On January 1, 2018, Reese Incorporated issued bonds with a face value of $120,000, a stated rate of interest of 8 percent, and a five- year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 7 percent at the time the bonds were issued. The bonds sold for $124,920. Reese used the effective interest rate method to amortize bond premium. Required a. Prepare an amortization table. b. What item(s) in the table would appear on the 2020 balance sheet? c. What item(s) in the table would appear on the 2020 income statement? d. What item(s) and amount in the table would appear on the 2020 statement of cash flows (Direct Method) and under what section the bond liability appear?

On January 1, 2018, Reese Incorporated issued bonds with a face value of $120,000, a stated rate of interest of 8 percent, and a five- year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 7 percent at the time the bonds were issued. The bonds sold for $124,920. Reese used the effective interest rate method to amortize bond premium. Required a. Prepare an amortization table. b. What item(s) in the table would appear on the 2020 balance sheet? c. What item(s) in the table would appear on the 2020 income statement? d. What item(s) and amount in the table would appear on the 2020 statement of cash flows (Direct Method) and under what section the bond liability appear?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 7C

Related questions

Question

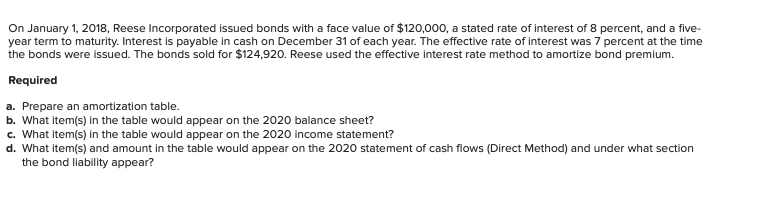

Transcribed Image Text:On January 1, 2018, Reese Incorporated issued bonds with a face value of $120,000, a stated rate of interest of 8 percent, and a five-

year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 7 percent at the time

the bonds were issued. The bonds sold for $124,920. Reese used the effective interest rate method to amortize bond premium.

Required

a. Prepare an amortization table.

b. What item(s) in the table would appear on the 2020 balance sheet?

c. What item(s) in the table would appear on the 2020 income statement?

d. What item(s) and amount in the table would appear on the 2020 statement of cash flows (Direct Method) and under what section

the bond liability appear?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning