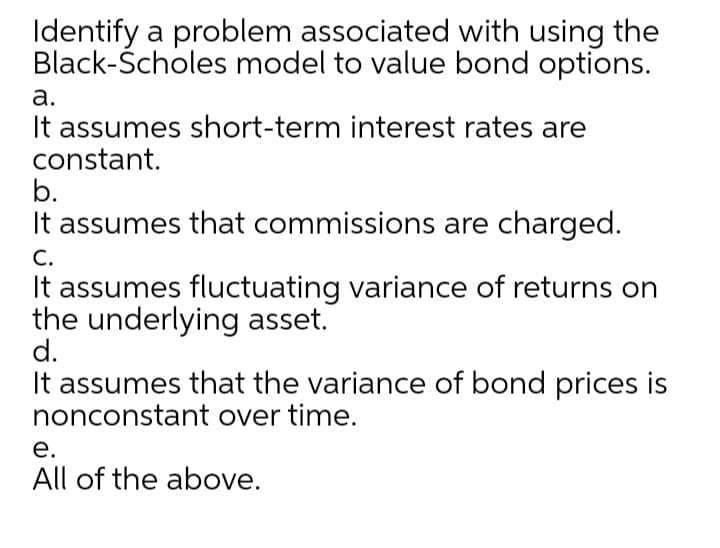

Identify a problem associated with using the Black-Šcholes model to value bond options. а. It assumes short-term interest rates are constant. b. It assumes that commissions are charged. С. It assumes fluctuating variance of returns on the underlying asset. d. It assumes that the variance of bond prices is nonconstant over time. е. All of the above.

Q: One main assumption of the segmented markets theory is that: Select one: O A. Bonds of different…

A: The theory which states that short term interest rate and long term interest rates are not related…

Q: As market rates of interest rise, investors move their funds into bonds, thus increasing their price…

A: Market interest rates are based on the market conditions. It gets affected with the market inflation…

Q: When working with the CAPM, which of the following factors can be determined with the most…

A: Capital asset pricing model uses the beta factor to estimate the risk of a given security.

Q: Which of the following is FALSE regarding spread duration? A Spread duration is an alternative…

A: Duration times spread (DTS) is the market standard method for calculating a corporate bond's credit…

Q: Which of the following statements is INCORRECT? A stock's beta is calculated as the covariance…

A: Beta is the measure of the systematic risk, portion of the security

Q: Assess the following statements: The traditional liquidity premium theory states that long term…

A: The liquidity premium is the additional amount of return that is expected by the investor for…

Q: Which of the following statements is the least accurate? a. Security returns are composed of…

A: The required rate of return is the minimum rate of return on investment. formula: Required rate of…

Q: Which of the following statements about CAPM is true? a. The expected return of a zero-beta security…

A: CAPM is the capital asset pricing model. As per CAPM expected return as follows: Expected return =…

Q: In measuring the performance of a portfolio, the time-weighted rate of return is superior to the…

A: Note we have two different type of measurement return of portfolio manager Time weighted rate of…

Q: In the capital asset pricing model, the beta coefficient is a measure of index of the degree of…

A: The Capital Asset Pricing Model (CAPM) is a mathematical model that describes the relationship…

Q: Which of the following statements is TRUE? O a. A decrease in the inflation rate will lead to an…

A: A security market line, or SML, is a graphical representation of the expected returns a security…

Q: An efficient capital market is best defined as a market in which security prices reflect which one…

A: Efficient Capital Market: It is the market where all available information is reflected in asset…

Q: Given that the formula for CAPM is Expected return= risk free rate + Beta*(Return on market - risk…

A: CAPM is a model used to determine a theoretical appropriate required rate of return of the asset.

Q: Which of the following is incorrect regarding margin trading? O a. The relationship between security…

A: Margin trading (MT) is the benefit which is provided by the trader to the investors to purchase…

Q: Which one of the following statements is NOT true? As interest rates increase, bond prices increase.…

A: Introduction: Bond is nothing but debt securities issued by a company or government if they want to…

Q: Volatility is a situation when the prices of financial instruments are potentially stable, and they…

A: Volatility is statistically measurement of movement of stock price.

Q: premium

A: Introduction: Nominal interest rate can be defined as the interest rate before taking the effects of…

Q: You can calculate the yield curve, given inflation and maturity-related risks. Looking at the yield…

A: The term structure of interest rates depicts the expectations of investors with regard to future…

Q: Assess the following statements: I. If the yield curve is upward sloping, some investors may attempt…

A: Riding the yield curve is a strategy of trading in which the investors buy bond which has longer…

Q: Consider the following scenario analysis A. Is it reasonable to assume that treasury bonds will…

A: Mr. X is USA based investor. Currently he has two investment opportunities. He can either invest in…

Q: Risk free rate can be derived from a triple A rated commercial bonds and the estimated price of…

A: You have posted multiple questions. So we'll solve the first question for you. To solve the other…

Q: In considering the market-based approach to measuring credit risk, choose all statements that are…

A: Credit risk is the risk of a loss coming from a borrower's failure to repay a loan or meet…

Q: A. What risk premium do you use? Why? B. Why is the geometric mean lower than the arithmetic mean…

A: Arithmetic mean- It is calculated by diving sum of total values by number of values. Suppose there…

Q: Consider a 1-factor parallel yield shift model with a flat structure of interest rates and consider…

A: Duration of bond is the rate of change in price of bond with change in interest rate in the market.…

Q: Which of the following statements is CORRECT about the yield curve? A) The yield curve shows the…

A: The relationship between interest rates and time to maturity is depicted by an yield curve. When the…

Q: The curvature of the bond price yield curve has been explained to be caused by three basic theories…

A: The curvature of the convexity is the relationship between the bond price and the yield to maturity.…

Q: a) Evaluate the following statement: "Two stocks should be viewed as equally risky because they have…

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions…

Q: True or false: Assume that expected returns and standard deviations for all securities (including…

A: When borrowing and lending rates are not similar then, based on the taste of persons (which means…

Q: Explain why bonds of different maturities have different yields in terms of expectations hypotheses.…

A: A yield curve plots interest rates of U.S. Treasury securities as on a particular date based on…

Q: With regard to interest rate sensitivity measures and bonds: Group of answer choices C. Convexity…

A: A bond's duration shows the measurement of the interest rate risk of the bond while bond convexity…

Q: Which one of the following statements about the term structure of interest rates is true?a. The…

A: Term structure of interest rates depicts the relationship between the interest rate or yield and…

Q: Consider the stocks in the table with their respective beta coefficients to answer the following…

A: Beta is the measurement of sensitivity of price with respect to the overall stock market.

Q: Assume that security returns are generated by the single-index model, Ri = αi + βiRM + ei…

A: Given:

Q: The risk structure of interest rates and the term structure of interest rates are identical. True or…

A: The risk structure of interest rate refers to the differences in default risk, liquidity, and Income…

Q: The Macaulay duration is the weighted average number of coupon periods until a bond’s scheduled cash…

A: Macaulay Duration: It is used to calculate the duration of bonds, which is a measure of the…

Q: Which of the following is/are correct regarding interest rates? Select all that apply. An inverted…

A: Interest rate is that the amount of interest due as the proportion of the amount of money lent,…

Q: Describe why a fully diversified portfolio is said to have no unsystematic risk but has systematic…

A: The risk of an investment portfolio can be reduced by diversifying it. Diversification helps to…

Q: Which one of the following expressions about risk and returns is wrong? A. In general, one reason…

A: The question is related to the risk and return relationship.

Q: “Short-term interest rates are more volatile than long-term interest rates, soshort-term bond prices…

A: The short-term bond prices are fewer sensitive if associated with the prices of long-period bond to…

Step by step

Solved in 3 steps

- If the yield curve in the bond market shows a flat curve, what do you think about the prediction of the liquidity premium in explaining this phenomenon? Then do you prefer the prediction of expectation theory in explaining this phenomenon?Which one of the following statements about the term structure of interest rates is true?a. The expectations hypothesis indicates a flat yield curve if anticipated future short-term rates exceed current short-term rates.b. The expectations hypothesis contends that the long-term rate is equal to the anticipated short-term rate.c. The liquidity premium theory indicates that, all else being equal, longer maturities will have lower yields.d. The liquidity preference theory contends that lenders prefer to buy securities at the short end of the yield curve.Which one of the following statements about the term structure of interest rates is true? A) The expectations hypothesis predicts a flat yield curve if anticipated future short-term rates exceed current short-term rates. B) The liquidity premium theory contends that lenders prefer to buy securities at the ghort-term end of the curve. C) The expectations hypothesis contends that the long-term spot rate is equal to the short-term rate. D) The liquidity premium theory indicates that, all else being equal, longer maturity bonds will have lower yields.

- Which of the following statements is correct? A.) A flat yield curve occurs when the yield-to-maturity is virtually unaffected by the term-to-maturity. B.) Real interest rates are generally lower than nominal interest rates. C.) Liquidity risk is the risk that a security may be difficult to sell on short notice for its true value. D.) All of these statements are correct.Which of the following is correct with regards to Theories of Term Structure? When the shape of the yield curve depends on investors’ expectations about prospective prevailing interest rates, the Pure Exception Theory is being applied. When the economic outlook is improving, the yield curve inverts as it reflects no changes in inflation premium. The liquidity preference theory suggests that long-term rates are generally higher than short-term rates since investors perceive more liquidity in long-term investments. Under the Market segmentation theory, there is an apparent relationship between the yield curve and the prevailing rate of returns in each market segment.Which of the following statements is false? A. Other things being equal, an increase in a bond’s maturity will increase its interest rate risk. B. Other things being equal, an increase in the coupon rate of a bond will decrease its interest rate risk. C. Other things being equal, an increase in a bond’s YTM will decrease its interest rate risk. D. Effective duration is calculated as Macaulay duration divided by one plus the bond’s yield to maturity.

- The inverted yield curve predicts that bond prices will fall. Select one: True OR FalseThe yield curve varies over time based the relative riskiness of buying a single long-term bond versus purchasing multiple short-term bonds. This explanation of the yield curve is most consistent with A.the Fisher Effect theoryB.the market segmentation theoryC.the unbiased expectations theoryD.the liquidity preference theoryCheck all that are true with respect to the yield to maturity (YTM) and the expected return for a bond. Group of answer choices The expected return is based on the contractly obligated payments whereas the YTM is based on what the investors expect to receive The YTM is based on the promised payments whereas the expected return is based on the expected cash flows Higher YTMs always mean higher expected returns In the presence of non-zero default risk, the YTM will be higher than the expected return YTM is just another name for the expected return

- The security market line (SML) is an equation that shows the relationship between risk as measured by beta and the required rates of return on individual securities. The SML equation is given below: If a stock's expected return plots on or above the SML, then the stock's return is sufficient to compensate the investor for risk. If a stock's expected return plots below the SML, the stock's return is insufficient to compensate the investor for risk.The SML line can change due to expected inflation and risk aversion. If inflation changes, then the SML plotted on a graph will shift up or down parallel to the old SML. If risk aversion changes, then the SML plotted on a graph will rotate up or down becoming more or less steep if investors become more or less risk averse. A firm can influence market risk (hence its beta coefficient) through changes in the composition of its assets and through changes in the amount of debt it uses. Quantitative Problem: You are given the following…Which of the following statements is CORRECT about the yield curve? A) The yield curve shows the behaviour of interest rate forecasts. B) When short-term rates are lower than long-term rates, there is a downward-sloping yield curve. C) A downward-sloping yield curve shows that investors demand an additional risk premium for lending money over the long term. D) A downward-sloping yield curve indicates that the market expects a future rise in interest rates.Some characteristics of the determinants of nominal interest rates are listed as follows. Identify the components (determinants) and the symbols associated with each characteristic: Characteristic Component Symbol This is the premium added to the real risk-free rate to compensate for a decrease in purchasing power over time. It is based on the bond’s rating; the higher the rating, the lower the premium added, thus lowering the interest rate. It is calculated by adding the inflation premium to r*. It changes over time, depending on the expected rate of return on productive assets exchanged among market participants and people’s time preferences for consumption. As interest rates rise, bond prices fall, and as interest rates fall, bond prices rise. Because interest rate changes are uncertain, this premium is added as a compensation for this uncertainty. This premium is added when a security lacks marketability,…