iaz Company issued $107,000 face value of bonds on January 1, Year 1. The bonds had a 7 percent stated rate of interest and a en-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 97. The straight-line nethod is used for amortization. Required a. Use a financial statements model like the one shown below to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the company's financial statements. b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1. c. Determine the amount of interest expense reported on the Year 1 income statement. lun (foro value less discount or plus premium) of the bond liability as of December 31, Year 2.

iaz Company issued $107,000 face value of bonds on January 1, Year 1. The bonds had a 7 percent stated rate of interest and a en-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 97. The straight-line nethod is used for amortization. Required a. Use a financial statements model like the one shown below to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the company's financial statements. b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1. c. Determine the amount of interest expense reported on the Year 1 income statement. lun (foro value less discount or plus premium) of the bond liability as of December 31, Year 2.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

100%

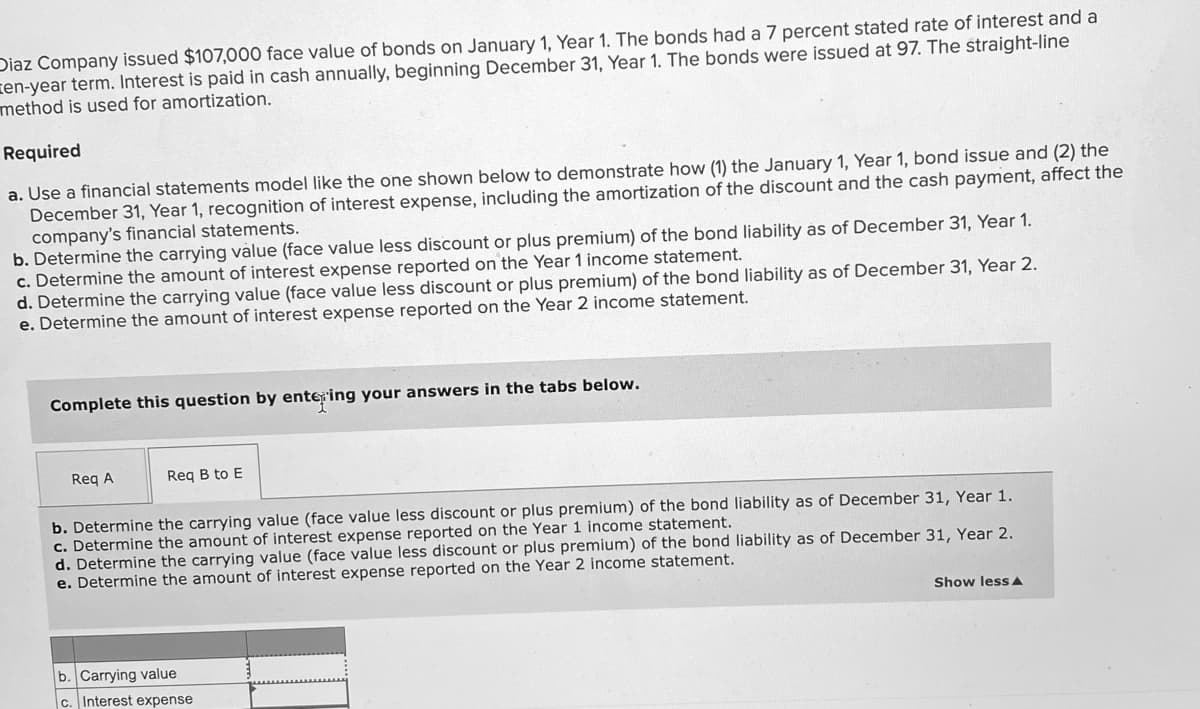

Transcribed Image Text:Diaz Company issued $107,000 face value of bonds on January 1, Year 1. The bonds had a 7 percent stated rate of interest and a

ren-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 97. The straight-line

method is used for amortization.

Required

a. Use a financial statements model like the one shown below to demonstrate how (1) the January 1, Year 1, bond issue and (2) the

December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the

company's financial statements.

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1.

c. Determine the amount of interest expense reported on the Year 1 income statement.

d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2.

e. Determine the amount of interest expense reported on the Year 2 income statement.

Complete this question by entering your answers in the tabs below.

Reg A

Req B to E

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1.

c. Determine the amount of interest expense reported on the Year 1 income statement.

d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2.

e. Determine the amount of interest expense reported on the Year 2 income statement.

Show lessA

b. Carrying value

c. Interest expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College