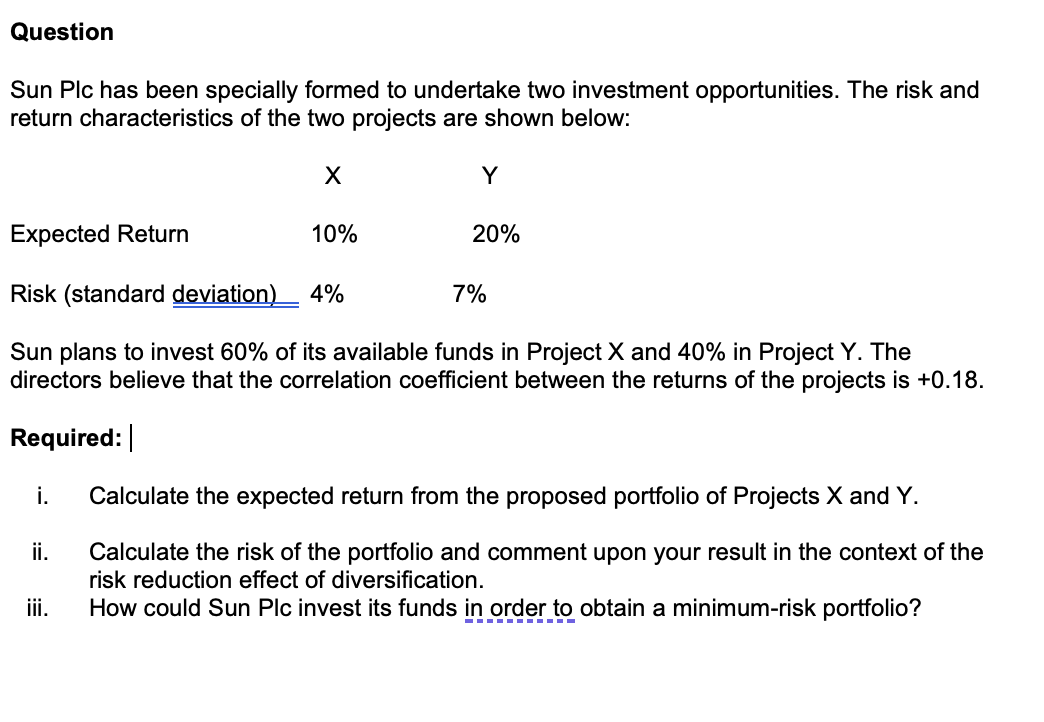

i. Calculate the expected return from the proposed portfolio of Projects X and Y. ii. Calculate the risk of the portfolio and comment upon your result in the context of the risk reduction effect of diversification. iii. How could Sun Plc invest its funds in order to obtain a minimum-risk portfolio? ‒‒‒‒‒

Q: Show Work.

A: In this question, we have to calculate the trade discount Trade discount refers the discount which…

Q: The marketing department of Jessi Corporation has submitted the following sales forecast for the…

A: Production Budgeting is a type of financial planning that refers to the number of units of goods…

Q: The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the…

A: The balance sheet is a summary of permanent accounts prepared at the end of the accounting period.…

Q: The following data were taken from the balance sheet Current assets $554,000 Debt investments…

A: Journal entries (JE) refers to reporting of the business events into the books of the company or…

Q: Question 3 of 75. Xavier (39) earned $236,000 in wages in 2021. His employer contributed $1,750 to…

A: The health saving account is an account that is made under high-deductible plans. The health saving…

Q: e distributed to partn

A: Basic Information In the given question we will first prepare statement of affairs on the date of…

Q: 1-a. Compute the throughput time for each month. 1-b. Compute the delivery cycle time for each…

A: Answer to (1) (1A) Compute the throughput time per month = Process Time + Inspection Time + Move…

Q: facturing Company decides to examine its working capital policy. In addition to its current strategy…

A: Here student asked for multi question we will solve for first question for you. If you need…

Q: Metal Company budgeted $556,000 manufacturing direct wages, 2,500 direct labor hours, and had the…

A: Formula used: Activity rate per hour = Total Machine set up / Number of setup

Q: This year, Leron and Sheena sold their home for $1,036,000 after all selling costs. Under the…

A: Taxable Income: It is an income that helps in calculating the tax liability as per the slab rate…

Q: Hillside issues $4,000,000 of 6%, 15-year bonds dated January 1, 2021, that pay interest…

A: Solution 1: Journal Entries - Hillside Date Particulars Debit Credit 1-Jan-21 Cash…

Q: Calculate the total budgeted product cost per unit for the Rubber Ball using Activity Based Costing…

A: Activity Activity Cost (A) Activity Driver (B) Activity Rate (A/B) Machining Department Cost…

Q: Prepare a statement showing the pricing of issues, on the basis of: (a) First In First Out (FIFO)…

A: FIFO- first in first out LIFO- Last in first out FIFO method issues the old units first to the…

Q: On August 31, 2018, Simmons Inc. leased warehouse equipmer lease agreement calls for Simmons to make…

A: The answer has been mentioned below. Note: Attempting the first three subparts of the…

Q: Juicy Ltd. is a fruit juice manufacturer that uses a standard costing system and flexible budget for…

A: Here we need to find out Direct Material price and Usage variance , Variable overhead Spending and…

Q: A cement manufacturer has supplied the following data: 220,000 Tons of cement produced and sold…

A: Increase in sales volume is increase in number of units. 220000 tons + 5℅ = 231000 tons

Q: 53. Tea Tree Ltd has acquired some government bonds on 1 July 2022. The government bonds will…

A: Note: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Watts and Lyon are forming a partnership. Watts invests $40,500 and Lyon invests $49,500. The…

A: The partners can share profits and losses on various parameters as decided in the agreement. For…

Q: Apparel Leasing Company signs a lease agreement on January 1, 2021, to lease equipment to Oman…

A: Lease Receivable: It is the present value of lease receipts expected during the duration of lease…

Q: In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa…

A: Requirement 1 2021 2022 2023 Revenue $0 $0 $10,000,000…

Q: Problem 4-29 Part-a (Algo) a. Determine Jeremy's tax refund or taxes due. Description (1) Gross…

A: The gross income means the total of all the incomes that are earned by the taxpayer. The gross…

Q: Use the information below to calculate the following: - Total stock needs for the month…

A: The inventory is one of the most important assets of the company. the company needs to determine the…

Q: A small gift shop has a beginning inventory that is valued at $8,700. If the additional inventory…

A: Cost of goods sold (COGS) : Cost of goods sold means the expenses incurred for the producing of the…

Q: Jeremy earned $101,000 in salary and $7,000 in interest income during the year. Jeremy's employer…

A: Regulation- The laws and regulations that govern the financial services industry are referred to as…

Q: On January 1, 2020, Sitra Company leased equipment from National Corporation. Lease payments are…

A: As per IFRS 16, Leases, lease liability, and right of use assets are recognized on commencement of…

Q: 27. Using the information below, determine the amount of the payroll tax expense for B. Harper…

A: Payroll tax expense refers to the tax charged on the payroll of the entity. It includes the social…

Q: The Boxwood Company sells blankets for $38 each. The following was taken from the inventory records…

A: The LIFO method assumes that the goods purchased last will be sold out first, and hence the cost per…

Q: What is

A: It is uncollectible from the debtors due to bankruptcy, financial problems, or collections by the…

Q: Watts and Lyon are forming a partnership. Watts invests $40,500 and Lyon invests $49,500. The…

A: The partners shares the profits and losses in different manners such as equally, investment ratio,…

Q: Finch and Gerhardt are partners. Finch's capital balance is P100,000 and Gerhardt's is P140,000 They…

A: Partnership is an agreement between two or more partners for forming a business and sharing the…

Q: Prepare a partial income statement, beginning with income before income taxes.

A: The income statement is one of the financial statements of the business entity. It reports…

Q: Computer Programmer $75/hour Architect $8,000 flat fee Attorney $250/hour Bankers 2% of capital…

A: $1 MM means $1000000. Cost of bank services= $1000000*2% = $…

Q: Texas Inc. has 10,000 shares of 6%, $125 par value cumulative preferred stock and 50,000 shares of…

A: Preference stock has held the hand of preference shareholders who are getting the preference while…

Q: Each partner's initial noncash investment in the partnership should be recorded at the a. carrying…

A: Answer: Option b Fair value of assets at the date of their transfer in to the business.

Q: The tax rates are as shown below: Taxable Income Tax Rate 15% $0 - 50,000 50,00175,000 25% 75,001…

A: Revised taxable income = $80900 + $22100 = $103000

Q: Post the transaction activity from requirement 1 to the T-Accounts below All accounts begin with…

A: Preparation of T-Accounts Cash A/c Particulars Amount ($) Particulars Amount ($) To capital…

Q: Directions: In each of the transaction below, indicate the account to be debited and the account to…

A: The accounts to be debited or credited for a transaction are based on the golden rules of accounting…

Q: The Boxwood Company sells blankets for $38 each. The following was taken from the inventory records…

A: Introduction: LIFO: LIFO stands for Last in First out. Which means last received inventory to be…

Q: PA3-3 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing an Unadjusted Trial…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Prepare Journal entries? A. July 1, issued common stock for cash, $15,000 B. July 15, purchased…

A:

Q: nature of arm's length transactions with information discussing the Income Tax Act of 1961 and…

A: The income tax defines how a fair price can be determined to determine whether a transaction was…

Q: Bramble Corp. lends Sheffield Corp. $50400 on April 1, accepting a four-month, 9% interest note.…

A: Adjusting entry is the entry passed in the books of account on reporting date to record the…

Q: Power Company manufactures a variety of drill bits. The company's plant is partially automated. The…

A: ABC method allocates overhead based on the relevant activity. It does not use a single overhead…

Q: Explain the methods of estimating bad debts ?

A: Bad Debt: A loan or outstanding sum that is no longer considered collectable and must be wiped off…

Q: 21 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs…

A: Gross profit refers to a company's earnings after deducting the costs of producing and selling its…

Q: On November 3, the Milwaukee Bucks sold a six-game pack of advance tickets for $300 cash. On…

A: On receipt of an advance from the customer for the service or sales to be made in the future, the…

Q: b. Interest revenue accrued, $2,700. Accounts b. Interest Receivable Interest Revenue Journal Entry…

A: Journal entries are the basic method of recording financial transactions. These are useful for…

Q: 3 Your boss informs you that s/he will be sending you overseas to negotiate a deal with a new…

A: Answer:- Negotiation meaning:- A negotiation is a strategic debate that aims to settle a problem in…

Q: Following are the transactions of a new company called Pose-for-Pics. Aug. 1 Madison Harris, the…

A: Ledger is the second step of Accounting after Journal. After Journal Entries are posted in…

Q: Stark company has the following adjusted accounts and normal balances at its December 31 year-end. $…

A: The financial statements are prepared by the business entity to show the performance of the…

Step by step

Solved in 4 steps with 3 images

- The Ajax Company uses a portfolio approach to manage their research and development (RD) projects. Ajax wants to keep a mix of projects to balance the expected return and risk profiles of their RD activities. Consider a situation in which Ajax has six RD projects as characterized in the table. Each project is given an expected rate of return and a risk assessment, which is a value between 1 and 10, where 1 is the least risky and 10 is the most risky. Ajax would like to visualize their current RD projects to keep track of the overall risk and return of their RD portfolio. a. Create a bubble chart in which the expected rate of return is along the horizontal axis, the risk estimate is on the vertical axis, and the size of the bubbles represents the amount of capital invested. Format this chart for best presentation by adding axis labels and labeling each bubble with the project number. b. The efficient frontier of RD projects represents the set of projects that have the highest expected rate of return for a given level of risk. In other words, any project that has a smaller expected rate of return for an equivalent, or higher, risk estimate cannot be on the efficient frontier. From the bubble chart in part a, which projects appear to be located on the efficient frontier?Lucky FC Ltd wants to invest in two projects, namely, A & B. The expected return on projects A & B are 12% and 20% respectively while the risk associated with project A is 13% and that of B is 7%. Lucky FC Ltd planned to invest 80% of its available funds in project A and the remaining in project B. The correlation coefficient between the returns of the projects is -0.10. Required 1) Estimate the returns from the proposed portfolio of projects A & B 2) Calculate the risk of the portfolio 3) Suppose the correlation coefficient between A & B was -1.0. How should the club invest its funds to achieve a zero-risk portfolio?Lorenzo Properties is evaluating 2 opportunities, each having the same initial investment. The project's risk and return characteristics are shown below: Project Burger's expected return 0.10 & proportion invested in each project 0.45; Project Fries' expected return 0.20 & proportion invested in each project 0.55. What is the expected return of a portfolio?

- An all-equity firm is considering the projects shown below. The T-bill rate is 3 percent and the market risk premium is 8 percent. Project Expected Return Beta A 8% 0.6 B 20 1.3 C 14 1.5 D 18 1.7 Calculate the project-specific benchmarks for each project. (Round your answers to 2 decimal places.) Project A: ____.__% Project B: ____.__% Project C: _____.__% Project D: ____.__% If the firm uses its current WACC of 12 percent to evaluate these projects, which project(s), will be incorrectly accepted? Project A Project B Project C Project DAn investment banker has recommended a $100,000 portfolio containing assets B, D, and F. $20,000 will be investedin asset B, with a beta of 1.5; $50,000 will be invested in asset D, with a beta of 1.7; and $30,000 will be invested inasset F, with a beta of 0.6. The beta of the portfolio is 1.25 1.45 1.33 unable to be determined from the information providedYou are evaluating the following four projects: Project Beta Projected (or Expected) Return A 1.80 19.5% B 1.20 14.0% C 0.80 11.5% D 0.50 7.0% Your company’s current practice is to apply its WACC of 12% as a single hurdle rate to all projects. Under your company’s current practice, which project(s) of the four projects above would be incorrectly accepted? Currently, the 3-month Treasury bill rate is 3%, and the market risk premium is 10%. (Hint: Measure the RADRs using the CAPM.) Group of answer choices C A D B At least two of the projects are incorrectly accepted.

- Dakota & Munroe invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045. The firm's goal is to form a client portfolio that has an expected return of $ 114. Given this information , how can the firm accomplish it goal?You are a consultant to a large manufacturing corporation considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax CF 0 −$ 26 1 to 10 $ 16 The project's beta is 1.5. Assuming rf = 6% and E(rM) = 12% Consider the following information: Portfolio Expected Return Beta Risk-free 6% 0 Market 11.4 1.0 A 9.4 2.0 Required: a. Calculate the return predicted by CAPM for a portfolio with a beta of 2.0. (Round your answer to 2 decimal places.) b. What is the alpha of portfolio A. (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) c. If the simple CAPM is valid, is the situation above possible?Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistics for your company are 2.5 and 3.0 years, respectively. Time: 0 1 2 3 4 5 Cash flow: −$356,000 $65,700 $83,900 $140,900 $121,900 $81,100 Use the NPV decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Should it be accepted or rejected?multiple choice accepted rejected

- GoldPure is considering the following independent, average-risk investment projects: Project Size of Project Project IRR Project V P1.0 million 12.0% Project W 1.2 million 11.5 Project X 1.2 million 11.0 Project Y 1.2 million 10.5 Project Z 1.0 million 10.0 The company has a target capital structure that consists of 50 percent debt and 50 percent equity. Its after-tax cost of debt is 8 percent, its cost of equity is estimated to be 16.5 percent, and its net income is P2.5 million. If the company follows a residual dividend policy, what will be its plowback ratio? Answers: a. 32% b. 100% c. 12% d. 54% e. 68% f. 66% g. 0Piedmont Hotels is an all-equity company. Its stock has a beta of .88. The market risk premium is 7.5 percent and the risk-free rate is 3.9 percent. The company is considering a project that is considers riskier that its current operations so it wants to apply an adjustment of 2.3 percent to the project's discount rate. What should the firm set as the required rate of return for the project?Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 13 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3 and 3.5 years, respectively. Time: 0 1 2 3 4 5 Cash flow: −$255,000 $61,800 $80,000 $133,000 $118,000 $77,200 Use the MIRR decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Should this be Accepted or Rejected