HW#5 (Monopoly, Monopolistic Competition, Oligopoly) 8. Regulating a natural monopoly Consider the local telephone company, a natural monopoly. The following graph shows the monthly demand curve for phone services and the company's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves. 100 90 80 70 60 50 40 30 20 ATC MC- 10 MR 6 8 10 12 14 16 18 20 QUANTITY (Thousands of subscriptions) PRICE (Dollars per subscription) Suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints. Complete the first row of the following table. Short Run Quantity Price Pricing Mechanism (Subscriptions) (Dollars per subscription) Profit Long-Run Decision Profit Maximization Marginal-Cost Pricing Average-Cost Pricing Suppose that the government forces the monopolist to set the price equal to marginal cost. Complete the second row of the previous table. Suppose that the government forces the monopolist to set the price equal to average total cost. Complete the third row of the previous table. True or False: Under the average-cost pricing policy, the telephone company has no incentive to cut costs. True False

HW#5 (Monopoly, Monopolistic Competition, Oligopoly) 8. Regulating a natural monopoly Consider the local telephone company, a natural monopoly. The following graph shows the monthly demand curve for phone services and the company's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves. 100 90 80 70 60 50 40 30 20 ATC MC- 10 MR 6 8 10 12 14 16 18 20 QUANTITY (Thousands of subscriptions) PRICE (Dollars per subscription) Suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints. Complete the first row of the following table. Short Run Quantity Price Pricing Mechanism (Subscriptions) (Dollars per subscription) Profit Long-Run Decision Profit Maximization Marginal-Cost Pricing Average-Cost Pricing Suppose that the government forces the monopolist to set the price equal to marginal cost. Complete the second row of the previous table. Suppose that the government forces the monopolist to set the price equal to average total cost. Complete the third row of the previous table. True or False: Under the average-cost pricing policy, the telephone company has no incentive to cut costs. True False

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: Monopolistic Competition

Section: Chapter Questions

Problem 3CQQ

Related questions

Question

Transcribed Image Text:HW#5 (Monopoly, Monopolistic Competition, Oligopoly)

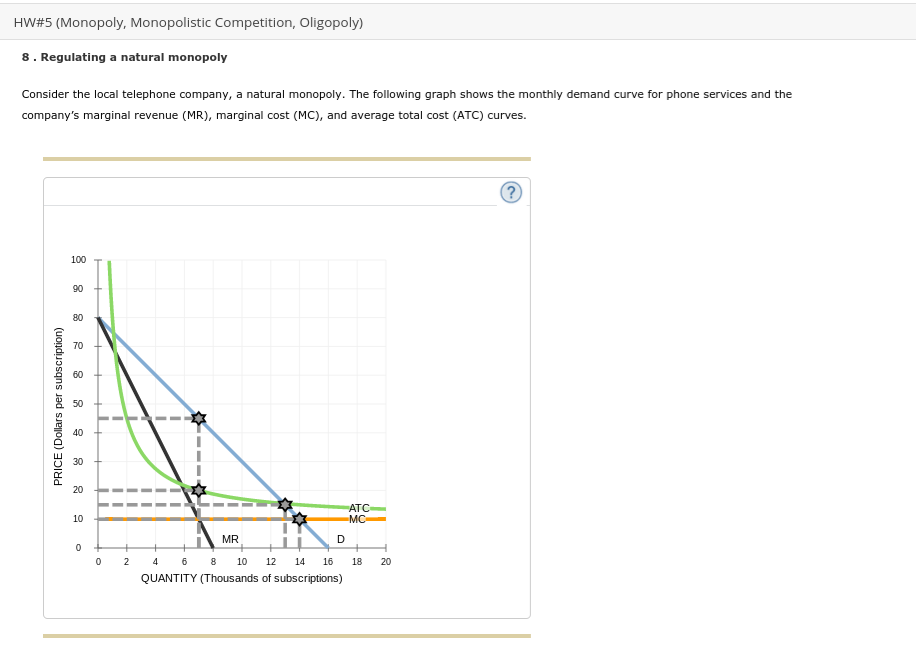

8. Regulating a natural monopoly

Consider the local telephone company, a natural monopoly. The following graph shows the monthly demand curve for phone services and the

company's marginal revenue (MR), marginal cost (MC), and average total cost (ATC) curves.

100

90

80

70

60

50

40

30

20

ATC

MC-

10

MR

6 8 10

12 14

16

18

20

QUANTITY (Thousands of subscriptions)

PRICE (Dollars per subscription)

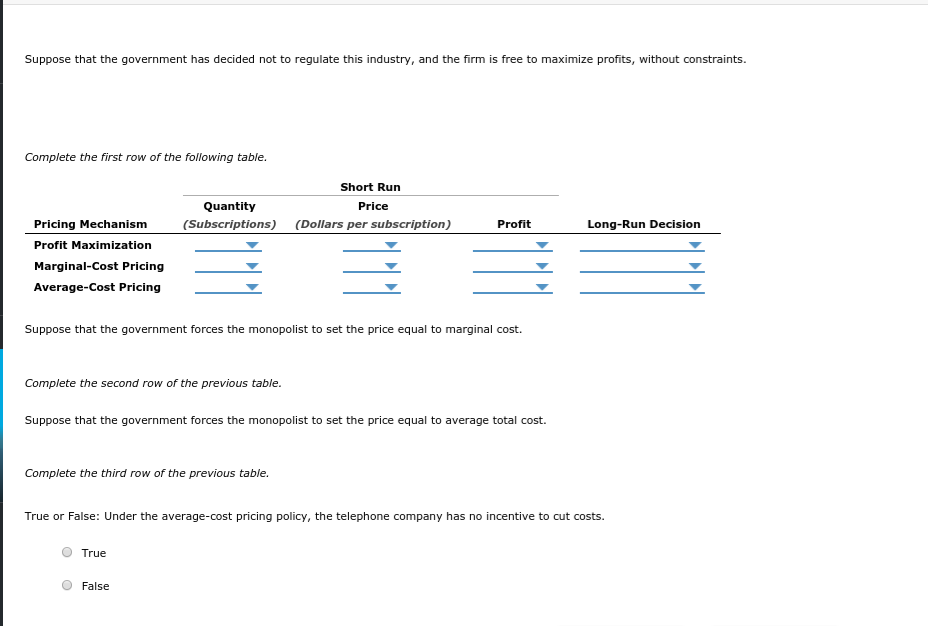

Transcribed Image Text:Suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints.

Complete the first row of the following table.

Short Run

Quantity

Price

Pricing Mechanism

(Subscriptions) (Dollars per subscription)

Profit

Long-Run Decision

Profit Maximization

Marginal-Cost Pricing

Average-Cost Pricing

Suppose that the government forces the monopolist to set the price equal to marginal cost.

Complete the second row of the previous table.

Suppose that the government forces the monopolist to set the price equal to average total cost.

Complete the third row of the previous table.

True or False: Under the average-cost pricing policy, the telephone company has no incentive to cut costs.

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning