Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 6, Problem 14P

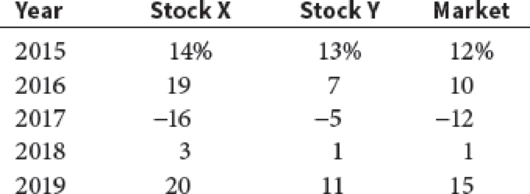

You have observed the following returns over time:

Assume that the risk-free rate is 6% and the market risk premium is 5%.

- a. What are the betas of Stocks X and Y?

- b. What are the required

rates of return on Stocks X and Y? - c. What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 6 Solutions

Financial Management: Theory & Practice

Ch. 6 - The probability distribution of a less risky...Ch. 6 - Security A has an expected return of 7%, a...Ch. 6 - If investors’ aversion to risk increased, would...Ch. 6 - Prob. 5QCh. 6 - Your investment club has only two stocks in its...Ch. 6 - Prob. 2PCh. 6 - Suppose that the risk-free rate is 5% and that the...Ch. 6 - An analyst gathered daily stock returns for...Ch. 6 - A stocks return has the following distribution:...Ch. 6 - The market and Stock J have the following...

Ch. 6 - Suppose rRF = 5%, rM = 10%, and rA = 12%. a....Ch. 6 - As an equity analyst you are concerned with what...Ch. 6 - Your retirement fund consists of a $5,000...Ch. 6 - Prob. 10PCh. 6 - You have a $2 million portfolio consisting of a...Ch. 6 - Stock R has a beta of 1.5, Stock S has a beta of...Ch. 6 - You are considering an investment in either...Ch. 6 - You have observed the following returns over...Ch. 6 - What are investment returns? What is the return on...Ch. 6 - Graph the probability distribution for the bond...Ch. 6 - Use the scenario data to calculate the expected...Ch. 6 - What is the stand-alone risk? Use the scenario...Ch. 6 - Your client has decided that the risk of the bond...Ch. 6 - Your client is shocked at how much risk Blandy...Ch. 6 - Explain correlation to your client. Calculate the...Ch. 6 - Prob. 8MCCh. 6 - Prob. 9MCCh. 6 - Prob. 10MCCh. 6 - Prob. 11MCCh. 6 - Calculate the correlation coefficient between...Ch. 6 - Prob. 13MCCh. 6 - (1) Suppose the risk-free rate goes up to 7%. What...Ch. 6 - Your client decides to invest $1.4 million in...Ch. 6 - Jordan Jones (JJ) and Casey Carter (CC) are...Ch. 6 - What does market equilibrium mean? If equilibrium...Ch. 6 - What is the Efficient Markets Hypothesis (EMH),...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?arrow_forwardSuppose that the risk-free rate is 5% and that the market risk premium is 7%. What is the required return on (1) the market, (2) a stock with a beta of 1.0, and (3) a stock with a beta of 1.7?arrow_forwardThe standard deviation of stock returns for Stock A is 40%. The standard deviation of the market return is 20%. If the correlation between Stock A and the market is 0.70, then what is Stock A’s beta?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY