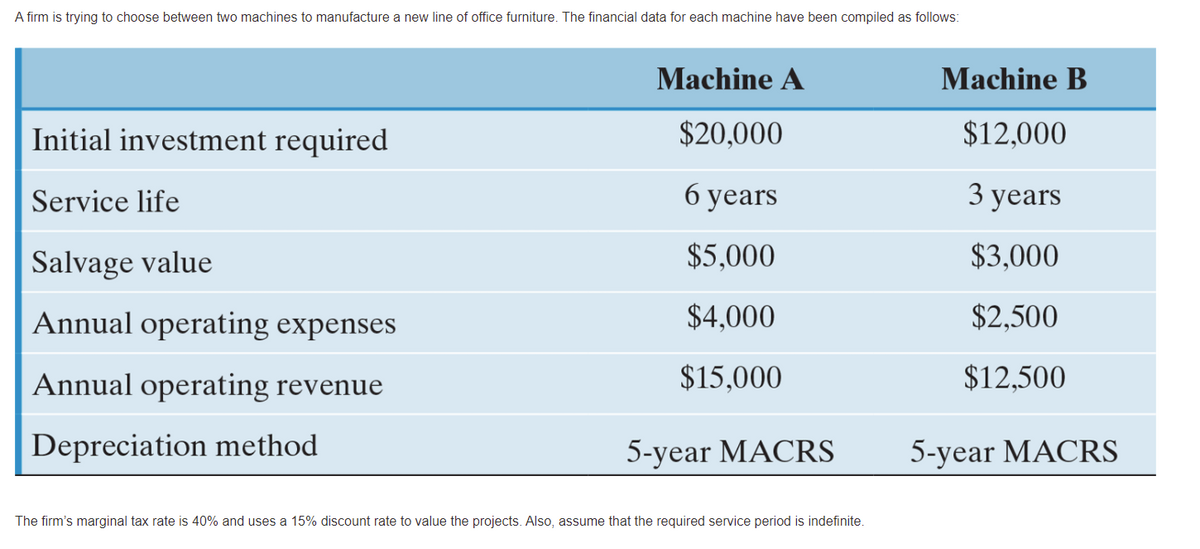

A firm is trying to choose between two machines to manufacture a new line of office furniture. The financial data for each machine have been compiled as follows: Machine A Machine B Initial investment required $20,000 $12,000 Service life б уears 3 years Salvage value $5,000 $3,000 Annual operating expenses $4,000 $2,500 Annual operating revenue $15,000 $12,500 Depreciation method 5-year MACRS 5-year MACRS The firm's marginal tax rate is 40% and uses a 15% discount rate to value the projects. Also, assume that the required service period is indefinite.

A firm is trying to choose between two machines to manufacture a new line of office furniture. The financial data for each machine have been compiled as follows: Machine A Machine B Initial investment required $20,000 $12,000 Service life б уears 3 years Salvage value $5,000 $3,000 Annual operating expenses $4,000 $2,500 Annual operating revenue $15,000 $12,500 Depreciation method 5-year MACRS 5-year MACRS The firm's marginal tax rate is 40% and uses a 15% discount rate to value the projects. Also, assume that the required service period is indefinite.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 18P: Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting...

Related questions

Question

100%

Attached is question diagram, USE EXCEL AS ITS REQUIRED

Question 9. What is the net present worth of machine B after tax over 3 years? Pick the correct answer.

-

$6,394

-

$6,233

-

$5,562

-

$7,070

Transcribed Image Text:A firm is trying to choose between two machines to manufacture a new line of office furniture. The financial data for each machine have been compiled as follows:

Machine A

Machine B

Initial investment required

$20,000

$12,000

Service life

б уеars

3 years

Salvage value

$5,000

$3,000

Annual operating expenses

$4,000

$2,500

Annual operating revenue

$15,000

$12,500

Depreciation method

5-year MACRS

5-year MACRS

The firm's marginal tax rate is 40% and uses a 15% discount rate to value the projects. Also, assume that the required service period is indefinite.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning