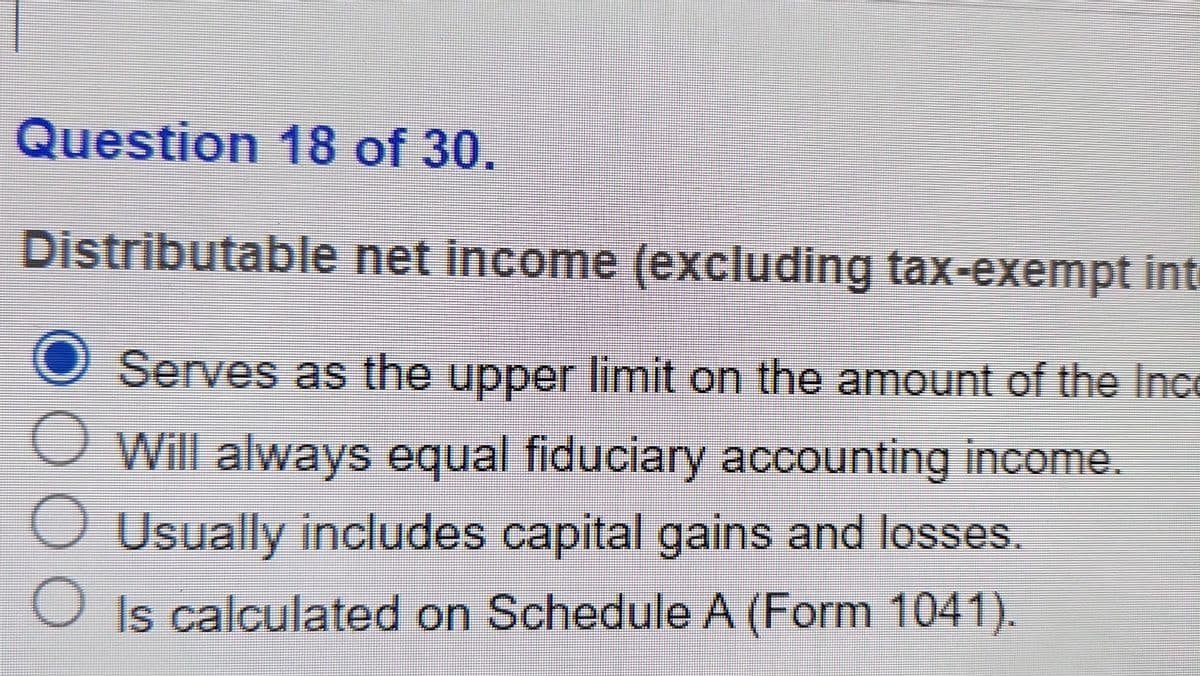

Question 18 of 30. Distributable net income (excluding tax-exempt ir Serves as the upper limit on the amount of the In O Will always equal fiduciary accounting income

Question 18 of 30. Distributable net income (excluding tax-exempt ir Serves as the upper limit on the amount of the In O Will always equal fiduciary accounting income

Chapter28: Income Taxati On Of Trusts And Estates

Section: Chapter Questions

Problem 5DQ

Related questions

Question

Transcribed Image Text:Question 18 of 30.

Distributable

net income (excluding tax-exempt int

O Serves as the upper limit on the amount of the Inco

O

Will always equal fiduciary accounting income.

O Usually includes capital gains and losses.

Is calculated on Schedule A (Form 1041).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning