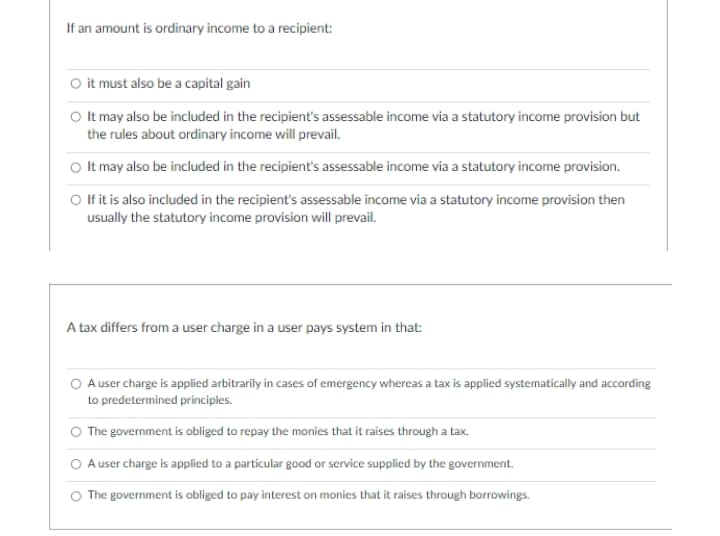

If an amount is ordinary income to a recipient: O it must also be a capital gain O It may also be included in the recipient's assessable income via a statutory income provision but the rules about ordinary income will prevail. O It may also be included in the recipient's assessable income via a statutory income provision. O Ifitis also included in the recipient's assessable income via a statutory income provision then usually the statutory income provision will prevail.

If an amount is ordinary income to a recipient: O it must also be a capital gain O It may also be included in the recipient's assessable income via a statutory income provision but the rules about ordinary income will prevail. O It may also be included in the recipient's assessable income via a statutory income provision. O Ifitis also included in the recipient's assessable income via a statutory income provision then usually the statutory income provision will prevail.

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 1MCQ: The definition of gross income in the tax law is: All items specifically listed as income in the tax...

Related questions

Question

Transcribed Image Text:If an amount is ordinary income to a recipient:

O it must also be a capital gain

O It may also be included in the recipient's assessable income via a statutory income provision but

the rules about ordinary income will prevail.

O It may also be included in the recipient's assessable income via a statutory income provision.

O fit is also included in the recipient's assessable income via a statutory income provision then

usually the statutory income provision will prevail.

A tax differs from a user charge in a user pays system in that:

A user charge is applied arbitrarily in cases of emergency whereas a tax is applied systematically and according

to predetermined principles.

The government is obliged to repay the monies that it raises through a tax.

A user charge is applied to a particular good or service supplied by the government.

The government is obliged to pay interest on monies that it raises through borrowings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you