PROBLEM 7-20 Evaluating the Profitability of Services LO7-2, LO7-3, L07-4, L07-5 Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $28 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear in the pictures below: Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so on. Required: 1.Using Exhibit 7-6 as a guide, prepare the first-stage allocation of costs to the activity cost pools. 2. Using Exhibit 7-7 as a guide, compute the activity rates for the activity cost pools. 3. The company recently completed a 500 square foot carpet-cleaning job at the Flying N Ranch- a 75-mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system.

PROBLEM 7-20 Evaluating the Profitability of Services LO7-2, LO7-3, L07-4, L07-5

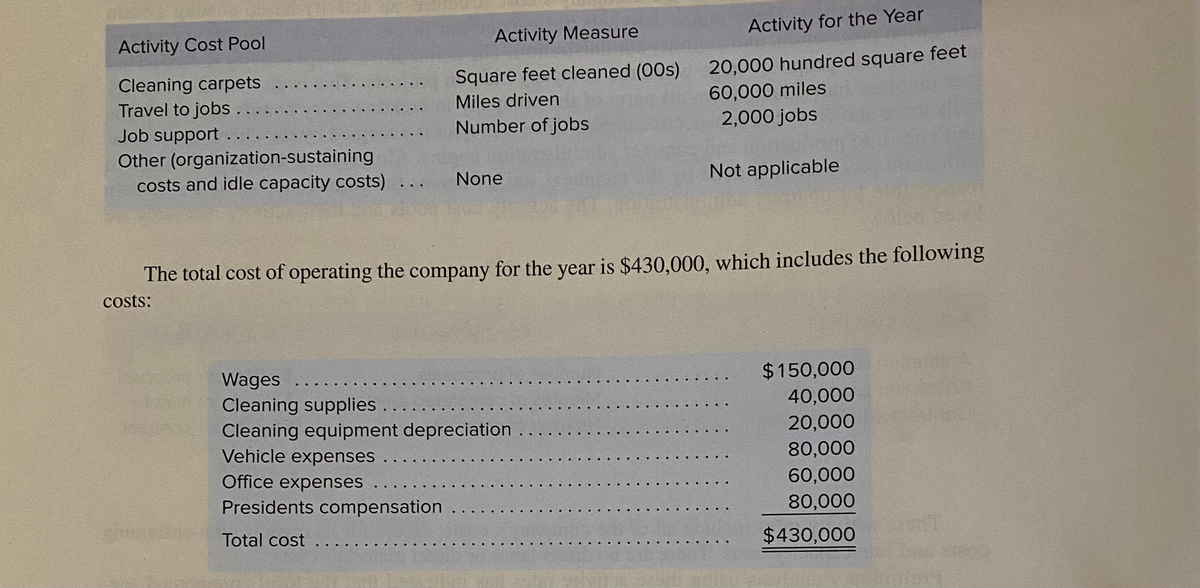

Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $28 per hundred square feet. However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear in the pictures below:

Job support consists of receiving calls from potential customers at the home office, scheduling

jobs, billing, resolving issues, and so on.

Required:

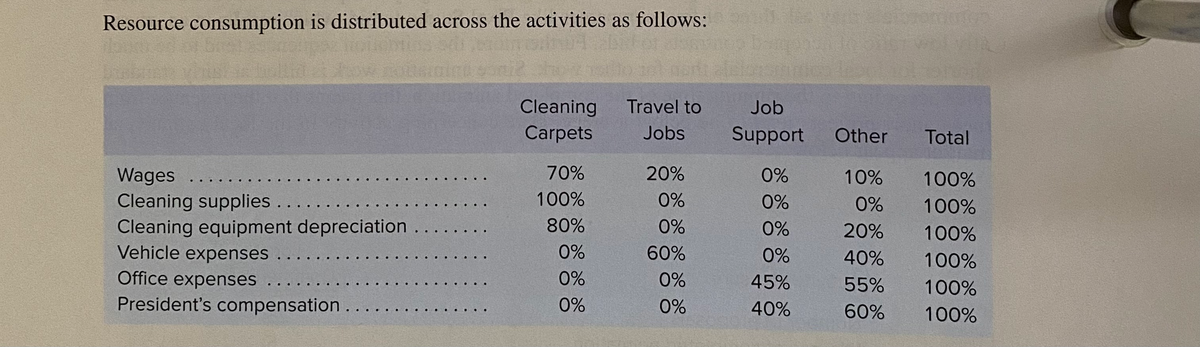

1.Using Exhibit 7-6 as a guide, prepare the first-stage allocation of costs to the activity cost

pools.

2. Using Exhibit 7-7 as a guide, compute the activity rates for the activity cost pools.

3. The company recently completed a 500 square foot carpet-cleaning job at the Flying N

Ranch- a 75-mile round-trip journey from the company's offices in Bozeman. Compute the

cost of this job using the activity-based costing system.

4. The revenue from the Flying N Ranch was $140 (500 square feet @ $28 per hundred square

feet).Using Exhibit 7-12 as a guide, calculate the customer margin earned on this job.

5. What do you conclude concerning the profitability of the Flying N Ranch job? Explain.

6.What advice would you give the president concerning pricing jobs in the future?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images