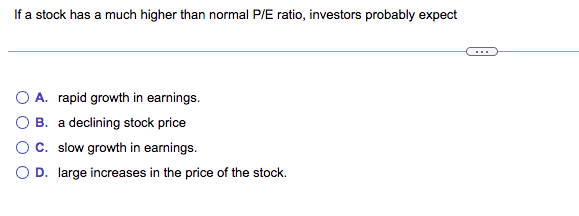

If a stock has a much higher than normal P/E ratio, investors probably expect ... O A. rapid growth in earnings. O B. a declining stock price OC. slow growth in earnings. O D. large increases in the price of the stock.

Q: If you save that money with interest rate of 10%, how much will it be after 20 years?

A: Future Value: It is the future worth of the present sum of money or stream of present annuity paymen...

Q: Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hi...

A: To Find: NPV

Q: You own 100 shares of a "C" Corporation. The corporation earns $5.00 per share before taxes. Once ...

A: Number of shares owned = 100 Earning per share before tax = 5 Corporate tax rate = 40% Personal tax ...

Q: A Treasury note has 2.5 years left to maturity, a yield to maturity of 3.6 percent, and a coupon rat...

A: Par value = $1000 Coupon rate = 4.40% Semi annual coupon amount = 1000*0.044/2 = $22 Years to matur...

Q: Lackson PLC and Hardy Corp. both have 8 percent coupon bonds outstanding, with semiannual interest p...

A: Assuming Face value of bond = 100 Price of bond = 100 = Par value Coupon = Coupon Rate / 2 × Par Val...

Q: An investment will have a future value equal to Php180,250 after 6 years. It has a nominal rate of 1...

A: Time Value of money states that each dollar has earning capacity hence a dollar today is worth more ...

Q: Selected information from the comparative financial statements of AppleVerse Company for the year en...

A: Receivables turnover ratio measures the number of times in a year the company collects its overdues....

Q: A note dated August 18 and due on March 9 (no leap year) runs for exactly:

A: In the world of finance 'note' refers to a legal document which is represenatation of a loan amount ...

Q: Your cousin has asked for your advice on whether or not to buy a bond for $995, which will make one ...

A: Here, Buying Price of Bond is $995 One Time Payment after 5 years is $1,200 Time Period is 5 years

Q: Mrs. Euclid wants to have Php246,916.30, within 3 years for her daughter's graduation. How much shou...

A: Answer - The future value annuity formula calculates the value at the end of given period n of a se...

Q: "s required return is 19%. a. How far away is the horizon date? I. The terminal, or horizon, date is...

A: The valuation of stock is done on the basis of variable growth rate and constant growth rate and bas...

Q: what are hedge funds role with direct listings?

A: A direct listing is a process by which a company can go public by selling existing shares instead of...

Q: An annuity that pays $13,000 a year at an annual interest rate of 4.42 percent costs $140,000 today....

A: Annual payment (P) = $13000 Interest rate (r) = 4.42% Present value (PV) = $140,000 Period = n

Q: Which of the following statements is false? A) In bankruptcy, management is given the opportunity t...

A:

Q: What is this bond's annual coupon rate as of October 31, 2016?

A: Coupon Rate: It refers to the nominal yield paid by the issuer on fixed income security. It is compu...

Q: Total Current Assets 700 610 Plant and Equipment 1,800 1,470 Less: Accumulated Depreciation 500 400 ...

A: Total Assets on the balance sheet is the sum of the current assets and fixed assets adjusted for dep...

Q: A car on sale costs P2,850,000.00 and requires a 10% down payment if purchased on an installment bas...

A: Here different subparts of a question have been asked and no subpart has been specified so we will s...

Q: A telemarketing company bought a new office space for Php720,000 downpayment and monthly installment...

A: Down payment (DP) = Php720,000 Monthly payment (P) = Php40,000 Period (n) = 42 Months Interest rate ...

Q: APPLY THE CONCEPTS: Net present value and Present value index Sutherland Engineering is looking to i...

A: Net present value = Total present value of net cash flow - Amount to be invested Present value ind...

Q: ABC is inclined to take a bank loan that has a face amount of P5,000,000, a term of 6 months, intere...

A: Generally, The loan is paid out off several Installments. Based on the credit history of borrower, B...

Q: Michael has a bank account that is worth $80,550. (a) Find the overall ROR if he had deposit...

A: a) Calculation of overall rate of return is calculated using the following formula: Compound annual ...

Q: What are the portfolio weights for a portfolio that has 110 shares of Stock that sell for $79 per sh...

A: Number of shares of stock A = 110 Shares Price per share stock A = $79 Number of shares of stock B =...

Q: + Explanation of Time Needed for Payback with uneven cash flows Note: For each year in which the unr...

A: The payback period is the amount of time that is required to break even, i.e., to recover the initia...

Q: You submitted an lOC (immediate-or-cancel), buy order for 200 shares at a limit price of $30 per sha...

A: The immediate or cancel order will match the bid with the best available ask at the limit price. If ...

Q: You need a new car and the dealer has offered you a price of $20,000, with the following payment o...

A: The net present value is a method of discounting cash flows and adding them to find the value of the...

Q: ABC Corporation issued 12%, 1000-par value preference shares. Interest is payable quarterly. It will...

A: To Find: Value of preference share

Q: Q5: The machine using PW with first cost $75000, savings the annual operating cost $11000 per year a...

A: According to the time value of money concept, a sum available at present is different from the same ...

Q: You are the loan department supervisor for a bank. This installment loan is being paid off early, an...

A: Your payback amount is the amount you will have to pay in order to meet the requirements of your mor...

Q: Krei is required to pay P57,000 in 15days or P60,000 in 60days. Find the annual rate of the interest

A: We will use the formula of simple interest to solve the question. The formula is: Total amount=P + (...

Q: Remerowski Corporation Inc. asks you to estimate the cost to purchase a new piece of production equi...

A: It is given that :Original Equipment:cost of similar old equipment- $10,000 Capacity- 2000 units cos...

Q: Sheaves Corporation economists estimate that a good business environment and a bad business environm...

A: (Note - Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the questi...

Q: ABC Inc. share will pay dividends of 40 for the first year, 45 for the second year, and 3% above the...

A: Dividend in year 1 (D1) = 40 Dividend in year 2 (D2) = 45 Growth rate (g) = 3% Required return (r) =...

Q: November 2009, Perrigo Co. (PRGO) had a share price of $39.20. They had 91.33 million shares outsta...

A: market capitalization = Number of shares outstanding × Market price per share

Q: 14.) The Virginia Corporation recently issued 10-year bonds at a price of $1,000. These bonds pay $6...

A: The current price of a projected amount of money or series of payments with a predetermined rate of ...

Q: Brief Exercise 3-5 Determine accrual-basis and cash-basis net income (LO3-1, 3- 2) Rebel Technology ...

A: Under cash basis accounting, only cash received and cash payments will be considered for calculation...

Q: eston Corporation just paid a dividend of $3.75 a share (i.e., Do = $3.75). The dividend is expected...

A: Given information : Current dividend $ 3.75 Growth rate for 3 years 12% Growth rate ther...

Q: Walgreen Company (NYSE: WAG) is currently trading at $48.75 on the NYSE. Walgreen Company is also l...

A: Arbitrage is the simultaneous buying and selling of securities at different markets, at different pr...

Q: A project requires an initial investment of $225,000 and is expected to generate the following net c...

A: Before investing in new projects or assets, profitability of the project is evaluated by using vario...

Q: Net present value (NPV) is one method that can be used evaluate the financial viability of potential...

A: Data given:: Initial investment = $ 190,000 Annual cash flow = $ 58,000 n ...

Q: The value of $60 deposited in a bank for six years at a rate of 10% compounded annually is: O $96.36...

A: Compound interest is the amount of interest which is being charged or received on amount of principa...

Q: P= $140 R= 3% T= 2 Year Find the simple interest owed for the use of the money. Assume 360 days in a...

A: P = $140 R = 3% T = 2 Year

Q: How do I prepare the cash budget for the quarter ended March 31, 20X1?

A: A cash budget is a document created to aid in the management of a company's cash flow. A cash budget...

Q: What are some market conditions that may favor companies listed in the S&P 500 communication sector?

A: Communication sector : Communication sector mainly comprises from media to internet companies. This...

Q: Assume all firms have the same expected dividends. If they have different expected returns, how will...

A: All the firms have same expected dividends but different expected returns.

Q: EBIT is $12,000 and interest expense is $3,000. If the tax rate is 20%, what is the net income? O $7...

A: EBIT = $12000 Interest expenses = $3000 Tax rate = 20%

Q: You have found three investment choices for a one-year deposit: 12% APR compounded monthly, 11% APR ...

A: Interest rate: 12% APR compounded monthly means compounding frequency is 12 11% APR compounded annu...

Q: One year ago, your company purchased a machine used in manufacturing for $115,000. You have learned ...

A: Incremental Analysis: Incremental analysis is a technique that is used to compare two projects by ta...

Q: Consider the following information: Rate of Probability of State Return State of if State Economy Re...

A: Expected return is used to find out whether an investment has positive or negative net outcome and i...

Q: What lump sum of money must be deposited into a bank account at the present time so that $500 monthl...

A: Monthly withdrawals six years from now is $500 Time period of withdrawal is 5 years interest rate co...

Q: A man borrowed P12,000 and agreed to repay it with P4,650.70 interest. If the interest is 6% compoun...

A: Here, Borrowed Amount is P12,000 Interest Paid is P4,650.70 Interest Rate is 6% Compounding Period i...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- When technical analysts say a stock has good “relative strength,” they mean:a. The ratio of the price of the stock to a market or industry index has trended upward.b. The recent trading volume in the stock has exceeded the normal trading volume.c. The total return on the stock has exceeded the total return on T-bills.d. The stock has performed well recently compared to its past performance.Which of the following statements is most accurate in analyzing a stock? If the expected return exceeds itsrequired return__________________a. The stock should be sold.b. The stock is good to buy.c. The management is probably not trying to maximize the price per share.d. Dividends are not likely to be declarede. The stock is experiencing supernormal growthWhich of the following will increase the price of a stock? Group of answer choices: A. Decrease in the required rate of return B. Decrease in the dividend growth rate C. Delay in the payment of dividends D. Decrease in earnings growth

- Use the data below to determine which of the statements is most accurate? a) For a given percentage change in stock price, company Y will have less impact on the market-cap weighted index as company Z. b) A 100% increase in the stock price of company X will have a smaller impact on the price-weighted index than a 100% increase in the stock price of company Z. c) For a given percentage change in the stock price, company X will have a greater impact on the market-cap weighted index than companies Y & Z.You, in analyzing a stock, find that its expected return exceeds its required return. This suggests that you think a. the stock should be sold. b. the stock is a good buy. c. management is probably not trying to maximize the price per share. d. dividends are not likely to be declared. e. the stock is experiencing supernormal growth.Which of the following empirical observations appear to contradict weak form market efficiency? a. The average rate of return of stocks is significantly greater than zero b. The month-to-month time series autocorrelation of stock returns is not significantly different from zero c. A strategy of buying recent high-return stocks (winners) and shorting recent low-return stocks (losers) provides significant positive alpha d. Low dividend stocks provide higher-than-average capital gains e. None of the above

- Suppose your expectations regarding the stock price are as follows: State of the Market Probability Ending Price HPR (includingdividends) Boom 0.30 $ 140 53.5 % Normal growth 0.28 110 17.5 Recession 0.42 80 −12.0 Use the equations E(r)=Σsp(s)r(s)E(r)=Σsp(s)r(s) and σ2=Σsp(s) [r(s)−E(r)]2σ2=Σsp(s) [r(s)−E(r)]2 to compute the mean and standard deviation of the HPR on stocks. (Do not round intermediate calculations. Round your answers to 2 decimal places.)The short seller anticipates the stock price will __________, so that the share can be purchased later at a __________ price than it initially sold for. A. fall, higher B. fall, lower C. rise, higher D. rise, lowerIf the intrinsic value of a stock is greater than its market value, which of the following is a reasonable conclusion? O 1. The stock offers a high dividend payout ratio. 02 The market is overvaluing the stock. O 3. The stock has a low level of risk. O 4. The market is undervaluing the stock

- based on the current variables that may impact stock demand, such as inflation, budget deficit, monetary policies, political situations, and investor's sentiment generally. Do you believe that stock prices will grow or drop this year's end based on these conditions? Justify your response using logic. Which of the following factors do you believe will have the greatest influence on stock prices?Consider the following information: State of Economy Probability of State of Economy Rate of Return if State Occurs Stock A Stock B Recession .17 .08 −.12 Normal .58 .11 .17 Boom .25 .16 .34 a. Calculate the expected return for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)Is stock with Increasing dividend yield and decreasing market price per share a good stock to invest?