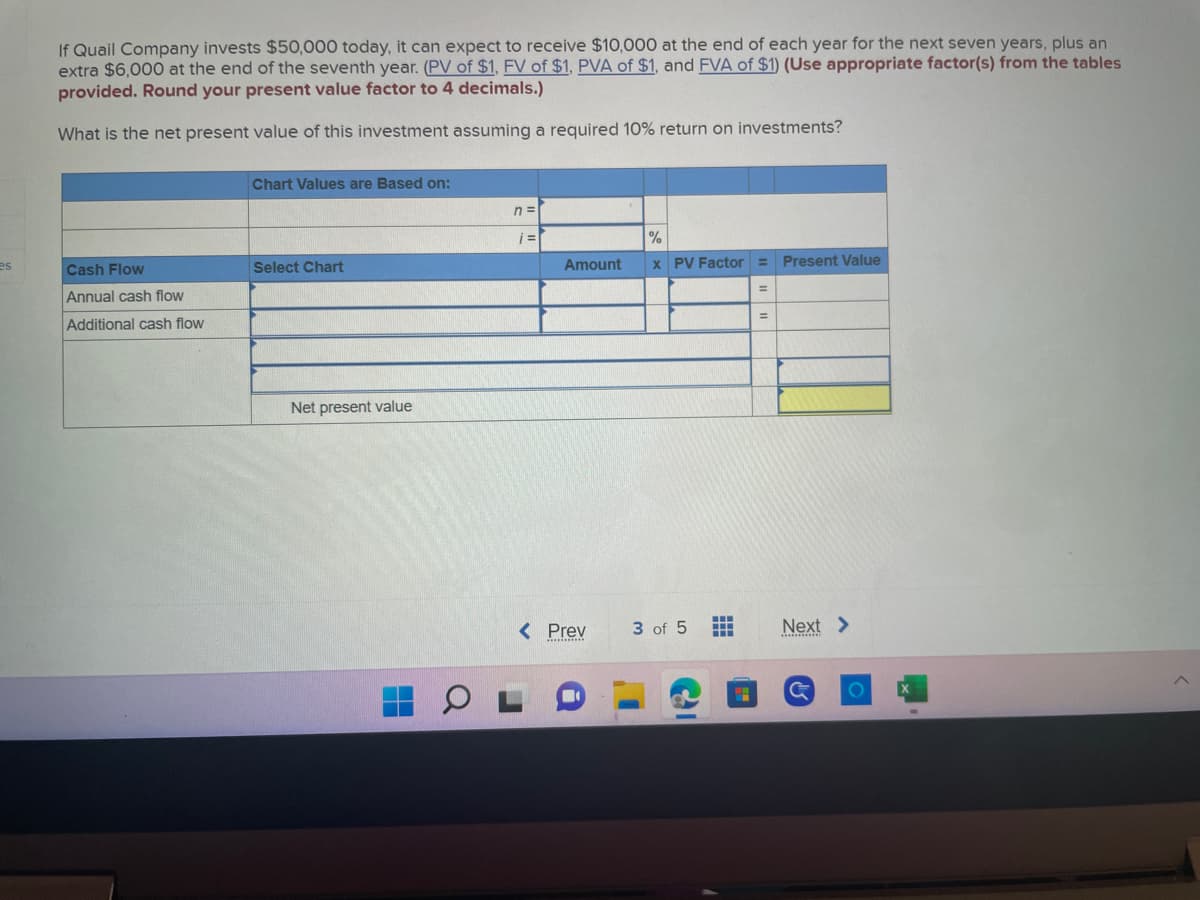

If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end of each year for the next seven years, plus an extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 10% return on investments? Cash Flow Annual cash flow Additional cash flow Chart Values are Based on: Select Chart Net present value n= 1 = Amount % x PV Factor = = = Present Value

If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end of each year for the next seven years, plus an extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 10% return on investments? Cash Flow Annual cash flow Additional cash flow Chart Values are Based on: Select Chart Net present value n= 1 = Amount % x PV Factor = = = Present Value

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 3CMA

Related questions

Question

Transcribed Image Text:es

If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end of each year for the next seven years, plus an

extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables

provided. Round your present value factor to 4 decimals.)

What is the net present value of this investment assuming a required 10% return on investments?

Cash Flow

Annual cash flow

Additional cash flow

Chart Values are Based on:

Select Chart

Net present value

n=

i=

Amount

< Prev

%

x PV Factor =

3 of 5

=

Present Value

Next >

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning