If Pepper would report according to FIFO method, what would be the reported inventories, net income and COGS amount (show your calculations)? Please comment on why LIFO method could be least preferable (from the company's, government's point of view?

If Pepper would report according to FIFO method, what would be the reported inventories, net income and COGS amount (show your calculations)? Please comment on why LIFO method could be least preferable (from the company's, government's point of view?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

100%

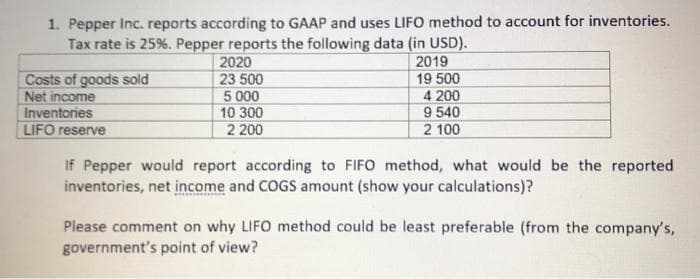

Transcribed Image Text:1. Pepper Inc. reports according to GAAP and uses LIFO method to account for inventories.

Tax rate is 25%. Pepper reports the following data (in USD).

2019

19 500

4 200

9 540

2 100

2020

Costs of goods sold

Net income

Inventories

LIFO reserve

23 500

5 000

10 300

2 200

If Pepper would report according to FIFO method, what would be the reported

inventories, net income and COGS amount (show your calculations)?

Please comment on why LIFO method could be least preferable (from the company's,

government's point of view?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,