If a trader developed a series of algorithms and bots to help her profit from predictable price trends, then which of the following algorithms would I have resulted in the highest profit? (Note: Assume there were no transaction costs associated with the transactions and that purchase and sell orders occur immediately.) If the price of Humphry Incorpora

If a trader developed a series of algorithms and bots to help her profit from predictable price trends, then which of the following algorithms would I have resulted in the highest profit? (Note: Assume there were no transaction costs associated with the transactions and that purchase and sell orders occur immediately.) If the price of Humphry Incorpora

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter9: Stocks And Their Valuation

Section: Chapter Questions

Problem 1DQ

Related questions

Question

FINANCE

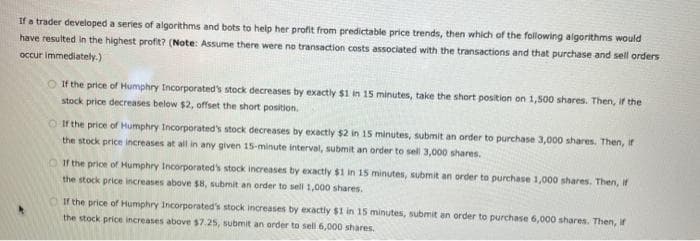

Transcribed Image Text:If a trader developed a series of algorithms and bots to help her profit from predictable price trends, then which of the following algorithms would

have resulted in the highest profit? (Note: Assume there were no transaction costs associated with the transactions and that purchase and sell orders

occur immediately.)

If the price of Humphry Incorporated's stock decreases by exactly $1 in 15 minutes, take the short position on 1,500 shares. Then, if the

stock price decreases below $2, offset the short position.

If the price of Humphry Incorporated's stock decreases by exactly $2 in 15 minutes, submit an order to purchase 3,000 shares. Then, if

the stock price increases at all in any given 15-minute interval, submit an order to sell 3,000 shares.

If the price of Humphry Incorporated's stock increases by exactly $1 in 15 minutes, submit an order to purchase 1,000 shares. Then, if

the stock price increases above $8, submit an order to sell 1,000 shares.

If the price of Humphry Incorporated's stock increases by exactly $1 in 15 minutes, submit an order to purchase 6,000 shares. Then, if

the stock price increases above $7.25, submit an order to sell 6,000 shares.

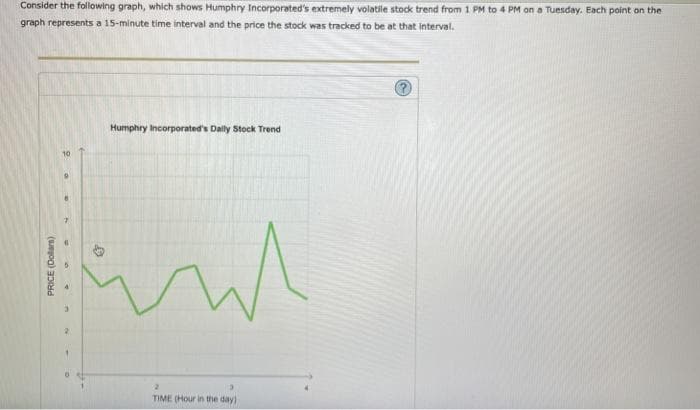

Transcribed Image Text:Consider the following graph, which shows Humphry Incorporated's extremely volatile stock trend from 1 PM to 4 PM on a Tuesday. Each point on the

graph represents a 15-minute time interval and the price the stock was tracked to be at that interval.

10

3

2

1

Humphry Incorporated's Daily Stock Trend

гл

w

2

TIME (Hour in the day)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,