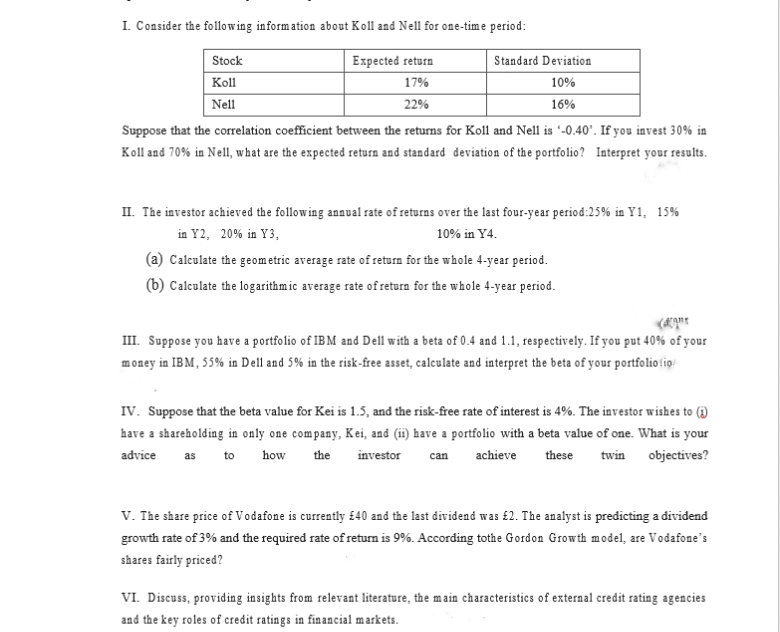

I. Consider the following information about Koll and Nell for one-time period: Stock Expected return 17% Koll Nell 22% Standard Deviation 10% 16% Suppose that the correlation coefficient between the returns for Koll and Nell is '-0.40'. If you invest 30% in Koll and 70% in Nell, what are the expected return and standard deviation of the portfolio? Interpret your results. II. The investor achieved the following annual rate of returns over the last four-year period:25% in Y1, 15% in Y2, 20% in Y3, 10% in Y4. (a) Calculate the geometric average rate of return for the whole 4-year period. (b) Calculate the logarithmic average rate of return for the whole 4-year period. III. Suppose you have a portfolio of IBM and Dell with a beta of 0.4 and 1.1, respectively. If you put 40% of your money in IBM, 55% in Dell and 5% in the risk-free asset, calculate and interpret the beta of your portfoliotio IV. Suppose that the beta value for Kei is 1.5, and the risk-free rate of interest is 4%. The investor wishes to (1) have a shareholding in only one company, Kei, and (ii) have a portfolio with a beta value of one. What is your advice as to how the investor achieve these twin objectives? can V. The share price of Vodafone is currently £40 and the last dividend was £2. The analyst is predicting a dividend growth rate of 3% and the required rate of return is 9%. According tothe Gordon Growth model, are Vodafone's shares fairly priced? VI. Discuss, providing insights from relevant literature, the main characteristics of external credit rating agencies and the key roles of credit ratings in financial markets.

I. Consider the following information about K oll and Nell for one-time period: Suppose that the correlation coefficient between the returns for Koll and Nell is -0.40'. If you invest 30% in Koll and 70% in Nell, what are the expected return and standard deviation of the portfolio? Interpret your results. II. The investor achieved the following annual rate of returns over the last four-year period: 25% in Y1, 15% in Y2, 20% in Y3, 10% in Y4. (a) Calculate the geometric average

Unlock instant AI solutions

Tap the button

to generate a solution