cash interest of 9…

A: A bond refers to the instrument which is issued by the government to borrow money when needed. It is…

Q: On July 1, 2020, Shake Corporation issued P5,000,000 of its 10%, 7-year bonds with one detachable…

A: Bond is a debt instrument issued by a company to get the cash from the public. It carry a interest…

Q: Garr Co. issued $6,000,000 of 12%, 5-year convertible bonds on December 1, 2018 for $6,025,480 plus…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: On September 30, 2020, ChowFan Company issued P5,000,000 face value, 5-year bonds at 102. Each…

A: A bond is a debt financial instrument that is being issued by the government or corporation with the…

Q: On January 1, 2018, CEBU Company purchased 12% bonds, having a maturity value of P800,000, for…

A: Bonds refers to the borrowing security issued by the company to raise fund from the market by making…

Q: On January 1, 2018, CEBU Company purchased 12% bonds, having a maturity value of P800,000, for…

A: As per PFRS 9 the Financial assets shall be initially record at Fair value and add or subtract any…

Q: Several years ago Brant, Inc., sold $850,000 in bonds to the public. Annual cash interest of 9…

A: a.

Q: 11%. Patton Company uses the effective-interest method and plans to hold these bonds to maturity. 1.…

A: since there is 2 multiple question we solve first for as per our honor. Patton Company purchased…

Q: On July 1, 2020, Berry Company issued 5,000 P1,000 bonds with share warrants at its fair value of…

A: bonds issued with share warrant here at the time of issue of the bonds by the company it will also…

Q: RCM Corporation, a calendar-year firm, is authorized to issue $200,000 of 10 percent, 20-year bonds…

A: Solution... Issue price = $200,000 RATE OF INTEREST = 10% Interest expenses accrued on April 1 =…

Q: In order to finance Plywood Company’s planned expansion, 10%, P5,000,000 face value bonds were…

A: The gain or loss on the early extinguishment of debt would be computed by deducting the amount from…

Q: On May 1, 2018, Luzon Company issued P2,000,000, 5 year, 10% bonds for P2,300,00O. Each P1,000 bonds…

A: Share warrants are the rights attached with the issue of shares which provides the issuer of the…

Q: On July 31, 2010, Honedge Co. issued P1,000,000 of 10%, 15 year bonds at par and used a portion of…

A: Issuance of Bonds Bond is considered to be the debt instrument which are utilized by the companies…

Q: Oriole Inc. issued $6 million of 10-year, 10% convertible bonds on June 1, 2020, at 99 plus accrued…

A: SOLUTION A JOURNAL IS AN COMPANY'S OFFICIAL BOOK IN WHICH ALL BUSINESS TRANSACTION ARE RECORDED IN…

Q: ature in six years, and interest is paid semi-annually on June 30 and December 31. The bonds were…

A: The bond will mature on the maturity date, and the issuing company would pay the debt holder the…

Q: On July 1, 2022, Mocha Corporation issued P5M of its 10%, 7-year bonds with one detachable share…

A: The question has asked about the issue price of the share warrants outstanding. Definition of some…

Hurley Co. has outstanding $420 million face amount of 9% bonds that were issued on January 1, 2007, for $409,500,000. The 20-year bonds mature on December 31, 2026, and are callable at 102 (i.e., they can be paid off at any time by paying the bondholders 102% of the face amount).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Which of the following events would make it more likely that a company would choose to call it’s outstanding callable bonds? An increase in market interest rates. An increase in the call premium. All the other statements are correct. The company’s bonds are downgraded. A reduction in market interest rates.Which of the following statements is CORRECT? Group of answer choices The bond-yield-plus-risk-premium approach to estimating the cost of common equity involves adding a risk premium to the interest rate on the company’s own long-term bonds. The size of the risk premium for bonds with different ratings is published daily in The Wall Street Journal or is available online. The WACC is calculated using a before-tax cost for debt that is equal to the interest rate that must be paid on new debt, along with the after-tax costs for common stock and for preferred stock if it is used. An increase in the risk-free rate is likely to reduce the marginal costs of both debt and equity. The relevant WACC can change depending on the amount of funds a firm raises during a given year. Moreover, the WACC at each level of funds raised is a weighted average of the marginal costs of each capital component, with the weights based on the firm’s target capital structure. Beta measures market risk,…Under which of the following situation, would a firm most likely to call its outstanding callable bonds? Group of answer choices a)The firm has financial distress. b)The company’s bonds are downgraded. c)The market interest rate increases d)The market interest rate declines

- Which of the following events would make it more likely that a company would choose to call its outstanding callable bonds? a. Market interest rates rise sharply. b. Market interest rates decline sharply. c. The company's nancial situation deteriorates signicantly. d. Ination increases signicantly. e. The company's bonds are downgraded. Please explain.Which of the following statements is right? Group of answer choices a)Ignoring the liquidity risk, the 10-treasry bond should have the same interest rate as the 10-year corporate bond. b)Ignoring the default risk, the 10-treasry bond should have the same interest rate as the 10-year corporate bond. c)The return of the 10-year treasury bond must be less than that of the 10-year corporate bond d)The return of the 10-year treasury bond must be greater than that of the 10-year corporate bondWhich one is not suitable for serial bonds?Select one:a. Principal matures in annual installmentsb. Principal matures in one lump-sum amountc. Some resources are likely to be raisedd. Idle cash balances should be invested

- Which of the following is not an effect of a call provision? A. Issuer can refund the bond issue if rates decline. B. Requires the issuer to pay off the loan over its life rather than all at maturity. C. Bond investors require higher yields on callable bonds D. Upon calling bonds the issuer must pay call premium to bond holder E. All of the above are effects of a call provisionWhich of the following statements is not correct? a) The export value of the bond; the value the investor pays when buying bonds b) Nominal value of the bond; is the value written on the bond c) Another reason for the difference in bond market prices is the dividend paid to bonds. d) Periodic interest amounts on bonds are calculated at nominal value. e) Market value of a bond is equal to the present value of the interest to be paid by the bond and the principal amount to be paid at the end of maturity. ------------------ What is the market value of İdil Gıda's bond with a nominal value of 15000 USD, maturity of 3 years and 30% annual interest payment, assuming that the desired yield rate is 36%? a) 12500b) 13494c) 9000d) 5456e) 7594 ============ What is the market value of Beril Gıda A.Ş.'s bond with a nominal value of USD 12,000, maturity of 5 years and an annual interest payment of 25%, when the desired rate of return is 25%? a) 18000b) 15000c) 12000d) 16000e)…The time value of money is used in calculating bond prices because: Group of answer choices A - The company might choose to repay the bonds prior to their maturity date B - Bond investors receive future payments and purchase bonds with current dollars C - The amount to be repaid at maturity will change as market rates change D - Cash interest payments to bondholders will change as market rates change

- Which of the following statements about Floating-Rate Debt is NOT true? A) Floating-rate debt has a stated interest rate that fluctuates in tandem with some interest rate benchmark (for instance, LIBOR). B)Floating-rate bonds allow companies to keep reported book value and fair value at the same level that protects investors from losses. C)The issuing company benefits from floating-rate debt when market interest rates increase. D)Floating-rate debt is issued at par.Which of the following will increase a firm's aftertax cost of debt financing? Select one: a. increase in a bond's current market price b. decrease in the corporate tax rate c. increase in the dividend yield d. decrease in the market rate of interestWhen a company retires bonds early, the gain or loss on the retirement is the difference between the cash paid and the…… Select one: a. original selling price of the bonds. b. carrying value of the bonds. c. maturity value of the bonds. d. face value of the bonds.