Identify the strategy employed by Dumo above. Protective Put Tabulate the Profit to the strategy at expiration for the following Exercise price R30; Stock price 20. Exercise price R30; Stock price 35.

Identify the strategy employed by Dumo above. Protective Put Tabulate the Profit to the strategy at expiration for the following Exercise price R30; Stock price 20. Exercise price R30; Stock price 35.

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 43P

Related questions

Question

- Dumo is a trader at ZNF Equity traders and has just identified a stock, UFSI Limited, which is currently trading at R25 per share. Dumo decides to take a long position in at-the money put option and simultaneously buys one share of UFSI stock. The put option expires in 3 months’ time and costs R2.5 per share. Assume a contract consists of one put option.

Required:

- Identify the strategy employed by Dumo above.

Protective Put

- Tabulate the Profit to the strategy at expiration for the following

- Exercise price R30; Stock price 20.

- Exercise price R30; Stock price 35.

Expert Solution

Question 1:

The strategy employed by Dumo is protective put investment strategy. A protective put position is formed by purchasing a stock and purchasing put options on the share-for-share origin.

Question 2:

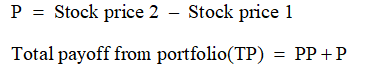

I) The computation of profit as follows:

Exercise price 30, stock price 20

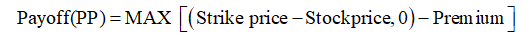

For long position (purchase) in Put option,

Pay off from long position in stock:

Hence, the profit is R 2.5.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT