If corporate headquarters for UPS in Atlanta is considering adding to its 96,000 + fleet of delivery vans, what is year 5’s depreciation expense using MACRS if one van costs $78,500? (Table 17.4 and Table 17.5)

If corporate headquarters for UPS in Atlanta is considering adding to its 96,000 + fleet of delivery vans, what is year 5’s depreciation expense using MACRS if one van costs $78,500? (Table 17.4 and Table 17.5)

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 6MCQ: Which of the following is not true about the MACRS depreciation system: A salvage value must be...

Related questions

Question

If corporate headquarters for UPS in Atlanta is considering adding to its 96,000 + fleet of delivery vans, what is year 5’s

******TABLES ATTACHED*******************

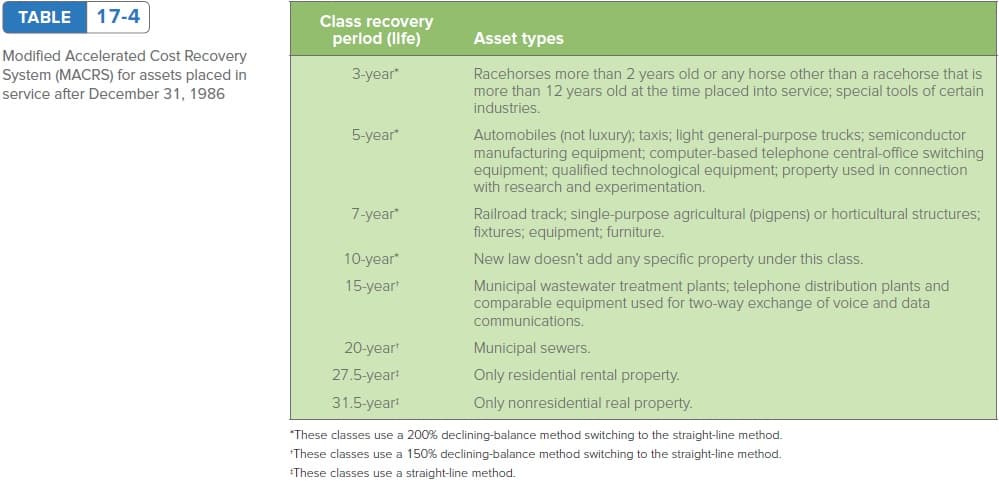

Transcribed Image Text:TABLE

17-4

Class recovery

perlod (life)

Asset types

Modified Accelerated Cost Recovery

System (MACRS) for assets placed in

service after December 31, 1986

3-year

Racehorses more than 2 years old or any horse other than a racehorse that is

more than 12 years old at the time placed into service; special tools of certain

industries.

5-year"

Automobiles (not luxury); taxis; light general-purpose trucks; semiconductor

manufacturing equipment; computer-based telephone central-office switching

equipment; qualified technological equipment; property used in connection

with research and experimentation.

Railroad track; single-purpose agricultural (pigpens) or horticultural structures;

fixtures; equipment; furniture.

7-year"

10-year*

New law doesn't add any specific property under this class.

15-year

Municipal wastewater treatment plants; telephone distribution plants and

comparable equipment used for two-way exchange of voice and data

communications.

20-year

Municipal sewers.

27.5-yeart

Only residential rental property.

31.5-yeart

Only nonresidential real property.

*These classes use a 200% declining-balance method switching to the straight-line method.

*These classes use a 150% declining-balance method switching to the straight-line method.

These classes use a straight-line method.

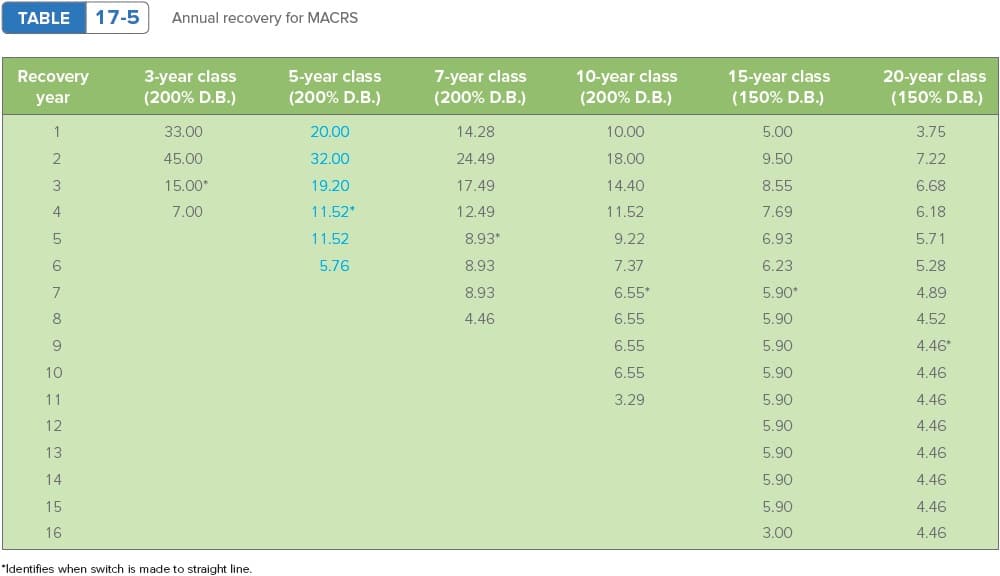

Transcribed Image Text:TABLE

17-5

Annual recovery for MACRS

3-year class

(200% D.B.)

5-year class

(200% D.B.)

7-year class

(200% D.B.)

10-year class

(200% D.B.)

15-year class

(150% D.B.)

20-year class

(150% D.B.)

Recovery

year

1

33.00

20.00

14.28

10.00

5.00

3.75

45.00

32.00

24.49

18.00

9.50

7.22

3

15.00*

19.20

17.49

14.40

8.55

6.68

4

7.00

11.52*

12.49

11.52

7.69

6.18

11.52

8.93*

9.22

6.93

5.71

6

5.76

8.93

7.37

6.23

5.28

8.93

6.55*

5.90*

4.89

8

4.46

6.55

5.90

4.52

9

6.55

5.90

4.46*

10

6.55

5.90

4.46

11

3.29

5.90

4.46

12

5.90

4.46

13

5.90

4.46

14

5.90

4.46

15

5.90

4.46

16

3.00

4.46

*Identifies when switch is made to straight line.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT