i. Using the CAPM, calculate the required return for Zambeef ii. Calculate the share Price of Zambeef iii. Calculate the market to book ratio of Zambeef

i. Using the CAPM, calculate the required return for Zambeef ii. Calculate the share Price of Zambeef iii. Calculate the market to book ratio of Zambeef

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 3MAD: Deere Company (DE) manufactures and distributes farm and construction machinery that it sells...

Related questions

Question

help

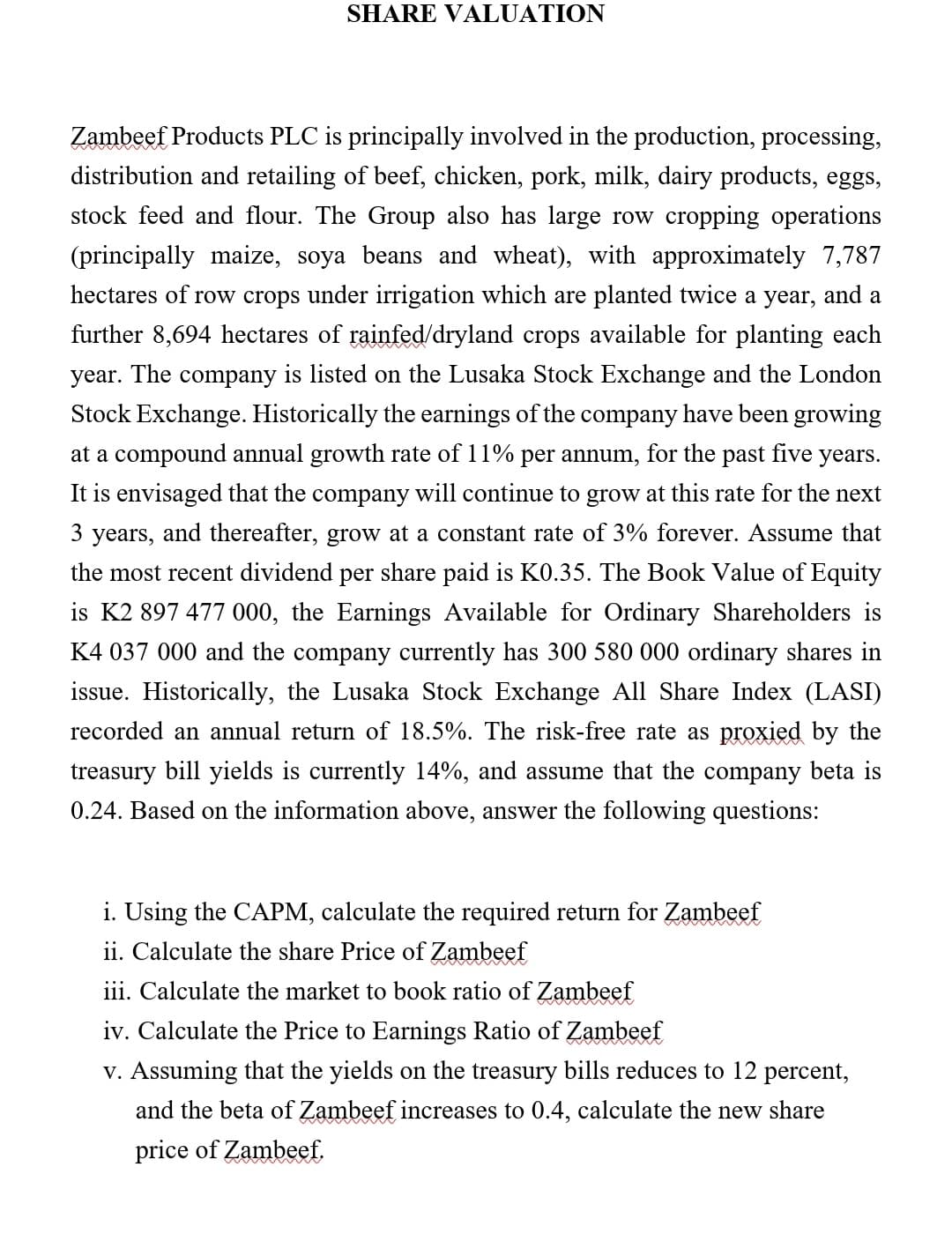

Transcribed Image Text:SHARE VALUATION

Zambeef Products PLC is principally involved in the production, processing,

distribution and retailing of beef, chicken, pork, milk, dairy products, eggs,

stock feed and flour. The Group also has large row cropping operations

(principally maize, soya beans and wheat), with approximately 7,787

hectares of row crops under irrigation which are planted twice a year, and a

further 8,694 hectares of rainfed/dryland crops available for planting each

year. The company is listed on the Lusaka Stock Exchange and the London

Stock Exchange. Historically the earnings of the company have been growing

at a compound annual growth rate of 11% per annum, for the past five years.

It is envisaged that the company will continue to grow at this rate for the next

3

years,

and thereafter, grow at a constant rate of 3% forever. Assume that

the most recent dividend per share paid is K0.35. The Book Value of Equity

is K2 897 477 000, the Earnings Available for Ordinary Shareholders is

K4 037 000 and the company currently has 300 580 000 ordinary shares in

issue. Historically, the Lusaka Stock Exchange All Share Index (LASI)

recorded an annual return of 18.5%. The risk-free rate as proxied by the

treasury bill yields is currently 14%, and assume that the company beta is

0.24. Based on the information above, answer the following questions:

i. Using the CAPM, calculate the required return for Zambeef

ii. Calculate the share Price of Zambeef

iii. Calculate the market to book ratio of Zambeef

iv. Calculate the Price to Earnings Ratio of Zambeef

v. Assuming that the yields on the treasury bills reduces to 12 percent,

and the beta of Zambeef increases to 0.4, calculate the new share

price of Zambeef.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 8 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,