If a taxpayer has taxable income $80,900, what is her tax bracket? (Taxpayer filing status is married filing jointly)

If a taxpayer has taxable income $80,900, what is her tax bracket? (Taxpayer filing status is married filing jointly)

Chapter12: Sequences, Series And Binomial Theorem

Section12.3: Geometric Sequences And Series

Problem 12.58TI: What is the total effect on the economy of a government tax rebate of $500 to each household in...

Related questions

Question

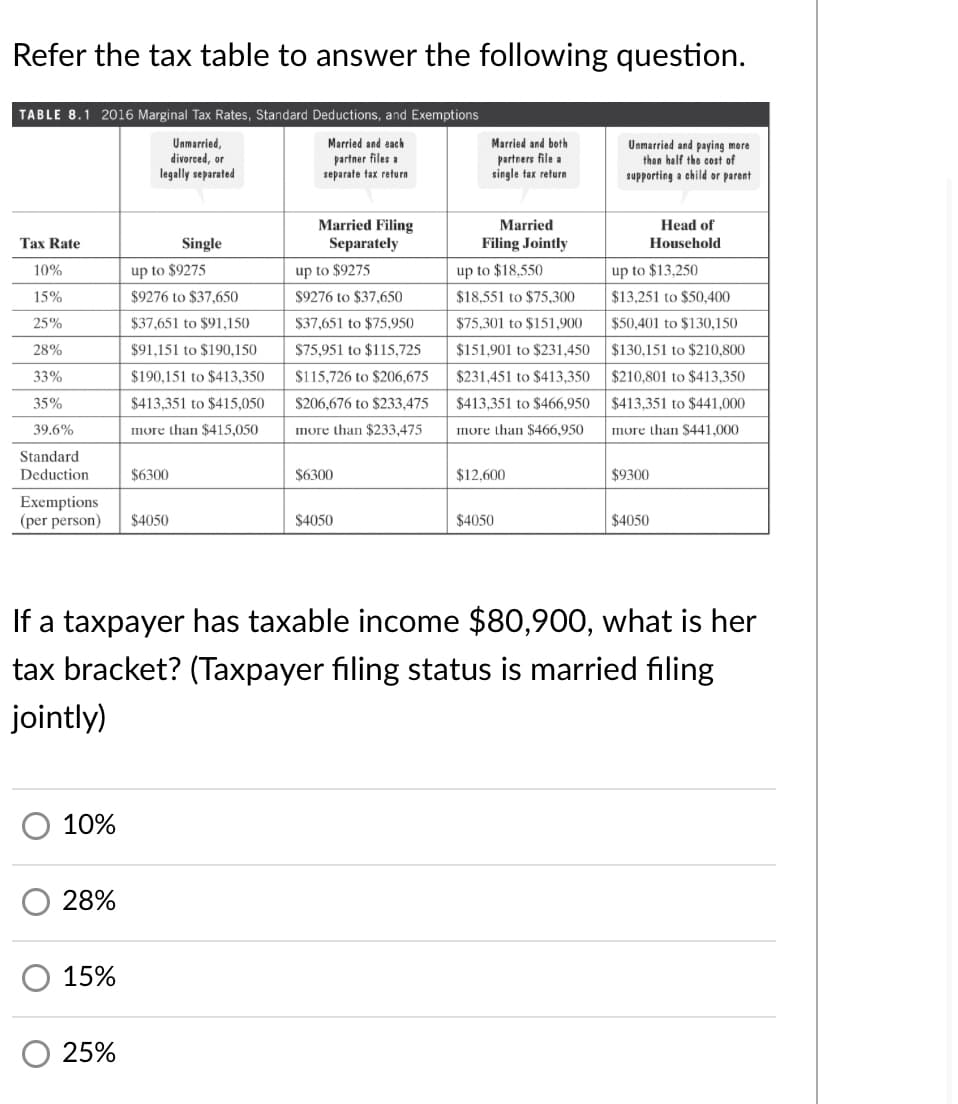

Transcribed Image Text:Refer the tax table to answer the following question.

TABLE 8.1 2016 Marginal Tax Rates, Standard Deductions, and Exemptions

Married and each

Unmarried,

divorced, or

legally separated

Married and both

Unmarried and paying more

than half the cost of

partner files a

separate tax return

partners file a

single tax return

supporting a child or parent

Married Filing

Separately

Married

Head of

Таx Rate

Single

Filing Jointly

Household

10%

up to $9275

up to $9275

up to $18,550

up to $13,250

15%

$9276 to $37,650

$9276 to $37,650

$18,551 to $75,300

$13,251 to $50,400

25%

$37,651 to $91,150

$37,651 to $75,950

$75,301 to $151,900

$50,401 to $130,150

28%

$91,151 to $190,150

$75,951 to $115,725

$151,901 to $231,450

$130,151 to $210,800

33%

$190,151 to $413,350

$115,726 to $206,675

$231,451 to $413,350

$210,801 to $413,350

35%

$413,351 to $415,050

$206,676 to $233,475

$413,351 to $466,950

$413,351 to $441,000

39.6%

more than $415,050

more than $233.475

more than $466,950

more than $441,000

Standard

Deduction

$6300

$6300

$12,600

$9300

Exemptions

(per person)

$4050

$4050

$4050

$4050

If a taxpayer has taxable income $80,900, what is her

tax bracket? (Taxpayer filing status is married filing

jointly)

10%

28%

15%

25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you