If a default occurs, all losses between 20% and 50% of the principal are equally likely. If the loan does not default, a profit of $0.5 million is made. What is the bank's one-year 99.5% VaR? a. 3.3 million b. 4.2 million C. 4.7 million d. 3.5 million

If a default occurs, all losses between 20% and 50% of the principal are equally likely. If the loan does not default, a profit of $0.5 million is made. What is the bank's one-year 99.5% VaR? a. 3.3 million b. 4.2 million C. 4.7 million d. 3.5 million

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section11.8: Probabilities Of Disjoint And Overlapping Events

Problem 2C

Related questions

Question

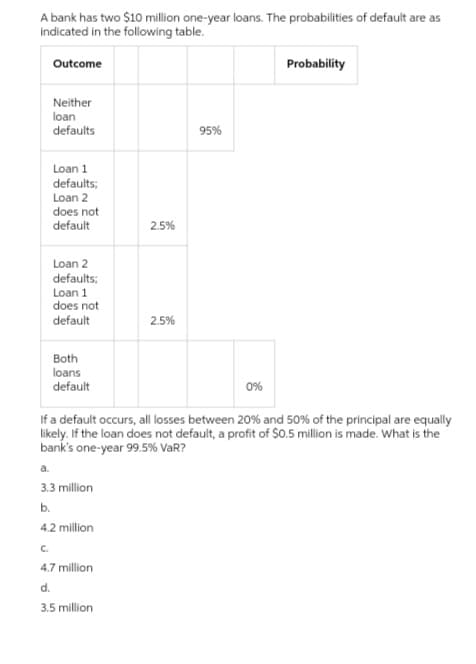

Transcribed Image Text:A bank has two $10 million one-year loans. The probabilities of default are as

indicated in the following table.

Outcome

Probability

Neither

loan

defaults

95%

Loan 1

defaults;

Loan 2

does not

default

2.5%

Loan 2

defaults;

Loan 1

does not

default

2.5%

Both

loans

default

0%

If a default occurs, all losses between 20% and 50% of the principal are equally

likely. If the loan does not default, a profit of $0.5 million is made. What is the

bank's one-year 99.5% VaR?

a.

3.3 million

b.

4.2 million

C.

4.7 million

d.

3.5 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL