Select the best answer from the choices below. Gifts received are excluded from taxable income. Inheritances received usually are excluded from taxable income. Both of the above are excluded (usually) from taxable income. Neither of the above are excluded from taxable income.

Select the best answer from the choices below. Gifts received are excluded from taxable income. Inheritances received usually are excluded from taxable income. Both of the above are excluded (usually) from taxable income. Neither of the above are excluded from taxable income.

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 29P

Related questions

Question

1

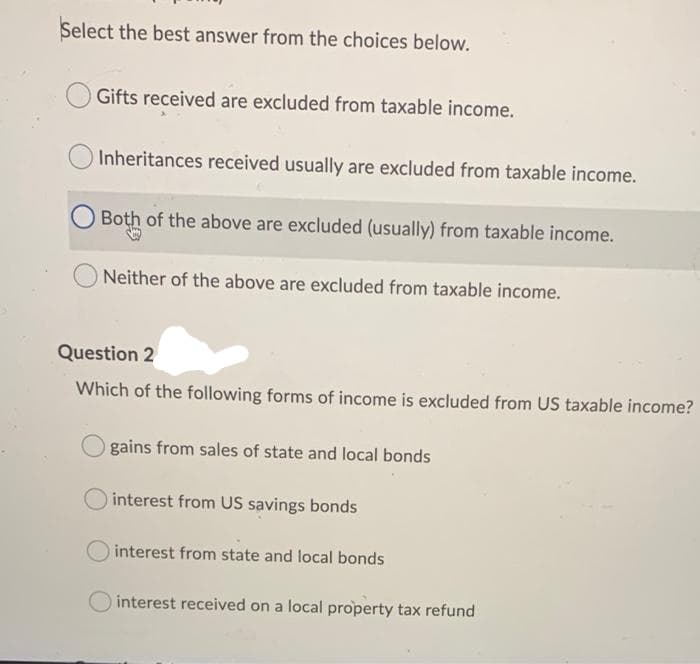

Transcribed Image Text:Select the best answer from the choices below.

Gifts received are excluded from taxable income.

Inheritances received usually are excluded from taxable income.

Both of the above are excluded (usually) from taxable income.

O Neither of the above are excluded from taxable income.

Question 2

Which of the following forms of income is excluded from US taxable income?

gains from sales of state and local bonds

interest from US savings bonds

interest from state and local bonds

interest received on a local property tax refund

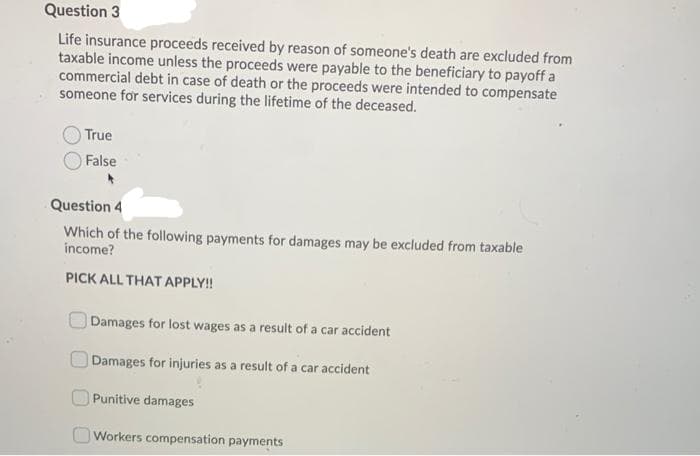

Transcribed Image Text:Question 3

Life insurance proceeds received by reason of someone's death are excluded from

taxable income unless the proceeds were payable to the beneficiary to payoff a

commercial debt in case of death or the proceeds were intended to compensate

someone for services during the lifetime of the deceased.

True

False

Question 4

Which of the following payments for damages may be excluded from taxable

income?

PICK ALL THAT APPLY!

Damages for lost wages as a result of a car accident

Damages for injuries as a result of a car accident

Punitive damages

OWorkers compensation payments

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT