On August 31, 2018, Simmons Inc. leased warehouse equipmer lease agreement calls for Simmons to make semiannual lease pa lease term, payable at August 31 and February 28, with the first. Simmons' incremental borrowing rate is 11%, the same rate Co payment amounts. Covington purchased the warehouse equipm August 31, 2018 with an expected useful life of 10 years and no for both Simmons and Covington ends on December 31. Required: What are the present value of the lease payments on August 31,

On August 31, 2018, Simmons Inc. leased warehouse equipmer lease agreement calls for Simmons to make semiannual lease pa lease term, payable at August 31 and February 28, with the first. Simmons' incremental borrowing rate is 11%, the same rate Co payment amounts. Covington purchased the warehouse equipm August 31, 2018 with an expected useful life of 10 years and no for both Simmons and Covington ends on December 31. Required: What are the present value of the lease payments on August 31,

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1P: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases...

Related questions

Question

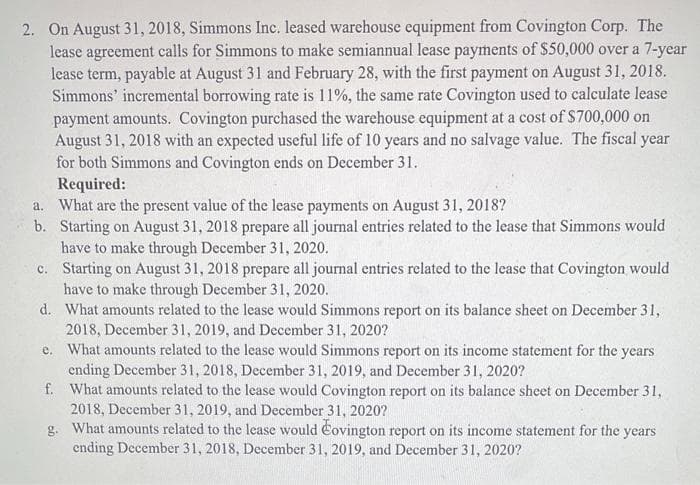

Transcribed Image Text:2. On August 31, 2018, Simmons Inc. leased warehouse equipment from Covington Corp. The

lease agreement calls for Simmons to make semiannual lease payments of $50,000 over a 7-year

lease term, payable at August 31 and February 28, with the first payment on August 31, 2018.

Simmons' incremental borrowing rate is 11%, the same rate Covington used to calculate lease

payment amounts. Covington purchased the warehouse equipment at a cost of $700,000 on

August 31, 2018 with an expected useful life of 10 years and no salvage value. The fiscal year

for both Simmons and Covington ends on December 31.

Required:

a. What are the present value of the lease payments on August 31, 2018?

b. Starting on August 31, 2018 prepare all journal entries related to the lease that Simmons would

have to make through December 31, 2020.

c. Starting on August 31, 2018 prepare all journal entries related to the lease that Covington would

have to make through December 31, 2020.

d.

What amounts related to the lease would Simmons report on its balance sheet on December 31,

2018, December 31, 2019, and December 31, 2020?

e. What amounts related to the lease would Simmons report on its income statement for the years

ending December 31, 2018, December 31, 2019, and December 31, 2020?

f.

What amounts related to the lease would Covington report on its balance sheet on December 31,

2018, December 31, 2019, and December 31, 2020?

g. What amounts related to the lease would Covington report on its income statement for the years

ending December 31, 2018, December 31, 2019, and December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT