Q: Given the following information, calculate the weighted average cost of capital for Digital…

A: “Since you have asked to solve part d only, we will solve the same part for you.” Weighted average…

Q: A bond with a coupon rate of 10 percent sells at a yield to maturity of 12 percent. If the bond…

A: Macaulay duration = Sum of weighted present values of cash flows from the bond/Price of bond…

Q: Music producer, will receive royalties over a period of 3 years for the theme song she made for a TV…

A: In order to calculate the present value of all future royalties at the given interest rate, the…

Q: Mr. Abdullah borrows $80,000 at 14 percent interest toward the purchase of a home. His mortgage is…

A: Given: Interest rate = 14% Loan = $80,000 Years = 25

Q: . Mr. and Mrs. Ramirez have 4 children and have decided that they need a bigger house. They intend…

A: Loans are paid by the equal monthly installments payment in that there are payments for loans and…

Q: An asset is planned to be purchased with an initial value of $400,000 and an estimated salvage value…

A: Free cash flow is the residual cash available with the company after paying all expenses and taxes.…

Q: The size of the monthly payment required to pay off the loan over the 30-year period The total…

A: Here we will use the concept of compounding and the concept of time value of money. The time value…

Q: Jack is a very successful manager. He has a management contract which grants him a lump sum payment…

A: Future value of a present value is the value of that amount after taking into account the time value…

Q: Assuming that money is worth 10%, compute the present value of: 1. $14,000 received 15 years from…

A: Present Value: It represents the present worth of the future amount and is computed by discounting…

Q: Production engineers of a manufacturing firm have proposed a new equipment to increase productivity…

A: As you have asked a multiple subpart question, we will answer the first three subparts for you. To…

Q: (c) Company X plans to purchase a methanol plant for $1 million. The plant is expected to generate…

A: Capital Budgeting refers to the process of analyzing whether the organization's long term investment…

Q: Cash Flow Assumptions - defenition, uses and other informations

A: Meaning of cash flow Assumptions, This term refers to the way in which the costs are cleared from a…

Q: A UK-based MNC has a contract to import raw materials in which it agreed to pay in Philippine peso.…

A: Since you have posted multiple questions, we shall be solving the first one for you as per our…

Q: lowing are examples of retirement plans EXC O 401(k) O 403(b) O Traditional IRA O Roth IRAS O…

A: There are many types of retirement plans depending on amount of deposit ,period of deposit and…

Q: MS ARS TERMS 6% 6% 7 7% 6% 7% 8% 9% IN YEARS 11.10 11.23 11.35 11.48 11.62 11.75 11.88 12.01 12.14…

A: Loans are taken for purchase of homes but they are paid by equal monthly payments that carry the…

Q: Dr. Barrett wants to purchase a new piece of equipment for his practice. The equipment can be…

A: Earning before tax = Revenue - expense - interest cost - depreciation = $68000 - 32000 - 0 -…

Q: An individual accident and health insurance policy must include O A. An automatic reinstatement…

A: In some form, every state in the US has passed the Uniform Individual Accident and Sickness Policy…

Q: Automatic dividend reinvestment O is a requirement of all mutual fund companies. O compounds share…

A: Automatic dividend reinvestment is the process where the dividends earned are not paid out but…

Q: ZCCM-IH is a major supplier of iron ore to the steel industry and the company is the 4th largest…

A: Capital budgeting tools include NPV and IRR. NPV id the difference between the present value of cash…

Q: 12. Consider a 25-year 6% bond selling at $70.357 with a par value of $100 to yield 9%. Using…

A: Absolute estimation error is the percentage error, which is simply difference between the two values…

Q: What is the APR that they are required to disclose? (Do not round ntermediate calculations and round…

A: Annual Percentage Rate: It is the annual rate charged on the loan amount or earned on the…

Q: Macy's was selling Calvin Klein jean shirts that were originally priced at $46.00 for $8.74. a. What…

A: Solution:- Markdown means the selling an item at a price less than its original price. So, markdown…

Q: What are governance mcechanisms that help align the incentives of stockhlers and managers - help…

A: The interest of stockholders and managers are often not aligned. Stockholders are owners of a…

Q: A corporation uses the indirect method of preparing the statement of cash flows. A fixed asset has…

A: Solution:- Cash flow statement is that part of financial statements that represents the total net…

Q: On 1 January 2019 the total present value of all the investments is R75,998.34. If the interest rate…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Comparative financial statements for Weller Corporation, a merchandising company, for the year…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Your father offers you a choice of $105,000 in 12 years or $47,000 today. а. If money is discounted…

A: Time Value of Money: According to this basic financial concept money in the present have more value…

Q: Assuming a 360-day year, proceeds of $46,510 were received from discounting a $47,941, 90-day note…

A: Notes are issued at discount and that discount depends on time and interest rate on the note but…

Q: 4/ Julieta and Eric are purchasing a home. They wish to save money for 15 years and purchase a house…

A: Solution:- When an equal amount is deposited each period, it is called annuity, We have, future…

Q: how was capital asset pricing model (CAPM) created? GIVE reference

A: Meaning CAPM Capital asset pricing model, It is created to explain the investor that he/she will get…

Q: In preparing a company's statement of cash flows for the year just ended, the following Information…

A: Cash flow from financing activities is the cash inflows and cash outflows for raising funds and…

Q: When the economy is weak, money is spent freely on needs and wants. True False

A: An economy is a large set of interrelated production, consumption, and exchange activities that help…

Q: If the risk-free return were 4.0% and a security's beta coefficient were 2.0, what would be the…

A: Security Market Line: It is a line representing a graphical representation of CAPM (capital asset…

Q: Analyse how and why bond and share prices will be affected by an unexpected fiscal expansion.

A: A bond is a financial instrument that represents a loan made by an investor to a borrower (usually a…

Q: Given the following information: determine the BC Ratio for a company considering investing in a new…

A: B/C ratio of the project can be defined as the benefit/cost ratio of the project which is calculated…

Q: How much do you need to invest today if you will also invest $2,700 at the end of every year for 39…

A: Accumulated amount (AV) = $1,000,000 Rate of return (r) = 0.065 Annual deposit (D) = $2,700 Period…

Q: Discuss the differences between a market order, limit order, and stop order.

A: Solution: Stock market is the place where securities are traded in market. There are different types…

Q: 12. A property has an NOI of $800,000. If you have a loan with annual debt service of $600,000, what…

A: DCR (Debt coverage ratio) It helps to determine the available net operating income to cover per unit…

Q: a. Calculate the expected return for Stocks A and B. (Do not round intermediate calculations and…

A: Expected return refers to the return earn by an investor on the amount invested during a period of…

Q: Required: 1. Compute Project Y's annual net cash flows. Annual amounts Income Cash Flow Sales of new…

A: Net annual cash flow refers to the amount of cash flow earned by the company during a period. Net…

Q: FRONT PAGE Treasury Prices Rise on Recession Fear Increasing fears of a recession next year brought…

A: Data given: Coupon rate = 1.75% Face value = $1000 n= 10 years Working Note #1 Coupon amount=…

Q: The Free Enterprise system is also known as a money market O market economic system O cash advance…

A: The free market, commonly known as capitalism, is an economic system based on supply and demand. The…

Q: You deposit $100, $150, & $200 in a bank account at the end of years 1,2,& 3 and earn 7% interest.…

A: Solution:- Present value means value in today’s terms by discounting it back at the given interest…

Q: 18. You are borrowing $700,000 for 30 years at 6% annually. The lender is charging you a 2 point…

A: Effective interest rate simply means annual interest rate. It contrasts the interest rates of two…

Q: a. If his opportunity cost is 9% compounded annually, what value should he place on this…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements…

A: Initial Investment $ 1,50,00,000.00 Sales revenue $ 50,00,000.00 Manufacturing costs…

Q: Your brother borrowed from your neighbour ₱7,000 to buy a new mobile phone. The neighbour charged…

A: Given: Amount borrowed = ₱7,000 Interest rate = 11% Period = 3years

Q: CRIA iV, N) Today you purchase a previously owned Tesla Model 3 for $40,000. You take out a 0.25%…

A: Loans are paid by the equal monthly installments and these have payment of loan amount and also…

Q: how was the trading of SAGE company in march 2022?

A: Buying and selling stocks regularly in an attempt to timing the market is known as stock trading.…

Q: Consider BOND AAA Coupon rate: 9,4% per year Yield to maturity: 10,6% per year Settlement date: 16…

A: Coupon rate 9.4% Settlement date is 16 july 2022 Maturity date is 9 october 2048 To Find: Accured…

Step by step

Solved in 2 steps with 2 images

- Talbot Enterprises recently reported an EBITDA of $8 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization?Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net income of $40 million. Included in the income was interest expense of $2,800,000. The companys tax rate was 40%. Total assets were $470 million, current liabilities were $104,000,000, and $72,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon?The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?

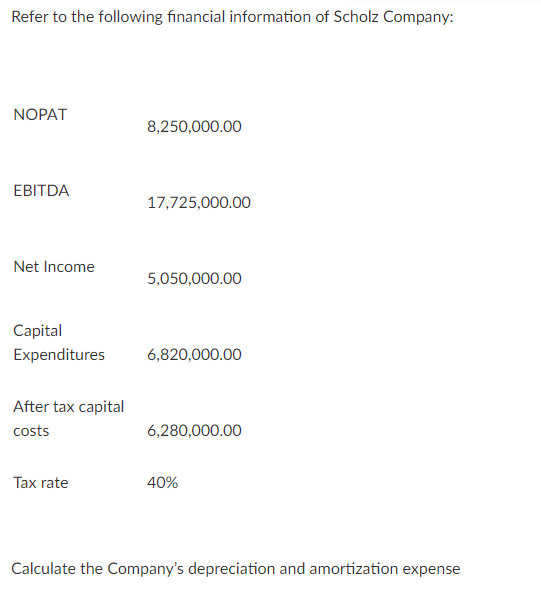

- Nicholas Health Systems recently reported an EBITDA of $25.0 million and net income of $15.8 million. It had $2.0 million of interest expense, and its federal tax rate was 21% (ignore any possible state corporate taxes). What was its charge for depreciation and amortization?Refer to the following financial information of Scholz Company: NOPAT 8,250,000.00 EBITDA 17,725,000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280,000.00 Tax rate 40% Calculate the Company’s depreciation and amortization expense Refer to the following financial information of Scholz Company: NOPAT 8,250,000.00 EBITDA 17,725,000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280,000.00 Tax rate 40% 13. Calculate the Company’s depreciation and amortization expense 14. Refer to Scholz Company, calculate its interest expense. Use 2 decimal places for your final answer. 15. Refer to Scholz Company, calculate its…Refer to the following financial information of Scholz Company: NOPAT 8,250,000.00 EBITDA 17,725,000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280,000.00 Tax rate 40% Calculate the Company’s depreciation and amortization expense

- Refer to the following financial information of Scholz Company: NOPAT 8.250.000.00 EBITDA 17,725.000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280.000.00 Tax rate 40% 1. Calculate the Company's depreciation and amortization expense 2. calculate its interest expense. Use 2 decimal places for your final answer. 3. calculate its EVA. Use 2 decimal places for your final answer.The following financial information was provided by Anya Company: Net Income 8,255,000.00 NOPAT 75,785,000.00 EBITDA 143,000,000.00 Net Profit Margin 6.00% Operating capital 425,070,000.00 After tax cost of capital 12.00% Tax rate 35.00% 16. Assuming the Company has no amortization expense, how much is its depreciation expense? Use 2 decimal places in your final answer 17. Refer to Anya Company, calculate its Interest Expense. Use 2 decimal places in your final answer 18. Refer to Anya Company, calculate its sales. Use 2 decimal places in your final answer