I need the debit and credit of the accounts Information given Land- 6,304, 800 Notes payable- 5,569,240

I need the debit and credit of the accounts Information given Land- 6,304, 800 Notes payable- 5,569,240

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.5: Declining-balance Method Of Depreciation

Problem 1OYO

Related questions

Question

I need the debit and credit of the accounts

Information given

Land- 6,304, 800

Notes payable- 5,569,240

PPE-

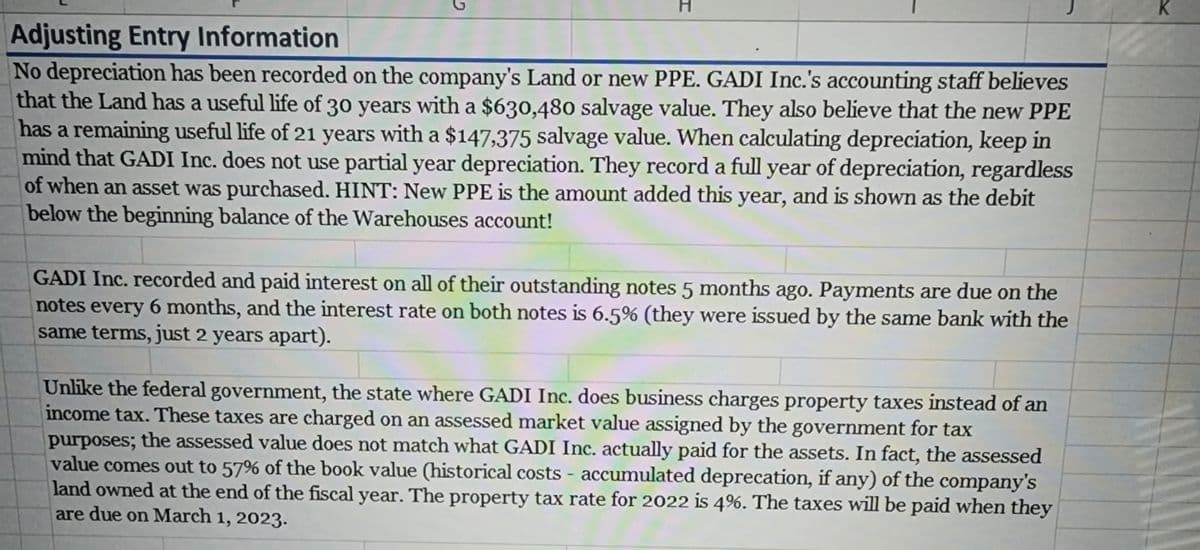

Transcribed Image Text:Adjusting Entry Information

No depreciation has been recorded on the company's Land or new PPE. GADI Inc.'s accounting staff believes

that the Land has a useful life of 30 years with a $630,480 salvage value. They also believe that the new PPE

has a remaining useful life of 21 years with a $147,375 salvage value. When calculating depreciation, keep in

mind that GADI Inc. does not use partial year depreciation. They record a full year of depreciation, regardless

of when an asset was purchased. HINT: New PPE is the amount added this year, and is shown as the debit

below the beginning balance of the Warehouses account!

GADI Inc. recorded and paid interest on all of their outstanding notes 5 months ago. Payments are due on the

notes every 6 months, and the interest rate on both notes is 6.5% (they were issued by the same bank with the

same terms, just 2 years apart).

Unlike the federal government, the state where GADI Inc. does business charges property taxes instead of an

income tax. These taxes are charged on an assessed market value assigned by the government for tax

purposes; the assessed value does not match what GADI Inc. actually paid for the assets. In fact, the assessed

value comes out to 57% of the book value (historical costs - accumulated deprecation, if any) of the company's

land owned at the end of the fiscal year. The property tax rate for 2022 is 4%. The taxes will be paid when they

are due on March 1, 2023.

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning